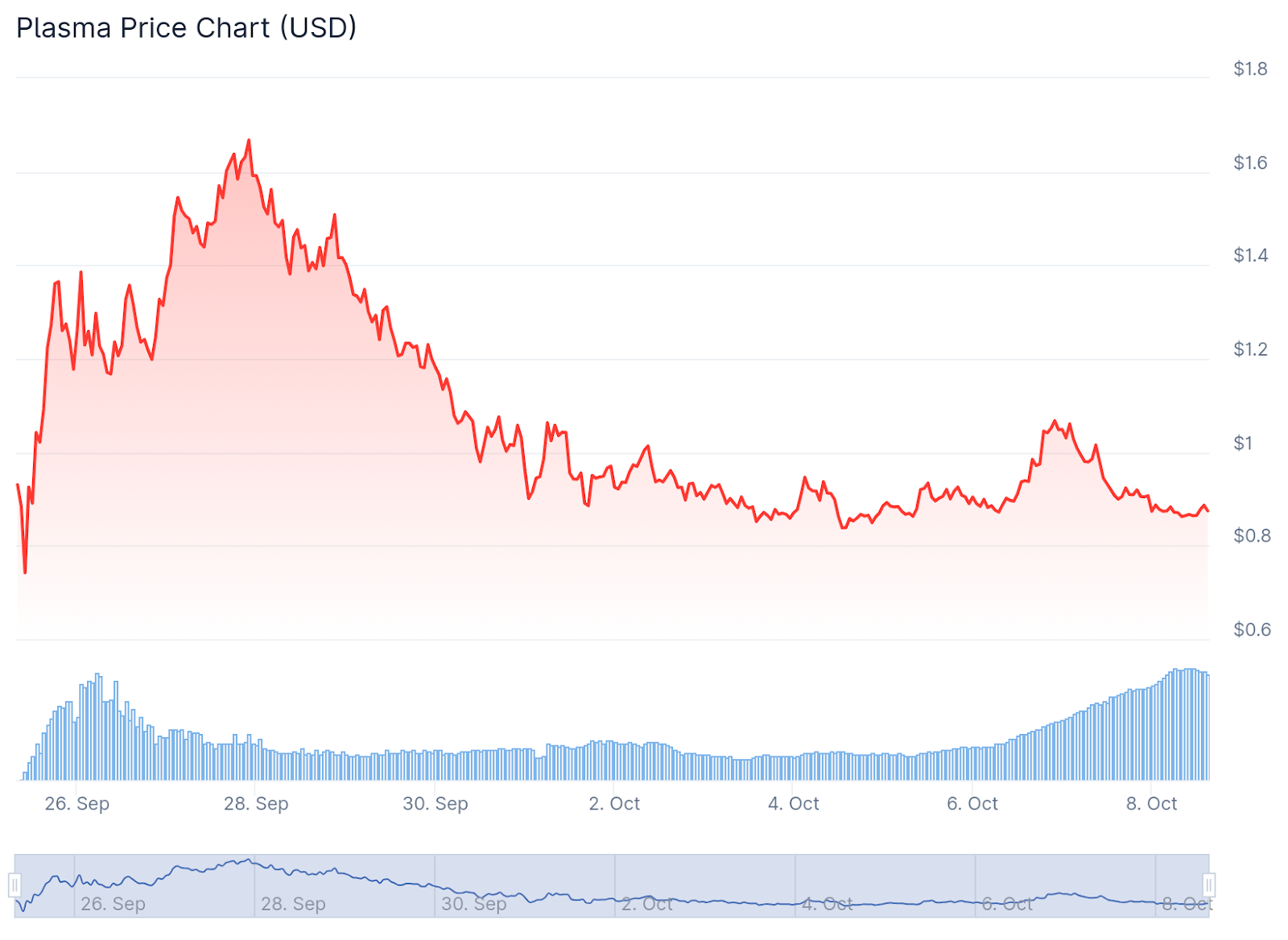

Stablecoin-focused layer-1 blockchain Plasma debuted its XPL token two weeks ago, but the token has been hemorrhaging since then after reaching a fully diluted valuation (FDV) of $17 billion in an impressive post-TGE surge.

XPL was launched on September 25th and doubled over the next few days from an opening price of about $0.8 to a high of $1.67, giving ICO participants a 3300% return on investment.

However, since its peak, the token has struggled, currently trading at $0.87, or a valuation of $8.7 billion, down 47% from its all-time high. The token has significantly underperformed the overall market, with BTC up about 12% from September 27th to October 4th, while XPL has fallen 49%.

XPL Chart – CoinGecko

It is unclear whether there is a specific trigger for the token’s slow performance after such an explosive start, and Plasma representatives called The Defiant back to founder Paul Faex’s X post, where he denied allegations that the Plasma team was selling the token or that controversial market-making company Wintermute was involved.

Although Faex has ruled out any possibility of wrongdoing, factors contributing to the stock price decline include the draining of liquidity incentives that pay more than $1 million per day in XPL, and ICO whales selling large amounts of tokens due to a controversial sales structure that allowed individuals to buy up to 10% of the original $500 million cap.

As a result, the first Plasma ICO vault quickly filled up, and the team increased the deposit limit from $500 million to $1 billion while allowing retail investors to purchase large amounts of tokens. The token was fully unlocked on September 25th.

Major indicators remain strong

Despite the token’s struggles last week, the network itself continues to grow and is now the sixth-largest ecosystem in DeFi with $6.4 billion in total value locked (TVL), particularly led by the Aave vault, which accounts for $4.5 billion, or 70% of the chain’s DeFi TVL.

Currently, the loan vault offers users more than 8% APY, with yields as high as 50% on TGE and 20% overnight, with rewards distributed from Plasma, Aave, and Veda.