Ethereum returned to climbing and cruised past the $3,800 threshold in the last 24 hours, earning 2.2% against the US dollar. Once the weekend was over, ETH’s market grips were close to 12% of the $3.91 trillion crypto economy.

Ether ignites the chart

By 10:40am, ETH had earned around 0.03221 BTC in Bitcoin terms at $3,816 per pop. The $4600 billion valuation, currently sitting as the second largest digital asset by market capitalization, accounts for 11.8% of the total weight of the crypto market.

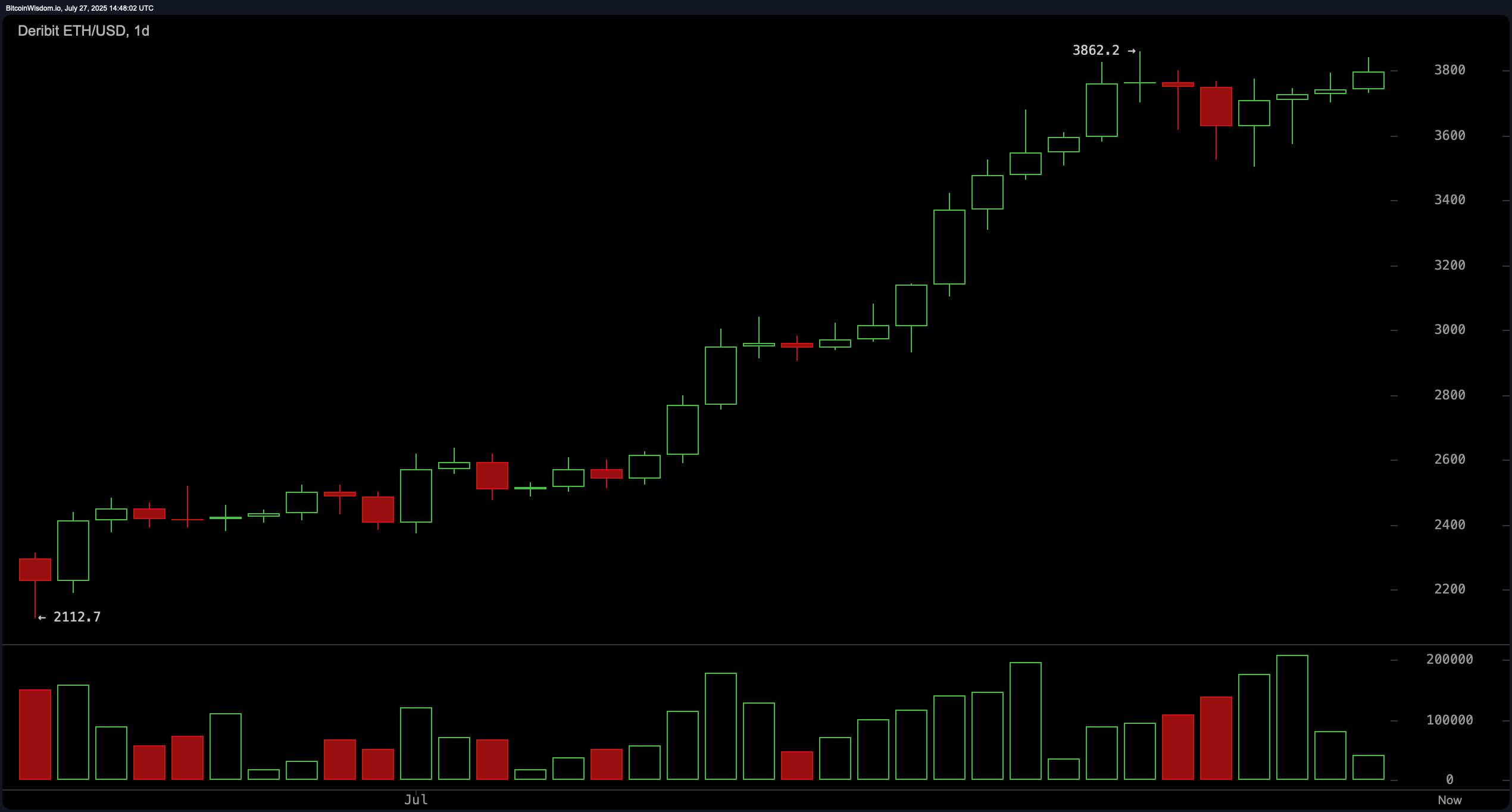

ETH/USD Daily Chart via Delibit on July 27th, 2025.

ETH rose 2.2% today, but its seven-day profit was a modest 2%, reaching 27.7% over the past two weeks. Zooming out in a month, ETH has skyrocketed 56.8%, with heavy global trading pushing that momentum. Ethereum is broken by more than $3,800, and it is at the forefront and center of liquidation in the derivatives market.

Over the past 24 hours, the $40.65 million ETH position has been washed away, bringing the short seller to the brunt. Of these, $28.41 million was shorts. The biggest settlement? My $10 million ETH-USDT-SWAP order was wiped out completely on OKX. Most of the Oscillators on ETH sit in a neutral region, but the Momentum Oscillator will flash a bearish cue.

Meanwhile, the average movement of Ethereum believes that the long-term trend still has fuel in the tank. Ethereum’s recent strength has put it in the spotlight for both bullish traders and those who caught offside in the derivatives field. With the technology leaning towards positives and trading activities getting hotter, there may still be room for ETH to run.