Omnichain versions of Tether’s stablecoins USDt (USDT) and Tether Gold (XAUT) are now available on Solana through Legacy Mesh, an interoperability network built on LayerZero that connects native stablecoin liquidity across multiple blockchains. This could position Solana as a competitive payment layer for on-chain finance and real-world assets (RWA).

The introduction of USDT0 and XAUT0 effectively brings Tether’s digital dollar and tokenized gold to Solana, potentially merging stablecoin liquidity with real-world asset use cases.

Unlike Tether’s USDT stablecoin, USDT0 is not issued by Tether. Instead, it is part of a third-party Omnichain liquidity network designed to integrate existing native USDT liquidity across multiple blockchains. As such, Solana’s integration could strengthen Tether’s omnichain footprint, following earlier USDT0 deployments in Ethereum, OP Superchain, Polygon, TON, and Arbitrum.

Legacy Mesh enables interoperability by linking native USDT liquidity pools, allowing stablecoins to move between networks without relying on wrapped tokens or third-party bridges. However, risk bridging and liquidity fragmentation remain challenges across multi-chain systems, and it is difficult to predict how much of USDT liquidity will actually migrate to Solana.

The expansion will increase access to Tether’s USDt, the largest stablecoin by market capitalization, with a total circulating supply of approximately $180 billion, the companies said.

Since launch, the USDT0 product has processed more than $25 billion in bridge volume with more than 32,000 transfers, according to the companies.

Circulating supply of USDT. sauce: Defilama

Tamar Menteshashvili, head of stablecoins at the Solana Foundation, said the integration will support the growth of decentralized finance, payments and institutional-grade financial products on Solana. In practice, this could include financial management, remittances, and secured loans.

XAUT0 is a lesser-known omnichain version of Tether Gold that has gained attention amid a year-long surge in gold prices. XAUT brings yellow metal to the blockchain, giving it programmable functionality similar to digital assets like Bitcoin (BTC).

Related: Ethereum Foundation’s near-term UX priority is interoperability

Stablecoins and RWA gain momentum with Solana

Solana has long been known as one of the fastest growing blockchain networks within the crypto industry, but it is receiving increasing attention from the traditional financial world. With a market capitalization of approximately $112.6 billion, Solana is the second largest smart contract platform after Ethereum.

Matt Hogan, chief investment officer at Bitwise Asset Management, said Solana is positioned to attract Wall Street and could become banks’ preferred network for stablecoin transactions.

sauce: matt hogan

At the same time, RWA tokenization on Solana is accelerating. Protocols such as Splyce and Chintai have recently launched products that allow individual investors to directly access tokenized securities on their networks.

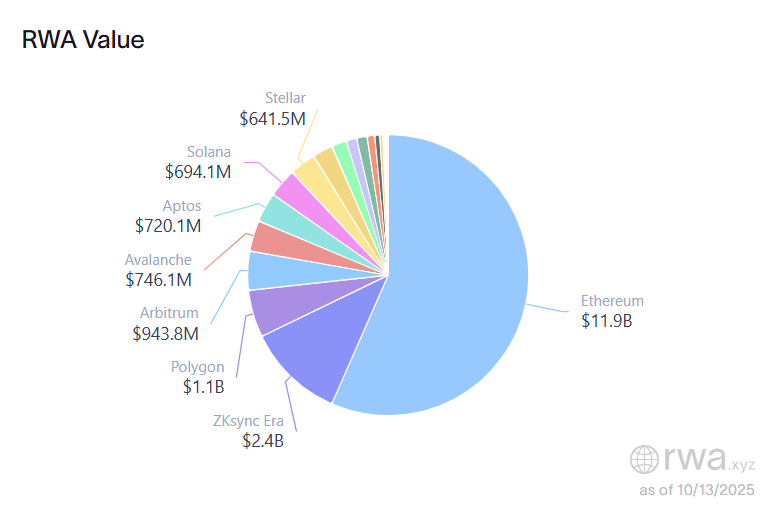

RWA values by network. sauce: RWA.xyz

Despite this momentum, Solana still represents a small portion of the overall RWA market, with approximately $694 million in tokenized assets currently on-chain, according to industry data. Ethereum remains the largest network for RWA, hosting nearly $12 billion in value.

This gap highlights the race between institutional finance and blockchain to attract real-world asset flows, especially amid industry-friendly regulatory changes in the United States.

magazine: Solana Seeker review: Is a $500 crypto phone worth it?