After a volatile week centered around the Black Friday sell-off, Bitcoin (BTC) prices have fallen about 2.3% over the past 24 hours, trading around $108,800. However, while the price is still struggling to recover, short-term holders (STH) seem to be buying on the dip, and the size of their purchases may come into question soon.

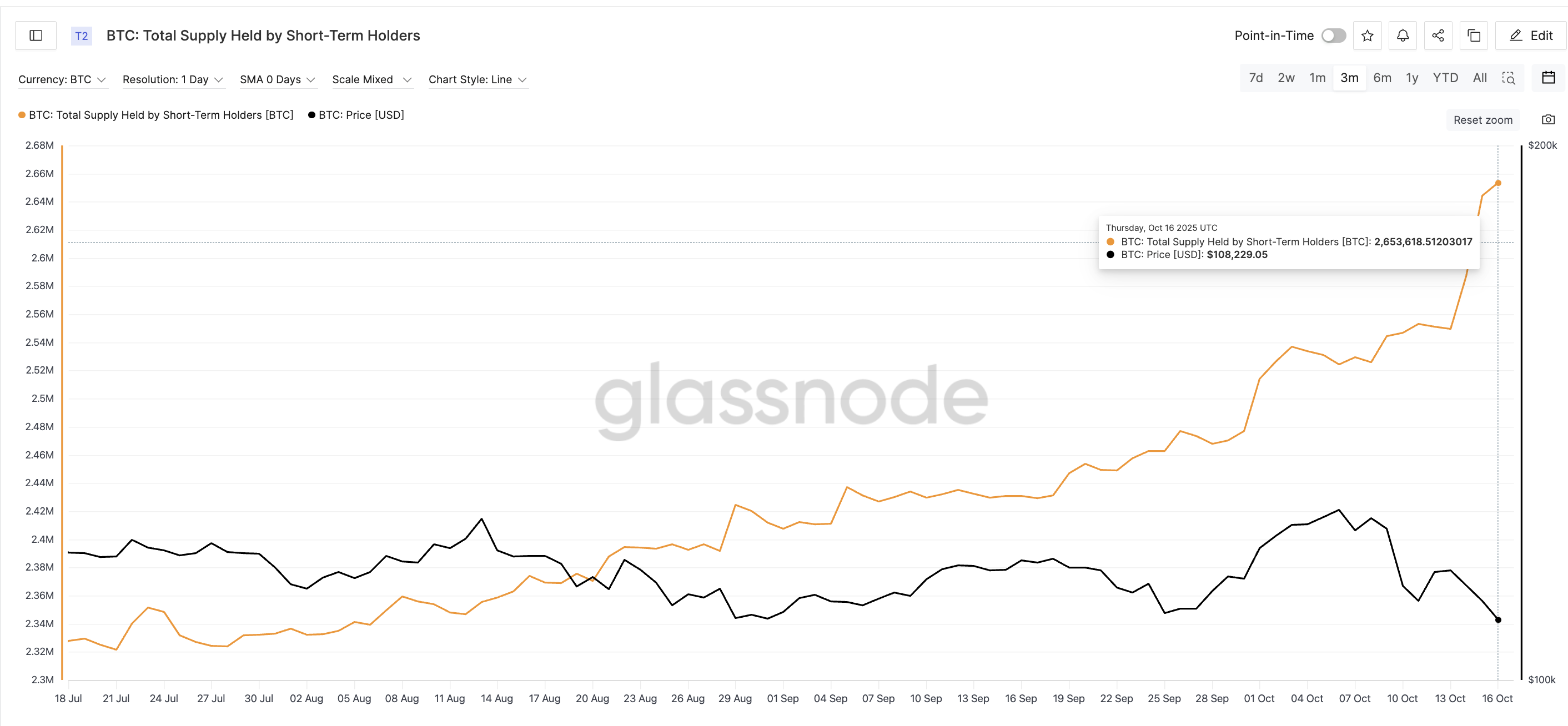

This sudden buildup, seen shortly after the Oct. 10 correction, suggests growing optimism, even though the overall trend remains cautious. But that’s not all. The accumulation trend in STH is now consistent with technical validation, suggesting a potential rebound in Bitcoin price, if not an uptick.

Short-term holders absorb declines as losses widen

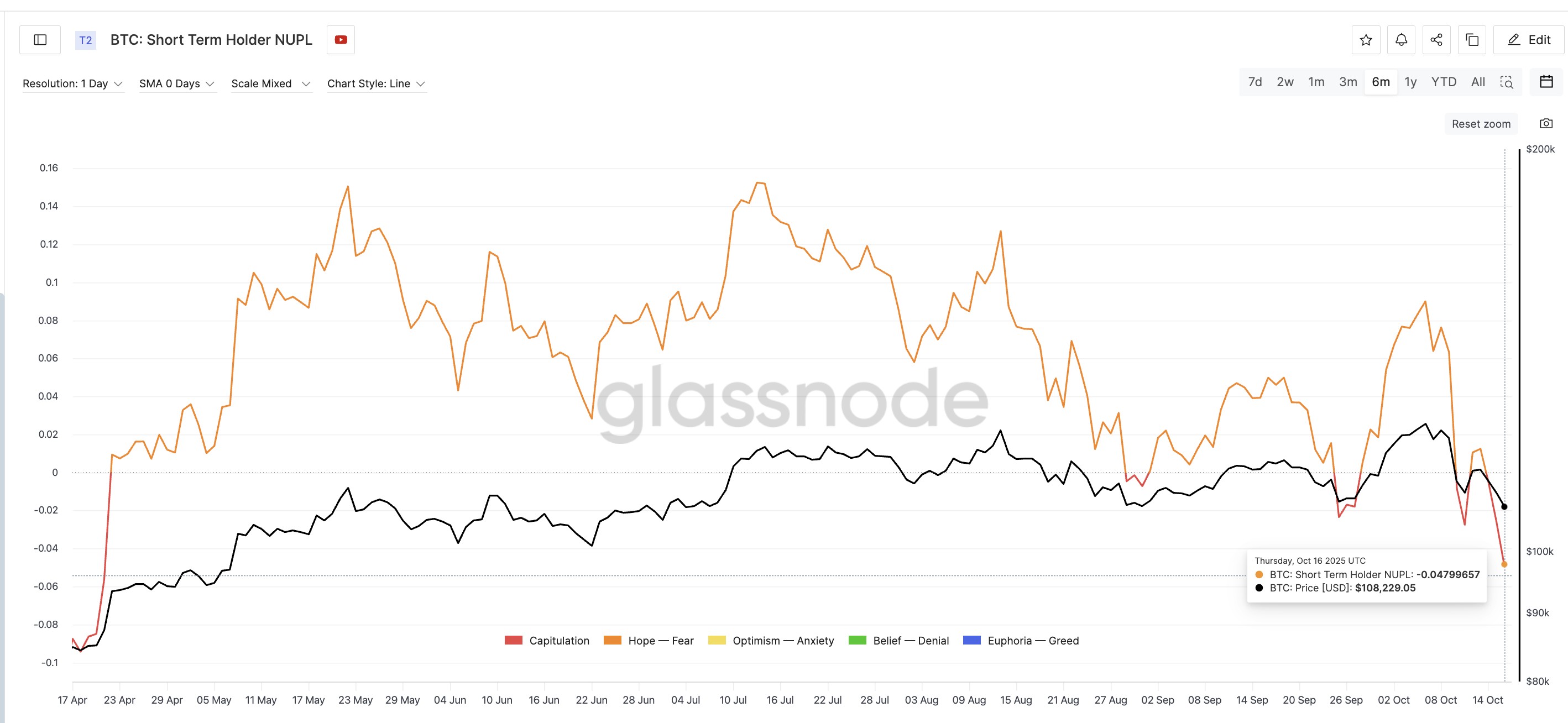

Short-term holders’ net unrealized gains and losses (NUPL), a measure of whether recent buyers are making a profit or losing money, fell to -0.04, the lowest level since April 20, 2025. Negative values mean that most short-term holders are in losses, which often signals that the market will reach a bottom or begin an early recovery as selling pressure eases.

Want more token insights like this? Sign up for editor Harsh Notariya’s daily crypto newsletter here.

Short-term Bitcoin holders are at a loss: Glassnode

Similar lows have caused rapid rebounds before.

- On September 25th, when NUPL reached -0.02, Bitcoin rose 4.9% from $109,000 to $114,300 in just four days.

- On October 11th, NUPL fell again to -0.02 and BTC rose 4.1% from $110,800 to $115,300 within three days.

Now, as NUPL has fallen further and losses have widened further, short-term holders appear to be doubling down instead of exiting.

According to Glassnode, the total supply held by short-term holders (STH) has surged from 2.54 million BTC on October 13 to 2.65 million BTC as of October 16, an increase of 4.3% in just three days. This rise means that short-term traders added around 110,000 BTC (roughly $12 billion at current BTC prices), showing active buying despite the drop. Additionally, STH supply is at a three-month high on the chart despite the price weakness, indicating near-term confidence.

Short-term BTC holders buy any dip: Glassnode

This combination of negative NUPL and increasing supply typically indicates a phase of quiet accumulation as short-term holders position for a potential rebound.

Bitcoin price still waiting for confirmation — 7% rally required for breakout

Bitcoin’s 4-hour chart shows that BTC price is forming a descending wedge. This is a pattern where lower highs and lower lows are compressed into a narrow boundary, often leading to a bullish breakout.

Since October 11th, BTC has been making lower price lows, while the Relative Strength Index (RSI), which measures the speed and strength of price movements, has been making higher lows. This is called a bullish divergence and is a technical signal indicating that momentum may be trending upward.

For a rebound to be confirmed, Bitcoin would need to rise around 7.4% to escape the wedge above $115,900. Before that, price needs to close above $112,100 and $113,500, the two resistance zones that have rejected recent recovery attempts.

Bitcoin Price Analysis: TradingView

If Bitcoin breaks above $115,900, it could pave the way to the next major resistance level at $122,500. However, if the support at $107,200 fails, BTC could fall back to the cycle bottom near $102,000.

The short-term situation is clear. Short-term holders are buying heavily, momentum is stable, and key technical patterns suggest reassurance. However, for this to develop into a rally, Bitcoin would need to hold $107,000 and close above $115,900. These two levels will determine whether this $12 billion wave of purchases turns into something bigger.

The post Short-Term Bitcoin Holders Add $12 Billion After Crash – Is It Enough to Cause a Price Rally? appeared first on BeInCrypto.