Since early August, Ethereum has maintained its lead in spot trading volumes via Bitcoin, and the trend continues.

summary

- Spot Ethereum’s trading volume has consistently surpassed BTC

- This trend suggests that traders are spinning into altcoins

- Fed’s expected rate compensates for fuel

Bitcoin has long been an uncontroversial leader in market liquidity. However, as BTC trades near record highs, investors are slowly turning to Altcoins, with Ethereum being the main beneficiary. As of September 11th, Ethereum is leading spot trading volume. This has been a trend that has been going on since early August. In particular, this is the first time Ethereum has turned BTC over the metric for the first time in seven years.

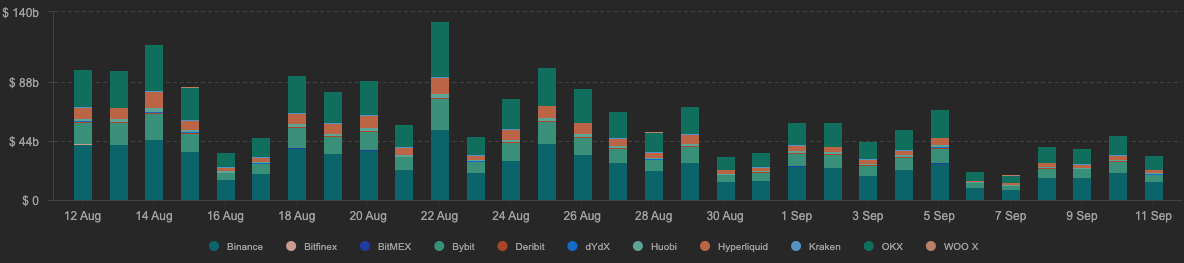

Ethereum Daily Spot Trading Volume | Source: Coinalyze

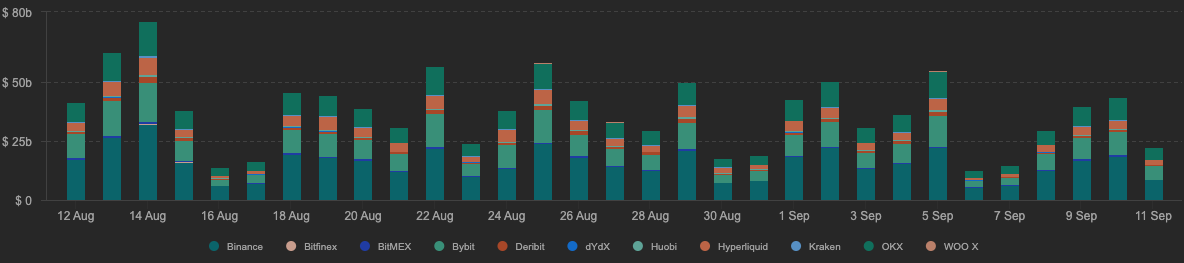

Bitcoin Daily Spot Trading Volume | Source: Coinalyze

According to Cryptorank, Ethereum (ETH) trade volume was 32.9% from early August to September 9th. At the same time, that figure for Bitcoin (BTC) was 32.6%. Furthermore, this trend continued, with Ethereum’s spot trading volume reaching $48 billion on September 10th, compared to BTC’s $43 billion.

You might like it too: Bitcoin price forecast: Is a 10k $10k swing imminent in a chart pattern?

ETFs show the branching of Ethereum and Bitcoin

The rise in Ethereum spot volume coincided with the divergence of Ethereum and Bitcoin spot ETF flows. In particular, according to Vaneck, Ethereum ETF pulled out $4 billion inflows in August, while Bitcoin ETF experienced a leak.

The most likely reason for this difference is to increase risk appetite among investors. Bitcoin is nearing its highest level ever, but investors expect the Federal Reserve to cut interest rates. In this environment, investors are willing to embrace high-risk bets that could offer higher returns.

For this reason, Ethereum traders have tested resistance zones between $4,400 and $4,500 and are trading above $4,200. These are important levels for coins now. Passing through this zone could lead you to $5,000, but it could fall below $4,000 due to a collapse of below support.

read more: Bitcoin Price beats $114,000, with ETF inflows of $757 million following signs cooling US inflation