The blockchain-focused lender figure technology solution aims to raise $526 million in initial public offerings (IPOs), highlighting the growth trends of crypto and blockchain companies pursuing public lists within the Bull Market.

According to regulatory filings filed Tuesday and reported by the Bloomberg Act, the figure is expected to sell 21.5 million shares in the range of $18-20, with existing holders set for sale 4.9 million shares. At the top of the range, the IPO values the company at approximately $4.3 billion.

The figure filed confidentially with regulators last month, revealing its public ambitions when it was filed by the formal Securities and Exchange Commission (SEC) on August 18th. The latest submissions show that the company is targeting September 10th as the pricing date for the IPO.

The company’s valuation has increased since 2021 since the $200 million Series D round led by 10T Holdings was valued at $3.2 billion. Finance has shown momentum recently, with revenues rising to $191 million in the first half of this year.

The figure is now best known for its blockchain-based financial products built on a blockchain of origin, but its origins were in consumer financing. The company’s first offering was a digitalised home equity line aimed at US homeowners, which later expanded to blockchain infrastructure to improve lending and securitization.

https://www.youtube.com/watch?v=0BX9ALZW1UI

Related: Crypto Biz: IPO Fever, Ether Wars, Stablecoin Awowds

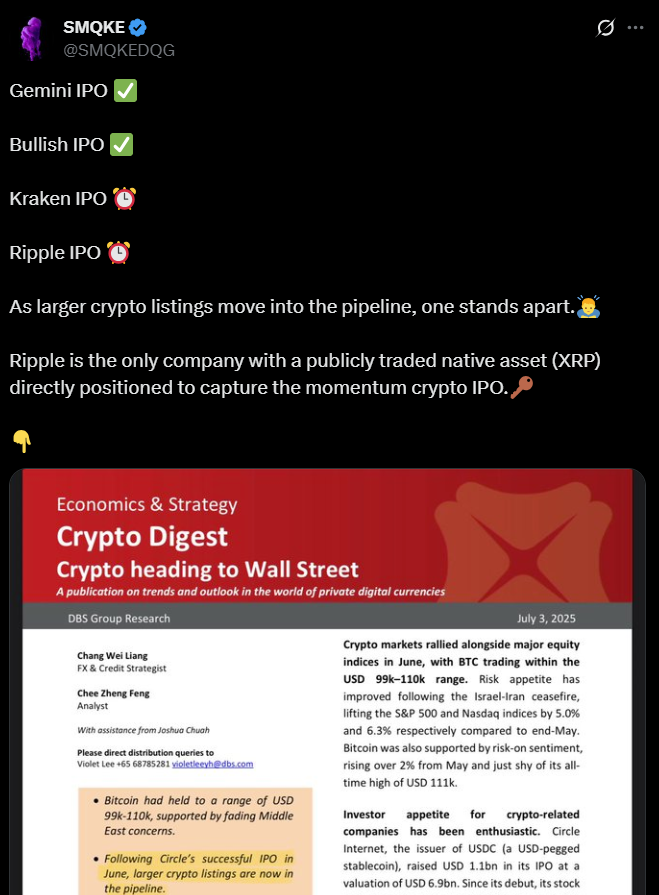

The Crypto IPO rush continues

The diagram is one of several blockchain companies heading towards the public list. As reported by Cointelegraph, Crypto Exchange Gemini filed for an IPO on Tuesday with the aim of raising up to $317 million.

Fellow Exchange Kraken is rumoured to pursue a $500 million increase at a valuation of around $15 billion, suggesting that the company could be made public in 2026.

sauce: smqkedqg

In August, Digital Asset Exchange Operator Bullish made its blockbuster debut. The shares were $37, up 218% on the first day of trading.

Prior to its offering, the company raised its IPO valuation to $4.8 billion amid strong institutional demand. Even after the initial surge has cooled, bull still orders a valuation of around $9.6 billion.

That list appeared shortly after the Stablecoin Issuer Circle IPO. Circle currently has a market capitalization of around $30 billion.

At the same time, industry players are exploring alternative routes to the public market. Several crypto executives have joined forces to launch Bitcoin Infrastructure Acquisition Corp, a Cayman Islands-based special purpose acquisition company (SPAC), with a goal of a $200 million salary increase through IPOs.

Related: Crypto biz: Is there a price for SEC project Crypto?