Bitcoin

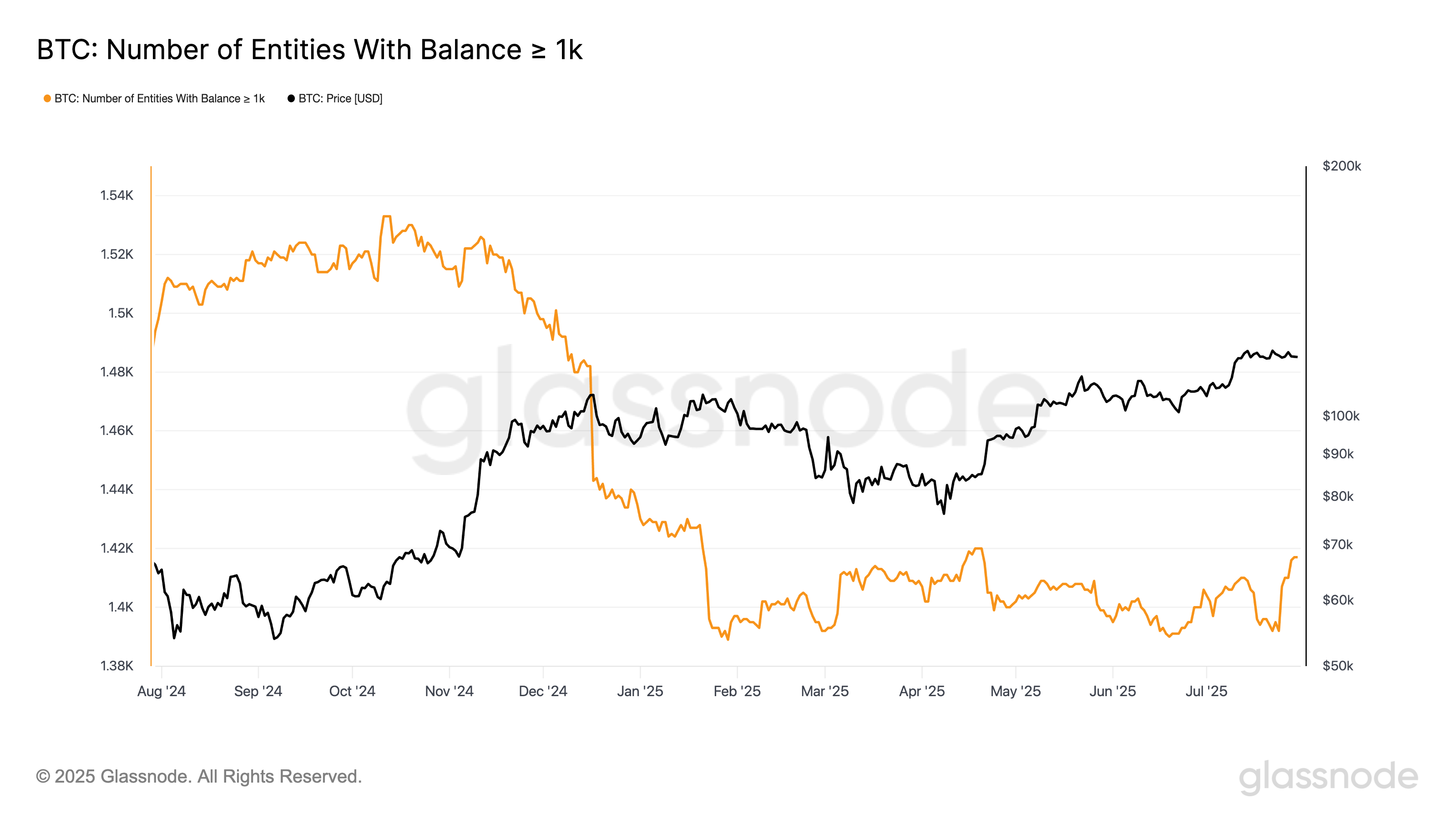

Recent data from GlassNode shows that the number of unique whale entities defined as having at least 1,000 BTC has risen from 1,392 to 1,417 in the past week. This is one of the highest number of whales recorded in 2025, indicating a revival of institutional or large investor trust.

GlassNode identifies an entity as a cluster of addresses controlled by the same user or organization.

Number of entities in 1K BTC (GlassNode)

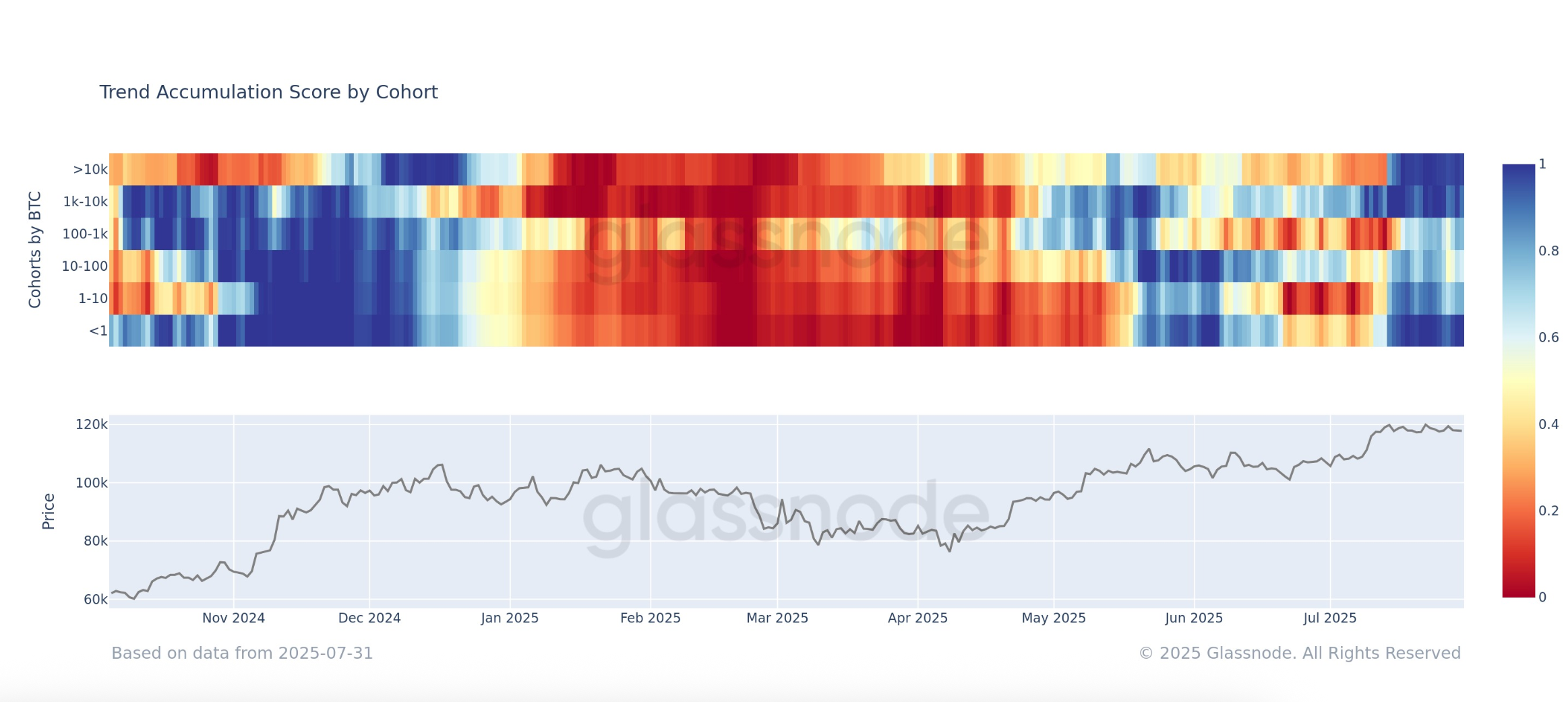

Furthermore, the accumulation propensity score, a key on-chain metric, reveals that not only whales accumulate aggressively, but also the smallest holder known as shrimp, who own less than one BTC. This purchase pressure highlights a rare moment of alignment between retailers and institutional investors.

Metrics break down the size of your wallet and the accumulated strength of your recent acquisition behavior over 15 days. A score close to 1 suggests a strong accumulation, while a value near 0 indicates a distribution. Entities such as exchanges and miners are excluded from focusing on authentic investor sentiment.

Importantly, this level of sustained accumulation across all cohorts has not been seen during President Trump’s reelection in November 2024. That period marked a bold sentiment and a sharp rise in price momentum, with Bitcoin claiming $100,000.

Given the wide accumulation and the psychological boost of new whale interest, market observers may be confident that Bitcoin could challenge it in the near future and potentially rise above its all-time high.

Accumulation trend scores by cohort (GlassNode)