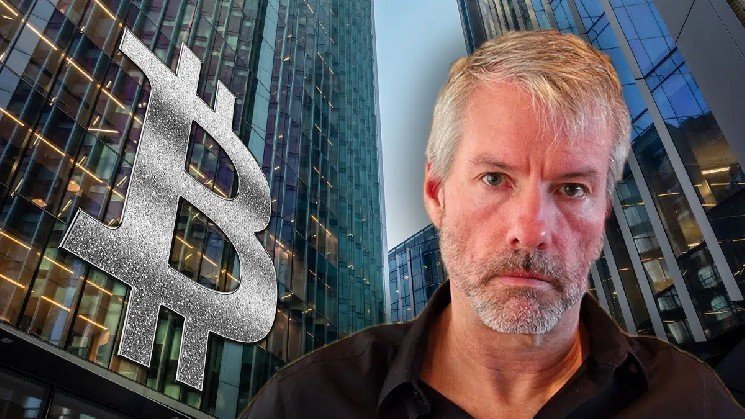

MicroStrategy founder Michael Saylor gained attention after resharing his Bitcoin tracker data.

“Don’t stop believing in Bitcoin,” Saylor wrote in his post. Traditionally, Saylor immediately follows such posts with announcements of increases in the company’s Bitcoin holdings.

Although Saylor did not buy any Bitcoin last week, the post sparked speculation among investors that MicroStrategy was preparing for a new round of purchases.

According to the latest data, MicroStrategy’s Bitcoin portfolio currently consists of 640,031 BTC. The total portfolio value is $71.25 billion. The company’s average acquisition cost was $73,983, and its ordinary profit margin was 50.48% (profits were approximately $23.9 billion).

A performance comparison shows that MicroStrategy outperformed Bitcoin by 33.78% over the past year. The company returned 43.37% over the same period, compared to 77.15% for Bitcoin.

On Friday, the cryptocurrency market experienced a significant decline after President Donald Trump announced a significant increase in tariffs on China. “There are no tariffs on Bitcoin,” Saylor said.

*This is not investment advice.