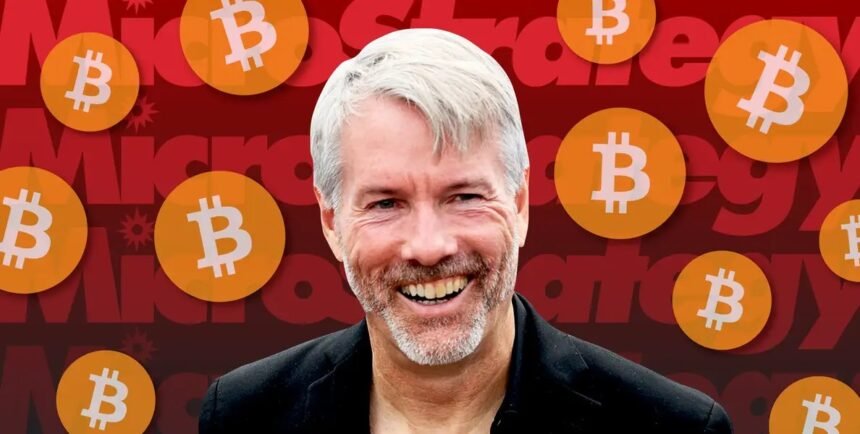

The company, a company known as MicroStrategy, is doubling Bitcoin. President Michael Saylor went on Friday to explain why the company doesn’t have Cryptocurrency at CNBC’s “Squawk Box”.

Saylor called Bitcoin a “Digital Capital,” and the strategy has now acquired more than 628,000 BTC, which is worth about $ 72 billion. It accounts for almost 3%of all Bitcoin to exist. The company recently raised $ 2.5 billion in IPOs of Series A Permanent Favorite Stocks, selling 28 million shares for $ 90, respectively. The fund was used to purchase 21,021 BTC on July 29.

Bitcoin funding IPO is now a core strategy

According to Saylor, the strategy has raised four funds this year. Two of them paid $ 500 million each, and the other brought $ 1 billion. The fourth interest and the latest product, which raised $ 2.5 billion, is known as the largest IPO in 2025 based on its total revenue.

This business model, which is used to raise capital and buy Bitcoin, does not have encryption. Saylor believes that volatile digital assets can be converted into refined securities and appealed to professional investors. He called a new product branded with the most interesting product of the company, “Stretch” (Strc).

The number of public companies with Bitcoin is increasing rapidly.

Saylor also talked about how other companies participated in the Bitcoin movement. He said more than 160 public companies have a bitcoin compared to about 60 a year ago. The public company owns about 955,048 BTC, which is 4.55% of the total supply.

He added that Bitcoin has begun replacing traditional assets such as gold, real estate and stocks with value shops. Saylor argued that Bitcoin is “democratizing these old asset classes.” He suggested that if a company that raises value and is self -worth, money in Bitcoin is more meaningful than having cash or buying something like a private equity fund.

According to the strategy, I don’t want to own all Bitcoin

Saylor made it clear that his company is not trying to reserve Bitcoin’s full supply. He thinks that he owns 3%to 7%, but he stressed that strategy wants to share. He pointed out that Blackrock has more BTCs in 740,896 through Ishares Bitcoin Trust (IBIT).

He also mentioned why large companies such as Apple and Microsoft do not buy each other’s stocks or S & P 500 companies. According to him, the SEC rules are limited to regaining their stocks because they prevents them from doing so. Saylor believes that if these rules do not exist, many large companies are likely to invest in each other and may be Bitcoin.

JOE RAEDLE/GETTY’s main image; Chart of SkyEE GOULD/Insider, TradingView