CFO’s second quarter research shows that cryptocurrency is becoming a financial planning priority, with 99% of the chief financial officers of $1 billion companies expecting to use it in the long term.

The survey was conducted among 200 CFOs in companies that have earned more than $1 billion in revenue, with 23% expecting crypto to use in investments or payments within the next two years. This figure has risen to almost 40% among CFOs of companies with revenues exceeding $10 billion.

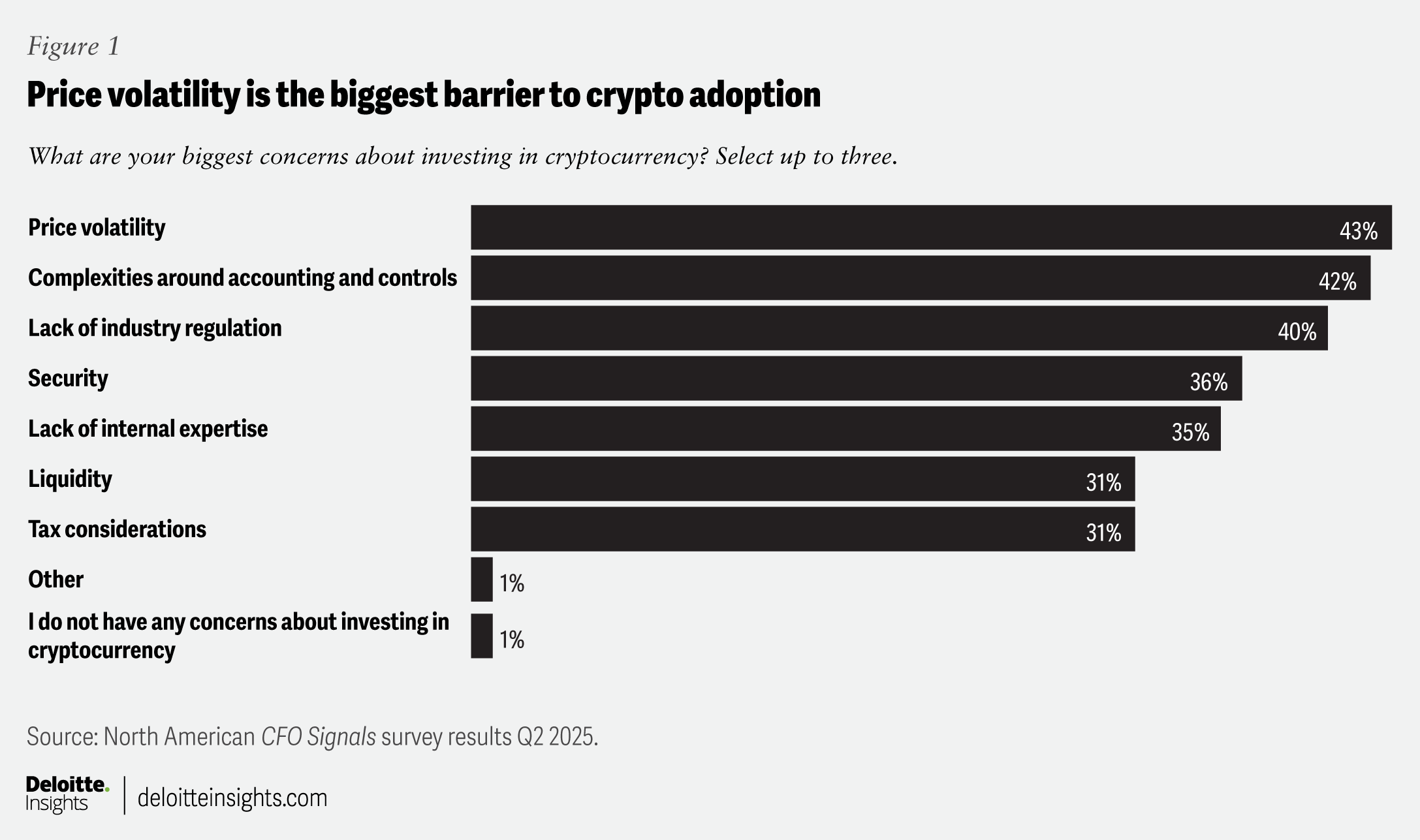

Despite the momentum, the finance chief remains cautious. Price volatility concerns are at the top of the list, with 43% of respondents citing it as the main barrier to adopting unstable cryptocurrencies such as Bitcoin (BTC) and ether (ETH).

Other major concerns include accounting complexity (42%) and regulatory uncertainty (40%), the latter exacerbated by shifting US policies.

Price volatility is the number one concern in the adoption of crypto. Source: Deloitte

Related: Crypto tops fixed income on ETF Investor Wishlist: Schwab Survey

CFOs plan to invest in crypto within two years

Despite some concerns, more and more CFOs are paying attention to direct exposure to cryptocurrency. 15% expected to invest in unstable cryptocurrencies within 24 months, with large companies rising to 24%.

“Respondents from organizations with revenues of over US$10 billion were even more likely to check the box,” the report said. “One in four (24%) said they are likely to invest in unstable cryptocurrency over the next two years.”

Recruitment is not limited to investment. Stablecoins also gain traction for payments. 15% of CFOs say that companies are likely to accept steady coins within two years, with the number reaching 24% for the largest companies.

Privacy and payment efficiency are top drivers, with 45% citing customer privacy and 39% emphasizing faster, lower cost cross-border transactions as a key advantage.

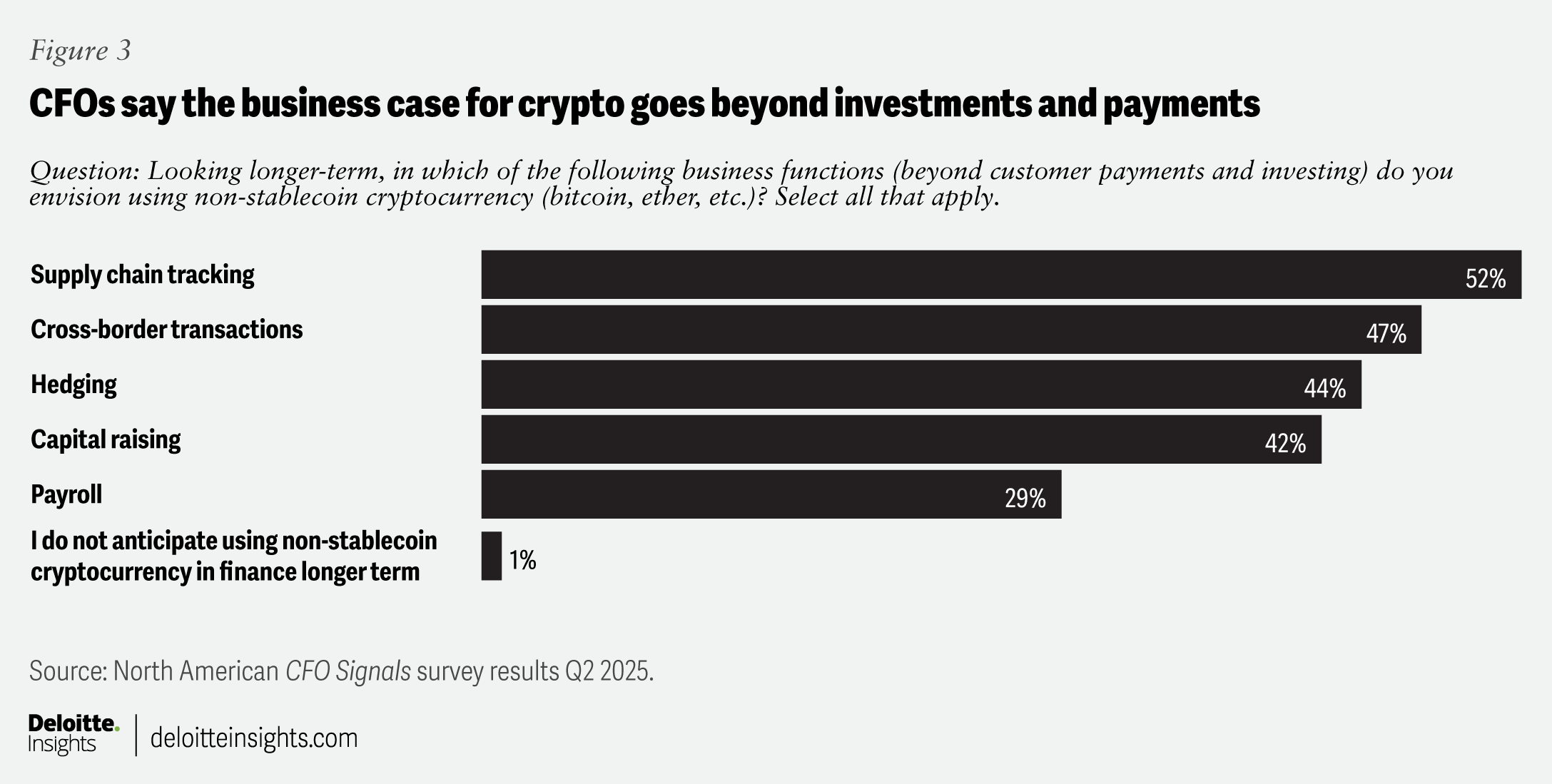

CFOs are also considering blockchain-based assets to improve operations. More than half of respondents said they expected to use cryptography to manage and track supply chains. Blockchain’s transparent and immutable record management can streamline payment verification.

The crypto business case goes beyond investment. Source: Deloitte

An internal cryptographic conversation is already underway. 37% of CFOs said they discussed digital assets with the board of directors, 41% with the Chief Investment Officer and 34% with the bank or lender. Only 2% reported no crypto-related discussions.

Related: Trump Media partner with Charles Schwab expands to cryptocurrency services

A systemic appetite for cryptography develops

A March survey by Coinbase and Ey-Parthenon found that 83% of institutional investors plan to promote crypto exposure in 2025, with many expanding beyond Bitcoin and ether.

XRP (XRP) and Solana (SOL) have emerged as top picks among respondents, but the majority expect to allocate at least 5% of their portfolios to digital assets this year.

magazine: Bitcoin OG Willie Woo sold most of his Bitcoin – this is why