Bitcoin’s price is on the verge of falling below another key level after failing to regain momentum following its all-time high a few weeks ago. Investors are now worried that the price measures may soon bring an end to the entire crypto bull market.

BTC Price: Technology

By Shayan

Daily Charts

On the daily charts, the assets have been gradually declining since winning an all-time high of $124K, as they may have been closed in August. This is a worrying sign for investors. With prices below the $110,000 key level, the price is dragged into the $104,000 region, potentially under $10,000.

The RSI is also stable below 50, indicating bearish momentum domination. As a result, further drawbacks appear to be more likely at this point, unless market dynamics change dramatically.

4-hour chart

Stopping by the 4-hour chart makes things a little more interesting. The asset has declined within the steep downward channel over the past few weeks, below key support levels. With the $110,000 level collapsed, investors are considering a major FVG of $104,000. This level coincides with the lower limit of the Fibonacci Golden Zone and strengthens its importance.

The RSI also shows a clear bearish momentum. If the $104K zone is also a lot, a low below $10,000 could be imminent, with a bearish trend in the coming weeks.

On-Chain Analysis

Exchange Netflow (30-day moving average)

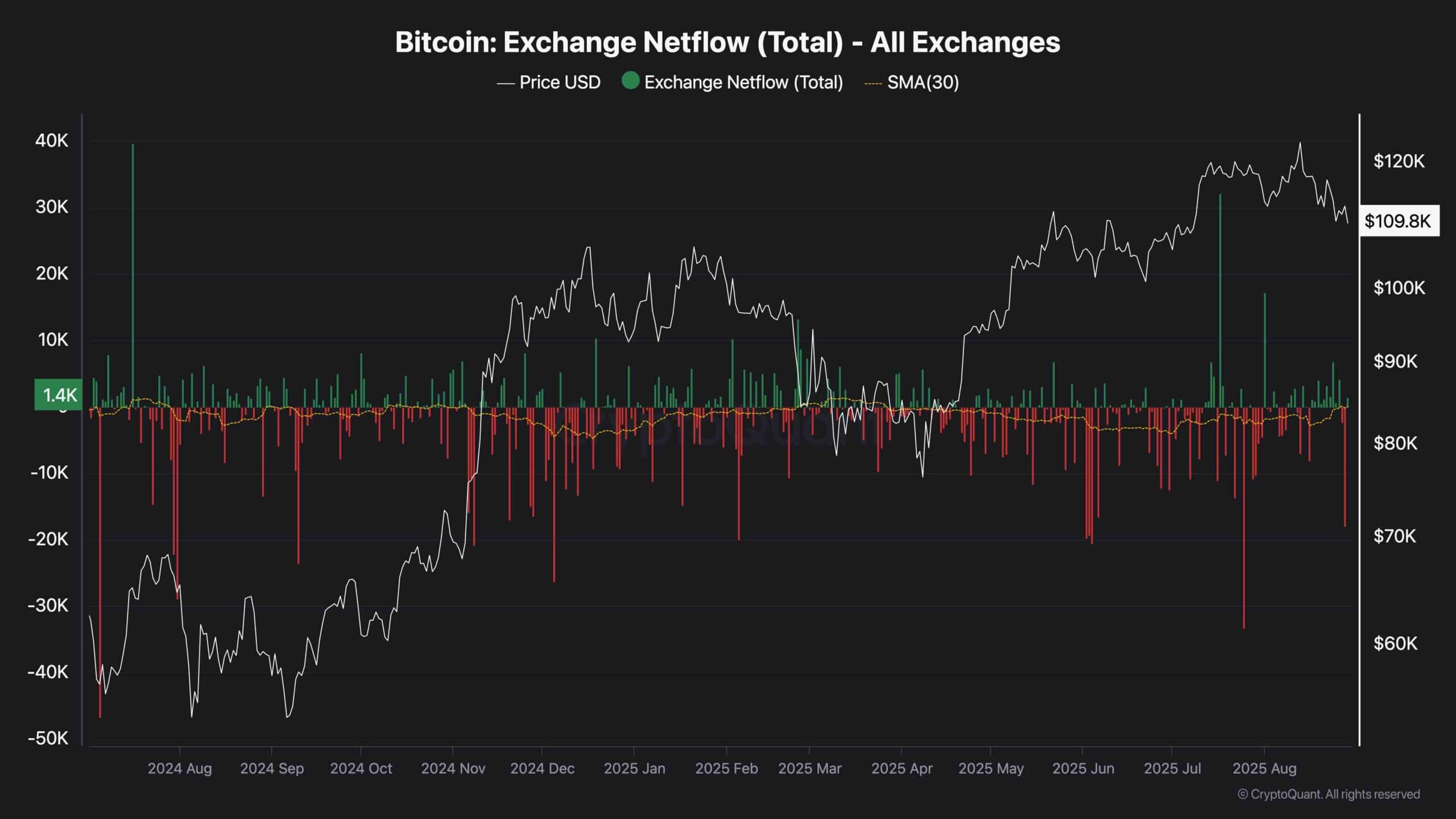

The chart shows that exchange Netflows have been more bearish than bullish since April, with the 30-day moving average consistently sitting in negative territory.

This means that many Bitcoins are away from exchanges more than they enter. The overall trend is consistent with a decrease in available exchange reserves, suggesting that supply throttles may be occurring beneath the surface.

At the same time, there have been isolated days of large influxes into exchanges, but they are similarly rebelled by strong outflows. This balance reinforces the idea that a short-term surge in sales pressure is not sufficient to reverse the broader accumulation trend.

As long as reserves continue to fall and coins move away from the exchange, long-term holders are still confident, indicating that this underlying accumulation can support prices over the coming months. Of course, this is when you overwhelm the sales pressure from the futures market.