The Bitcoin futures market is entering the cooling phase, raising questions about whether retailers can maintain price momentum without the impact of whales at their facility.

Data from the Blockchain Intelligence Platform shows that the market is increasingly driven by small players, but selling pressure on futures contracts could send Bitcoin value down.

Bitcoin Zilla’s recession, retail

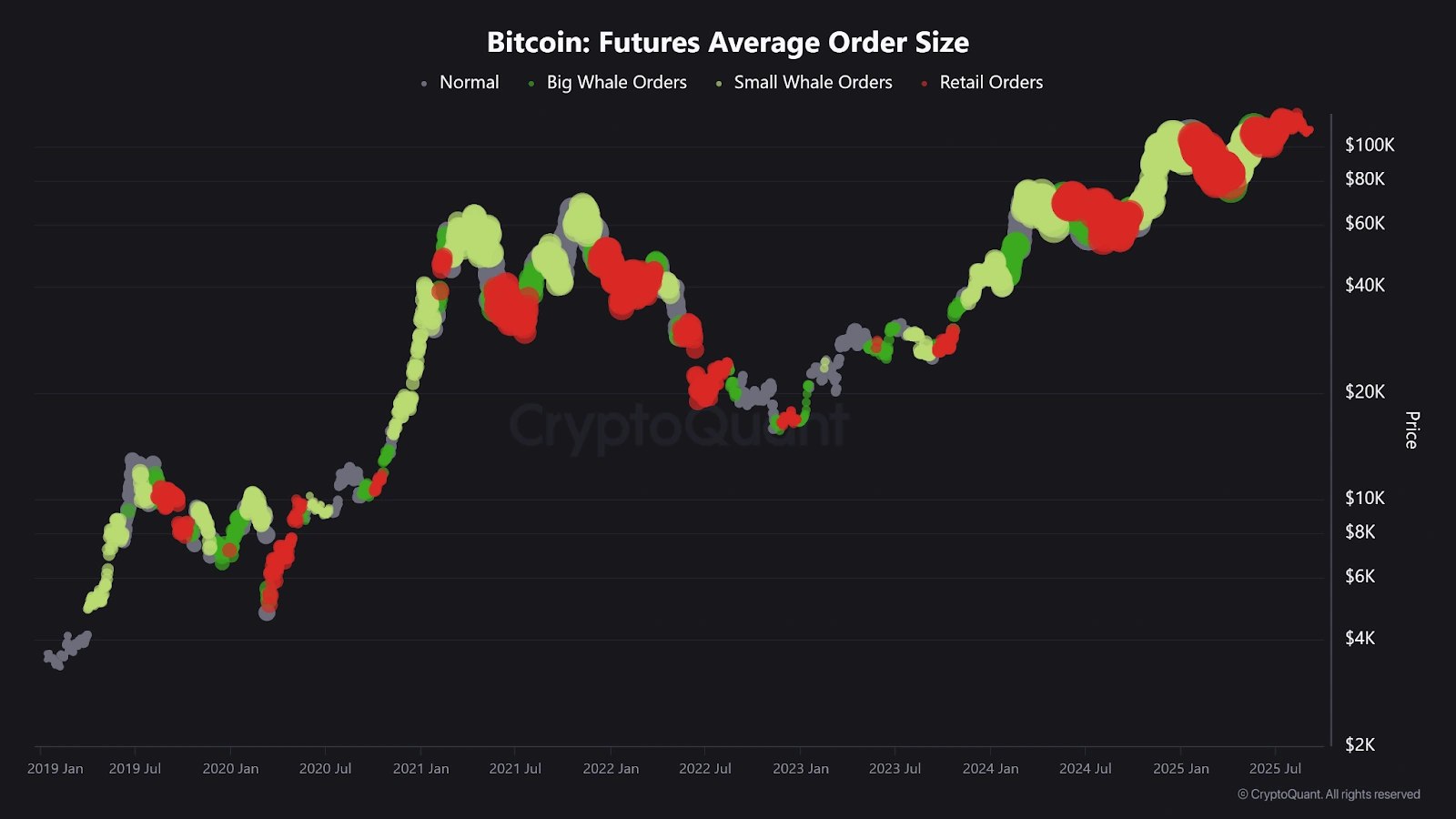

Analysis from encryption highlights a decrease in whales’ participation in the futures market. The average order size, calculated as the total transaction volume divided by the number of transactions, continues to decline.

Bitcoin futures average order size. Source: Cryptoquant

Larger average order sizes are a sign that whale investors are increasingly participating in trading. Current data shows that small transactions, a distinctive feature of retail investors, are currently setting the tone of market direction.

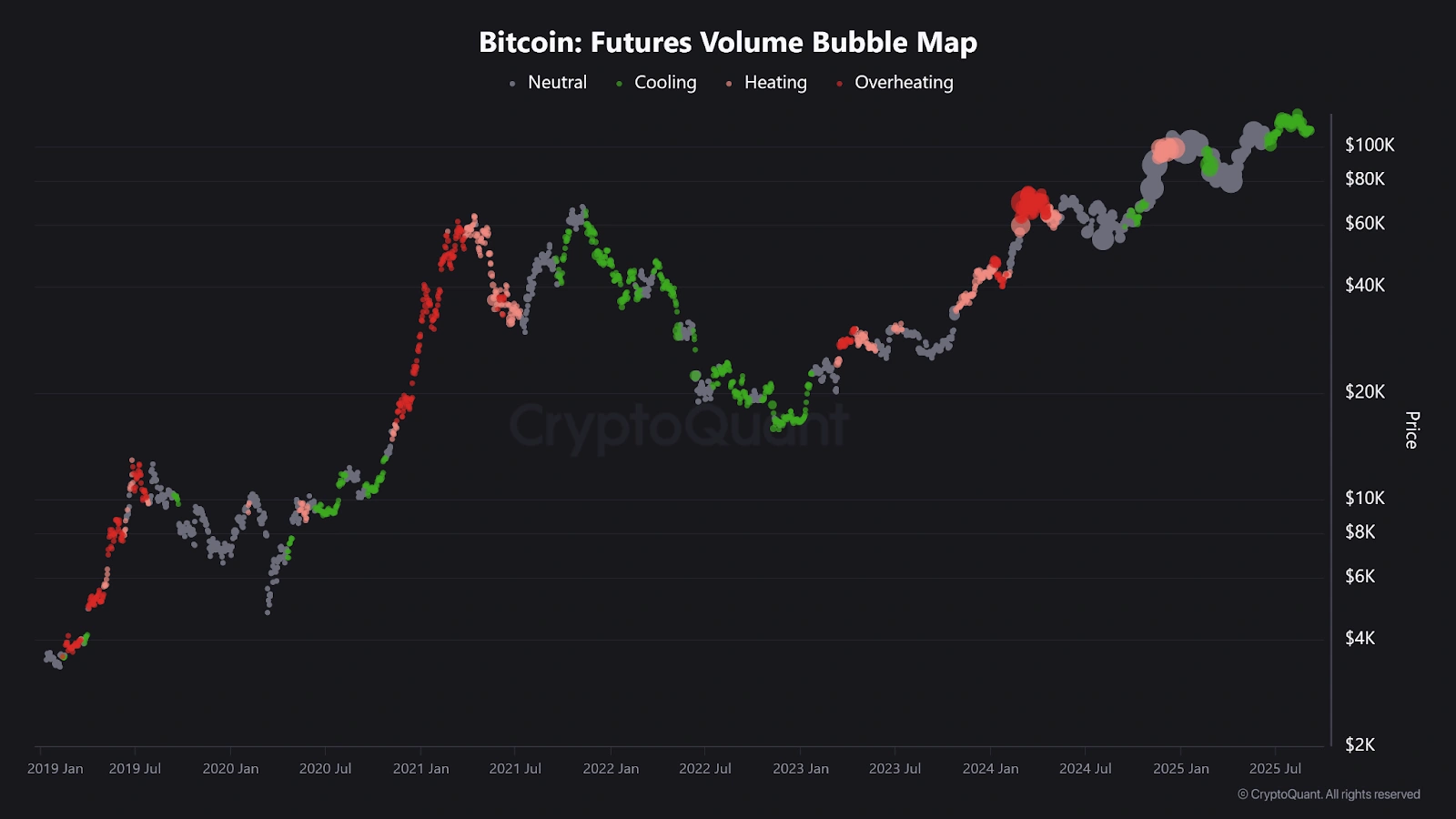

The volume bubble map of futures supports this trend, showing a cooling stage marked by a decline in whale-driven trading activity and a decline in overall volume.

Bitcoin futures volume bubble map. Source: Cryptoquant

Retailers now dominate the futures market, but whales appear to be on the sidelines.

This transition will affect market stability. While institutional players are known to provide more liquidity and long-term positioning, retail-driven flows can amplify short-term volatility.

There is a risk that BTC’s price behavior will become more unstable without whales locking in the futures market. Previous reports confirm that even strategy BTC purchases have been scaled down.

Building bearish emotions

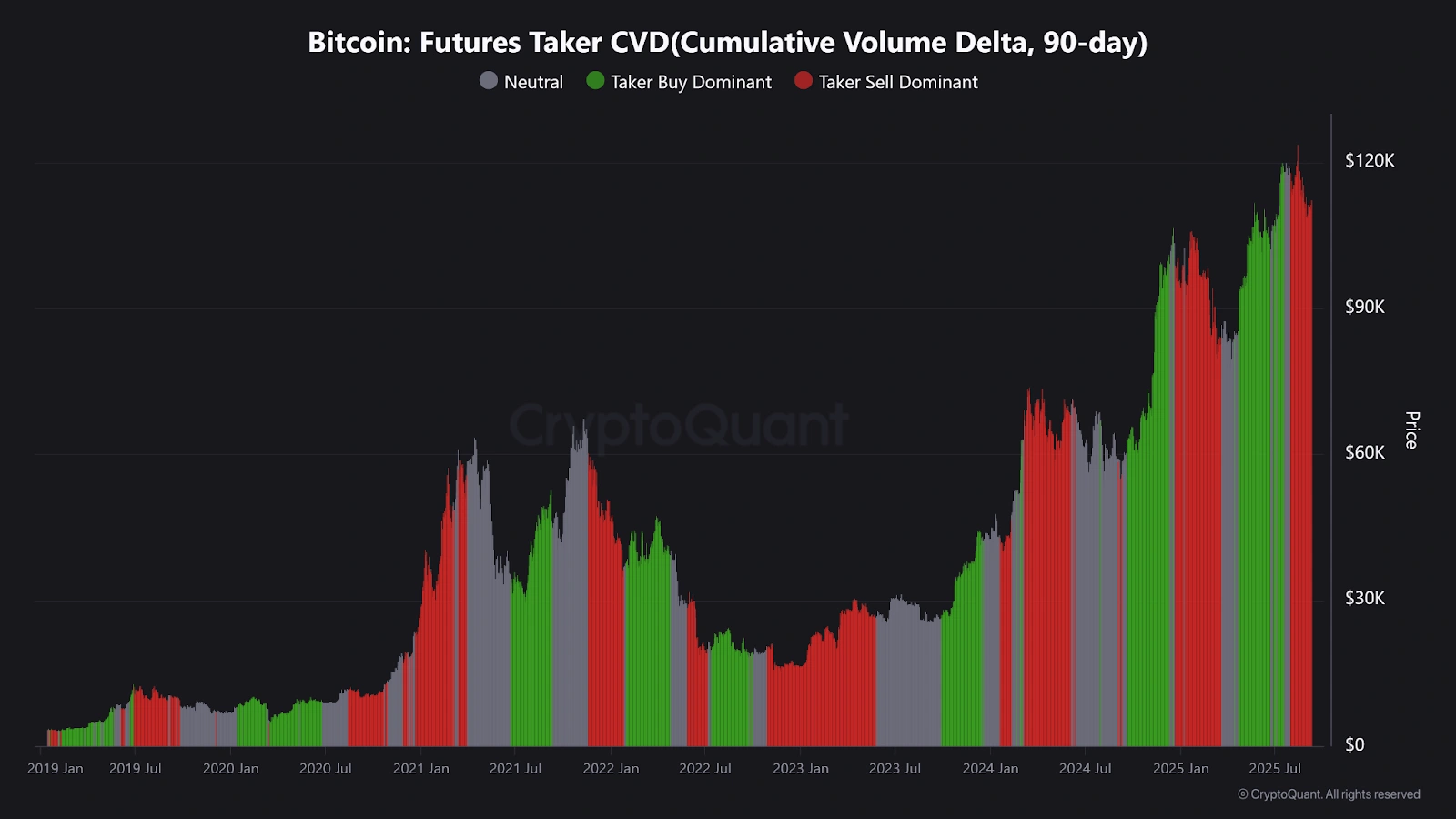

According to Cryptoquant’s 90-Day Taker Cumulative Volume Delta, sales activities outweigh buys, with sellers putting pressure on the market direction. This trend suggests that futures market traders may be preparing in anticipation of a decline in Bitcoin prices.

Bitcoin Futures Taker Cumulative Volume Delta. Source: Cryptoquant

Other analyses reinforce this view, noting that since August, Bitcoin has exceeded the range of over $115,000 to $120,000, with key liquidity zones of $110,000 and $113,000. Updated sales pressures at these levels could pave the way for further weakness.

About a week ago, an analyst at VT Markets noted that Bitcoin futures had not repeatedly violated resistance levels between $111,000 and $111,400. However, at the time of writing, Bitcoin is just over $112,000.

Institutional demand has been a key driver of the rally this year, with ETFs attracting billions of dollars inflows and spurring Bitcoin to record the best. Cryptopolitan reported that institutional trends account for a large part of the momentum of the summer surge and that they are interested in the regulated futures reaching record levels.

However, recent data suggests that its stabilization power has declined.

Is BTC bound by scope or will the market worsen?

Bitcoin’s close outlook relies on whether whales will increase participation in futures trading. Without a new increase in demand from institutional players, major cryptocurrencies risk remaining trapped without significant profits, or even worse, floating low with the weight of retail-driven sales.

However, there is still room for surprise as analysts say that despite sustained sales, Bitcoin has shown resilience and demonstrates evidence of strong absorption of sales pressure in derivative exchanges such as Binance.

It may be evidence that institutional buyers are quietly accumulating BTC prior to clearer macro indicators or major industrial catalysts.