Many predictions about future trends of Bitcoin Price It’s still bullish, but in the short term, we need to be aware of what happens today.

In fact, US inflation data was released for July, which could lead to financial market volatility.

The problem is that there is a signal that indicates that Bitcoin prices may respond poorly to this volatility today.

Inflation data

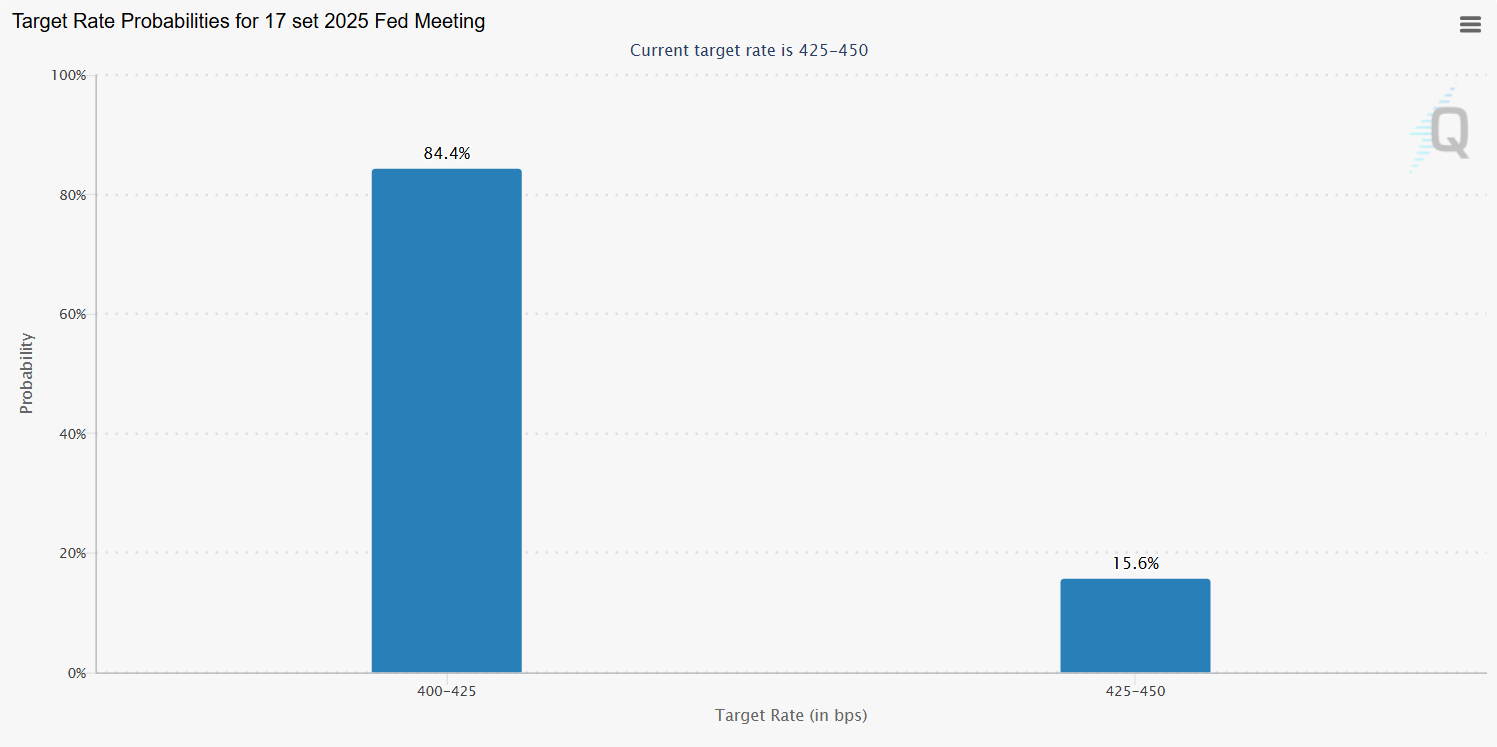

Currently, the market is betting on the next market cut With interest rates By the Fed in September, it is likely to be considered at over 80%.

Analysts will assign an 84.4% chance to a 25 bps interest rate cut during the next Fed meeting. sauce: CME Group | Fed Watch

Potential cuts will encourage current Treasury holders to sell them to reduce US government bond yields. Such sales tend to be inversely correlated if it occurs, if the dollar is theoretically weakened, and Bitcoin price trends tend to be inversely correlated. Dollar Index In the medium term, potential weakening of the dollar could be caused Bitcoin It rises.

However, there is still more than a month before the next Fed rate decision.

In the meantime, today we will release updated data on US inflation for July.

The fact is that inflation could increase and lower the possibility of a Fed rate reduction in September, which could also reduce the dollar index.

The most important data regarding US Central Bank monetary policy is core inflation (excluding energy and food).

Currently, the consensus is due to increased Core inflation In particular, from 2.9% to 3% Trump Customs.

It should be noted that Trump’s tariffs will begin to have a slightly negative impact on prices in July, increasing them, and this dynamic at current speed could last for several months.

The Fed’s goal is to bring Inflation to 2%therefore, theoretically, fees should not be reduced as the core inflation rate has risen to 3%.

But they are expected to do so, especially as the Fed has another primary purpose, full employment purpose, and the US labor market is likely to show signs of minor difficulties due to Trump’s tariffs.

Bitcoin price response

If the currently published data is related to Core inflationit should have been exactly 3%, and perhaps the market response will be minimized.

Instead, if it is already 2.9% or 3.1%, the response may also be important.

In particular, if US annual core inflation remained at 2.9% in July, the market response could also be very positive, as the probability of further Fed reductions in October and December increases.

Meanwhile, if the annual core inflation rises to 3.1% in July, the response is clearly negative, as the probability of a September cut could be significantly reduced.

It is important to remember that the market is already priced with this hypothetical reduction. Therefore, if the probability collapses, it is necessary to align as quickly as possible.

Medium-term forecast for Bitcoin (BTC) prices

However, all this applies only in the short term.

In the medium term, everything actually changes.

The points will be from July Bitcoin Price In proportion, it started to resemble those from the end of 2017.

In particular, compared to the trends of Dollar IndexThe monthly candles for Bitcoin price in July 2025 are similar to the prices in August 2017, and the current and incomplete candles for August this year are incomplete with the current and incomplete with the current and in September 2017.

After a relatively difficult September at the time, the second largest speculative bubble had swelled for three months. Prices BTCthanks to that, it rose from under $4,000 to nearly $20,000, but back to about $6,000.

It is never certain that history will have to repeat itself at all costs, but there are still many analysts who see Bitcoin’s price as rising $150,000 By the end of the year.

Bitcoin Price (BTC/USD) Candlestick Chart, Binance Market. Source: TradingView

According to the co-founder of PayPal, Peter Tielthe Bitcoin boom is similar to the internet boom of the late 90s of the last century.

But Thiel also argues that Bitcoin is still undervalued, as was the Internet in the early 2000s.

The gap is immeasurable when comparing the current overall value of various activities on the Internet to what Internet activities had overall 25 years ago. At the time, there were already Amazon and Google to clarify, but there were no Facebook or Twitter (now X).

Furthermore, Google was not yet listed on the stock exchange, and Amazon’s stock was valued 40 times less than the stock exchange’s current value despite the infamous Dot-Com bubble.

This view is shared in part by many innovation experts, but in fact it only relates to the long term or very long term.