Over the past week, the Bitcoin market has experienced a significant volatile price action, resulting in a 0.07% decline in net prices. Crypto market leaders first surged to $118,000, especially as bullish sentiment rose after the US Federal Reserve announced its first interest rate cuts in 2025.

However, due to the cooling of transaction activity, Bitcoin has been raised to around $115,700 in the last 24 hours. When studying the price structure of assets, popular market analysts using the X username KillaxBT highlight two important price levels:

Faced with the weekly opening of Bitcoin amid the threat of daily imbalance

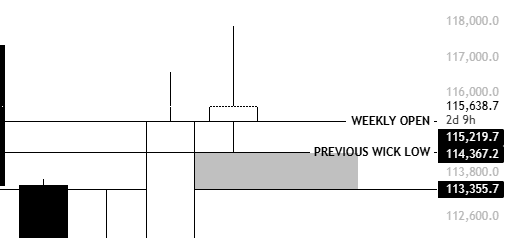

In a September 19th X post, KillaxBT shares important attention insights into the current Bitcoin market, identifying two support zones at risk. Notably, at the time of the latest session, BTC retested its weekly opening at $115,219, a level that served as an important pivot point for both bulls and bears.

Holding it above this threshold is a strong indication, but market sentiment can be bearish when the critical movement is low. However, it focuses on the daily fair value gap, extended to $113,355, which is highlighted in the chart as an area of imbalance left by rapid price action.

Killaxbt explains that losing the weekly opening is likely to cause a price drop to $113,355 as prices trace back to the order flow of zones and thus such inefficiencies are ultimately met. However, there is also the previous Wick Low, which is now just above the FVG zone, at $114,367. This interim support may act as a buffer before deeper probes for the $113,355 mark.

According to KillaxBT, Bitcoin prices, which are above the weekly open and FVG price range, are important for entering next week. A successful price defense at these levels will result in a $118,000 bill being collected, potentially bringing the current ATH to $124,000. Meanwhile, when the decisive price falls below $113,355, the best cryptocurrencies are exposed to a downside target of around $112,000, $110,000 and $108,000.

Bitcoin price overview

At the time of writing, Bitcoin is trading at $115,700, reflecting a past 0.98% decline. Meanwhile, trading volume fell 17.14%, valued at around $35.8 billion. Despite its $2.3 trillion market capitalization, Bitcoin’s advantage reached 57.1%, indicating a continuous outperformance by Altcoins as Altseason potentially launches.

Pexels featured images, TradingView charts