Ethereum has regained strength over the past week, rallying and reclaiming the $4,500 zone. Momentum remains constructive, but signs of short-term fatigue are emerging as the market approaches key resistance.

ETH Price Analysis: Technology

by Shayan

daily chart

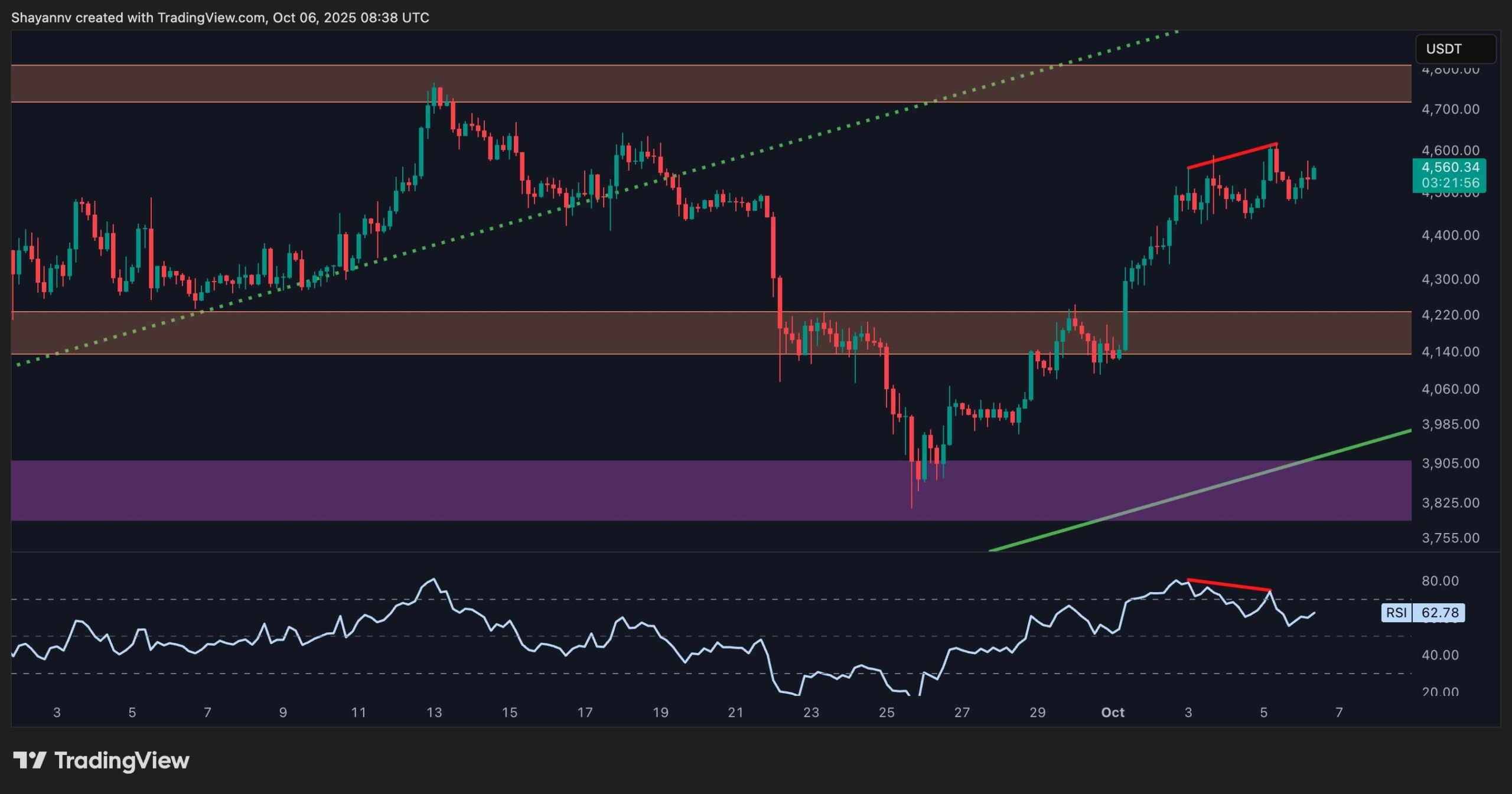

On the daily time frame, ETH continues to trade within a well-defined ascending channel that has been guiding price action since early spring. The current push towards $4,550 confirms a sustained bullish structure above both the 100-day and 200-day moving averages. However, the price is approaching a strong supply area between $4,600 and $4,800, with previous rallies facing rejection.

Also, the RSI has risen to 59, reflecting new bullish momentum but not entering bought territory yet. If ETH is able to break and close above $4,800, the next leg between $5,000 and $5,200 could develop. On the other hand, failure to break higher could trigger a retracement to the $4,000 support and lower boundary of the ascending channel.

4 hour chart

On the 4-hour timeframe, ETH is showing a bearish potential divergence between price and RSI, suggesting that the price test $4,550 will weaken short-term momentum. This region could act as immediate resistance before the $4,800 level, but the support zone below $4,200 is a key support that was previously actively defending.

A short-term pullback to this zone will not break the overall bullish trend and may provide better long-term opportunities. Maintaining above $4,200 is important to maintain the current higher structure.

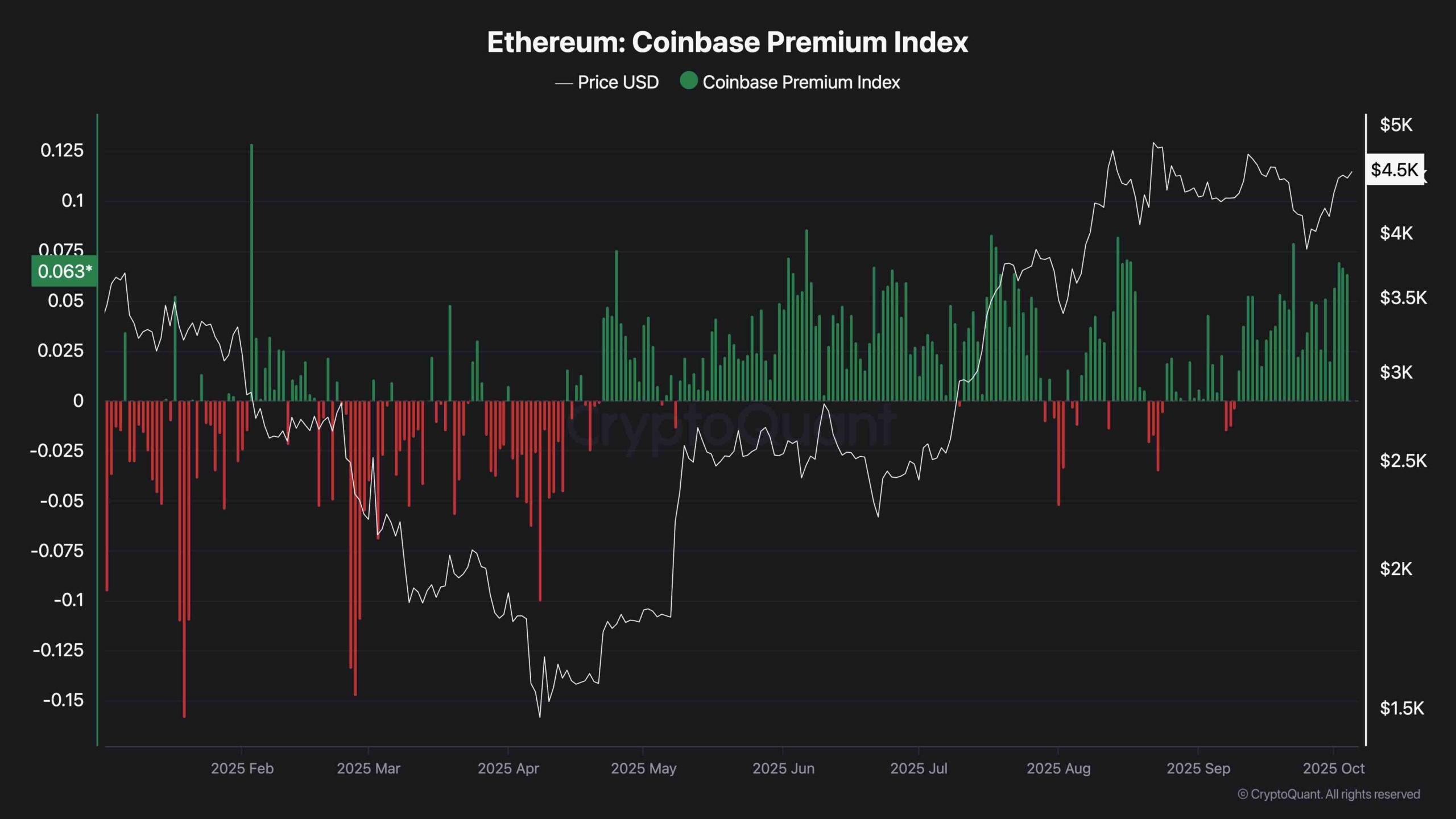

The Coinbase Premium Index has positively flipped to +0.063, indicating renewed buying pressure from Coinbase’s US-based investors. This indicates increased spot demand and potential institutional accumulation even though ETH is at an all-time high.

A sustained positive premium often coincides with strong market inflows and confidence in ETH’s medium-term prospects. If this buying trend continues, it could provide solid support for Ethereum price even in the event of a short-term correction.