Ethereum Treasury Company BTCS, one of the largest ETH Treasury Departments to date, will pay a one-off special dividend. All BMNR shareholders qualify for $0.05 per share of ETH paid in chains.

BTCS plans to reward all investors with special on-chain dividends and pay ETH of $0.05 per share. BTCS CEO Charles Allen has announced a special dividend.

I’m excited that BTC can share a one-time blockchain dividend, or “Vivid” to shareholders, paying “Vivid” at $0.05 per share of Ethereum (ETH). Additionally, it offers Ethereum royalty payments of $0.35 per share to shareholders who move their shares to shareholders…pic.twitter.com/wkrn308g8t

– Charlesallen.eth 🐢🦄 (@Charles_BTCS) August 18, 2025

The Ethereum Treasury Company has announced one-off plans for an unprecedented “Vivid” or blockchain dividend. BTCS will become the first public company to issue dividends to ETH, filling in crypto funds for traditional investors.

BTCS has a second one-time Offer ETH’s $0.35 per share is a royalty payment to shareholders who hold shares in BTCS Transfer Agent. Shares must not be sold by January 26th, 2026. Therefore, shareholders receive an ETH of $0.40 per share.

Payments are intended to reward long-term shareholders. The move also encourages traders to take control of their stocks and prevents predatory short sellers from using it.

The program encourages both new stock purchases and loyalty. All BTCS buyers who acquire shares prior to the September 26th cutoff date will be eligible for dividends.

The shares must then be entrusted to the transfer agent selected by BTCS. During the opt-in process, buyers will also provide ETH wallets to receive dividends.

BTCS prices will be weakened with ETH correction

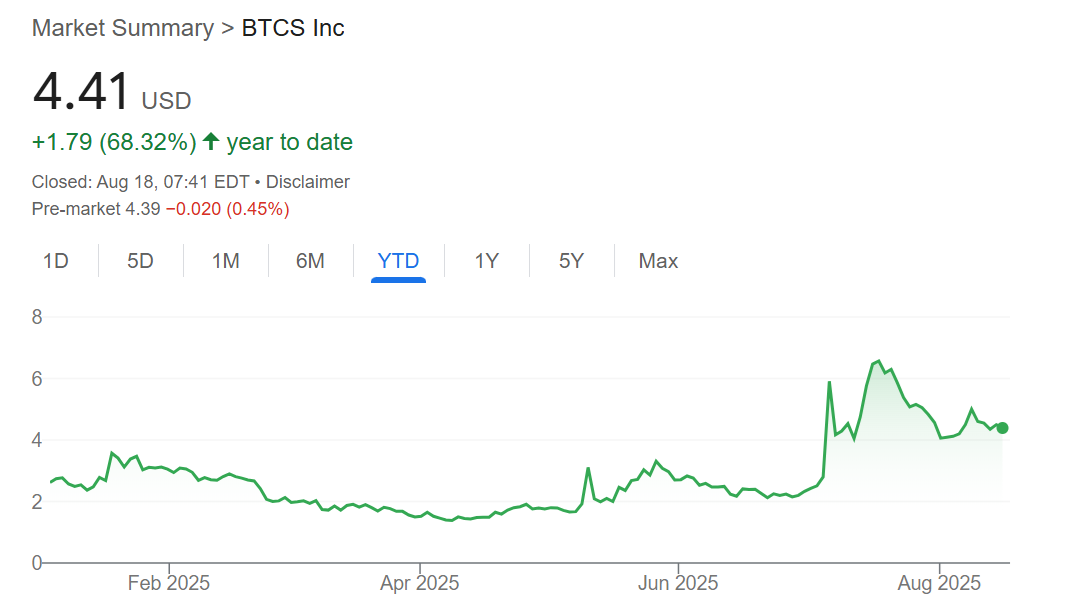

BTCS prices have weakened to the low range at around $4.41 over the past month. In the past 2025, stocks have grown by more than 68%, with most profits consistent with the recent ETH rally.

BTCS has taken a step back, but it still shows how strong it has been up to this year. |Source: Google Finance

ETH slid to $4,343.31. The meeting sparked hope for further expansion, but was shortened as uncertainty was set.

BTCS stocks have also weakened over the past week, with more traders opening short positions. At the end of July 10.4% The BTCS float was shorted, but most positions are still relatively easy to cover. The Treasury company’s stock is sluggish and could potentially lead to more short-circuit positions.

Along with BTC, other ETH Treasury ministries have also fallen from recent highs. Sharplink Gaming (SBET) has reduced nearly 18% to $19.85 from its price over the past week. Bitmine (BMNR) fell to $57.81.

BTC is a battle for the top 10 financial spots

BTCS is currently outside the top 10 of the ETH Treasury Department, with a total of 70,000 ETH in known reserves.

The company accelerated its purchases in July along with other financial buyers, but for now, new ETH purchases have not been reflected in the stock price.

As previously reported by Cryptopolitan, BTCS relies on traditional funding and Defi, Aave Lending To get more ETH. Some of the available ETHs are also from the BTCS block construct operation. This is one of the main sources of revenue. In Q2, BTCS expanded its Builder+ share to 2.7% of all Ethereum transactions.

Ethereum’s Treasury Department will provide more flexible and still passive income from staking, as well as the usefulness of lending. Currently, ETH’s finances are filled faster with more aggressive purchases compared to ETFs.