On the weekend, I was rushing to an exit from the world’s largest proof blockchain. As of 8:00 PM UTC on Sunday evening, Staters lined up 893,599 Ethers (ETH). Unlocking $4 billion accumulation from Ethereum Network.

Ethereum limits the amount of unstable ETH per epoch for 6.4 minutes. If there is no more ETH generated than what future epochs can handle, then additional ETHs will have to wait in the queue.

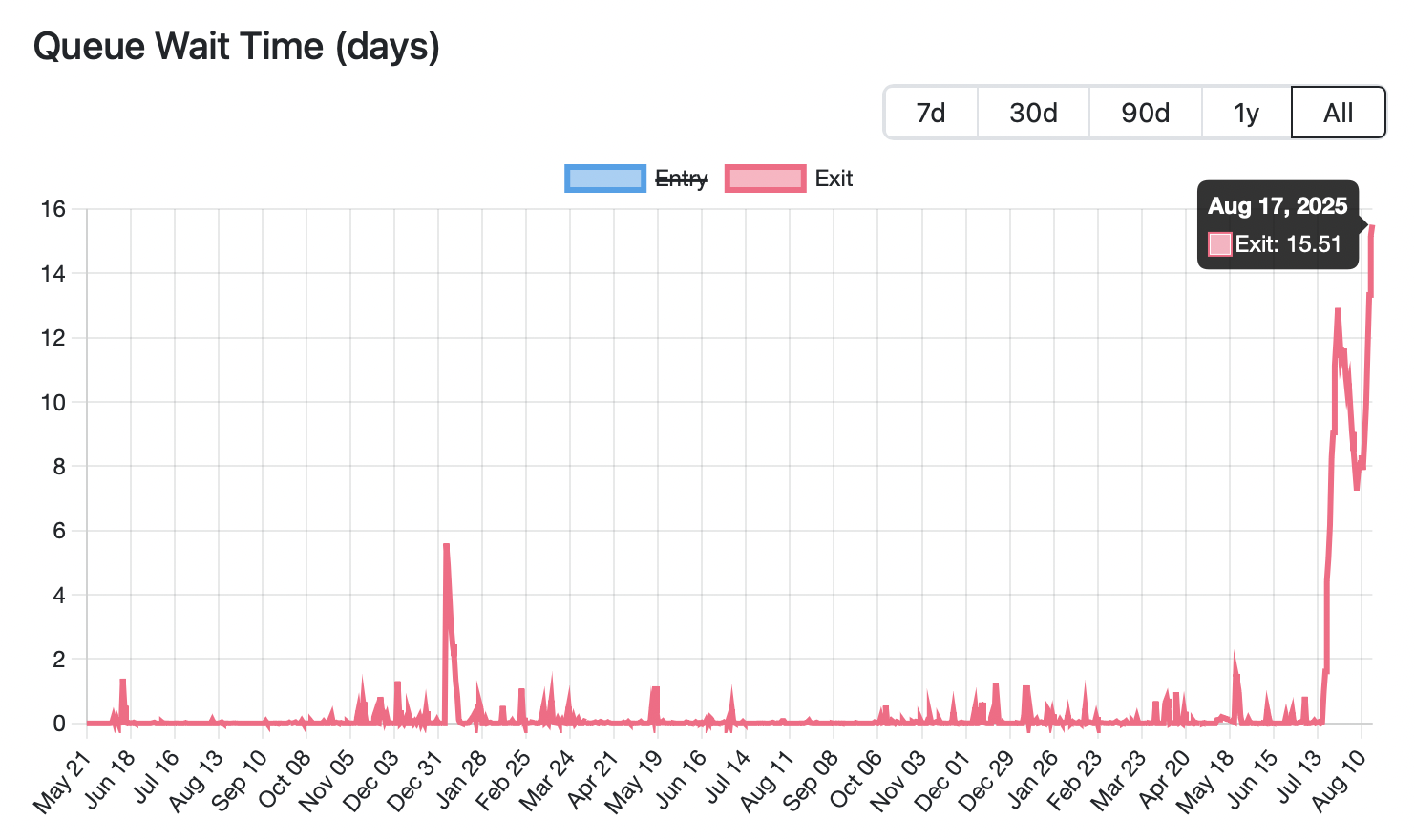

As of 2am on Sunday, Ethereum’s staking-free wait time was extended to the worst validator queue in history: 15.5 days.

Source: validatorqueue.com

There was one major explanation for the long multi-billion dollar line.

Staking in US ETFs

According to one observer, the SEC is ready to approve ETH staking within our spot ETFs. US residents who have previously staking ETH via staking pools like Coinbase or Lido have the option to easily earn staking rewards with publicly available ETFs.

Someone else criticized this Paul Atkins-led SEC plan for approving staking revenue within the ETF.

Another skepticism repeated “so many mediators.”

Still, if the market is planning to approve ETF staking, the news can explain some of the record-level staking requests this weekend.

read more: Ethereum’s biggest staking service finally brings back Steth Peg

Rewinding loop from a higher borrowing rate

Another explanation involves ETH borrowing rates and loops, which have been increasing dramatically since July 16th.

A loop in the term Decentralized Financial Financial (DEFI) is a risky transaction that involves redepositing the loan revenue as collateral for additional loans. The loop adds leverage to Ethereum’s mere 2.9% APR staking reward, offering two-digit or triple-digit rates in the most loops.

Galaxy Research has in part denounced the HTX exchanges belonging to Justin Sun for surge in ETH borrowing rates with the dominant lending protocol, Aave. They also noted the knock-on effect of HTX from the massive anxiety. This includes liquid staking hair removal and token recurrence, which replicated the token from ETH prices.