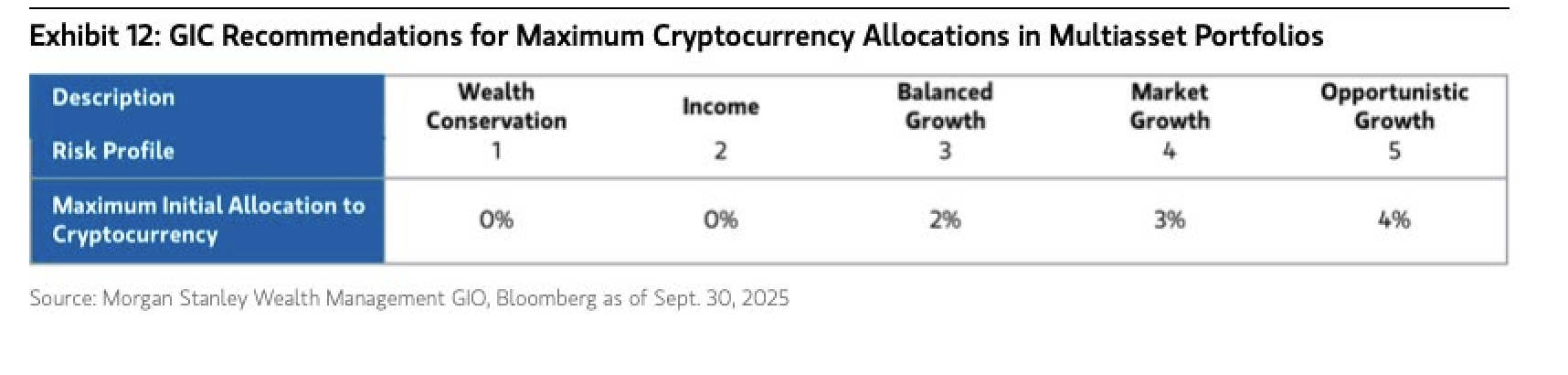

Financial services giant Morgan Stanley has issued guidelines for the allocation of cryptocurrencies in multi-asset portfolios, recommending a “conservative” approach in its October Global Investment Council (GIC) report to investment advisors.

Morgan Stanley analysts recommended up to 4% allocation to cryptocurrencies in “opportunistic growth” portfolios structured for higher risk and higher returns.

Analysts also recommended an allocation of up to 2% to a “balanced growth” portfolio, which is characterized by a more moderate risk profile. However, the report recommends a 0% allocation to a portfolio focused on asset preservation and income. The authors write:

“While emerging asset classes have experienced impressive total returns and reduced volatility in recent years, cryptocurrencies are likely to experience even higher volatility and higher correlation with other asset classes during periods of macro and market stress.”

GIC Guidelines for Maximum Cryptocurrency Allocation in Morgan Stanley Investment Portfolios. sauce: hunter horsley

Hunter Horsley, CEO of investment management firm Bitwise, called the report “huge” news. “GIC guides 16,000 advisors who manage $2 trillion in savings and assets for their clients. We are entering the mainstream era,” he wrote.

Morgan Stanley’s report reflects the growing institutional adoption and acceptance of cryptocurrencies, particularly among large banks and financial services companies, which is attracting more capital to the cryptocurrency market and solidifying the legitimacy of cryptocurrencies as an asset class.

Related: E*Trade adds Bitcoin, Ether, Solana to Morgan Stanley crypto expansion

Morgan Stanley report calls Bitcoin digital gold as BTC hits new all-time high

Deemed by Morgan Stanley analysts to be a “scarce asset akin to digital gold,” Bitcoin (BTC) continues to be adopted by institutional investors as a Treasury reserve asset and through investment vehicles such as exchange-traded funds (ETFs).

Bitcoin prices hit a new all-time high of more than $125,000 on Saturday as BTC trading balances, the number of purchasable coins held by an exchange, hit a six-year low, according to data from Glassnode.

Bitcoin has hit new highs on the back of the US government shutdown and rising prices for safe-haven, store-of-value, and risk-on assets.

“There is now a widespread rush to assets, as inflation recovers and the labor market weakens,” investment analysts at Covisi Letters wrote on Sunday.

magazine: Indicators show $250,000 Bitcoin is ‘best case’, SOL, HYPE hint at gains: trade secrets