This is part of the 0xResearch newsletter. Please subscribe to read the full version.

Hello everyone. It’s a fun Tuesday. After a solid start to Monday, there is widespread weakness across the board. Beneath the surface, spot DEX trading volumes and active loans are still near highs. This week, new tokens will be launched at the MET in Meteora. Where is the fair value?

index

The week started on a strong note with BTC up 7% from the lows set last Friday. Launchpad was the best-performing sector in Monday’s trading, but AI was the top loser, reversing some of the relative strength and weakness each had shown over the past week.

Zooming out on a week-by-week basis, recent launchpad strength positions the sector as a relative winner, only outperforming gold, which once again closed near all-time highs on Monday. Broadly speaking, most indexes remain negative on a weekly basis after a historic liquidation event. Within the Launchpad index, BSC’s Launchpad, Auction, was the only ticker with a positive weekly showing, rising 46%.

While shorter time frames are showing some green, on a monthly basis we see that almost all cryptocurrency indexes have declined over the subsequent 30 days. The Oct. 10 liquidation remained weak across the board, with the only areas of strength being gold, crypto miners, AI, and stock indexes.

The VIX spiked to 29 on Friday morning before falling sharply to 18. The S&P 500 and Nasdaq rose during Monday trading, coming just short of new highs.

Market Latest Information

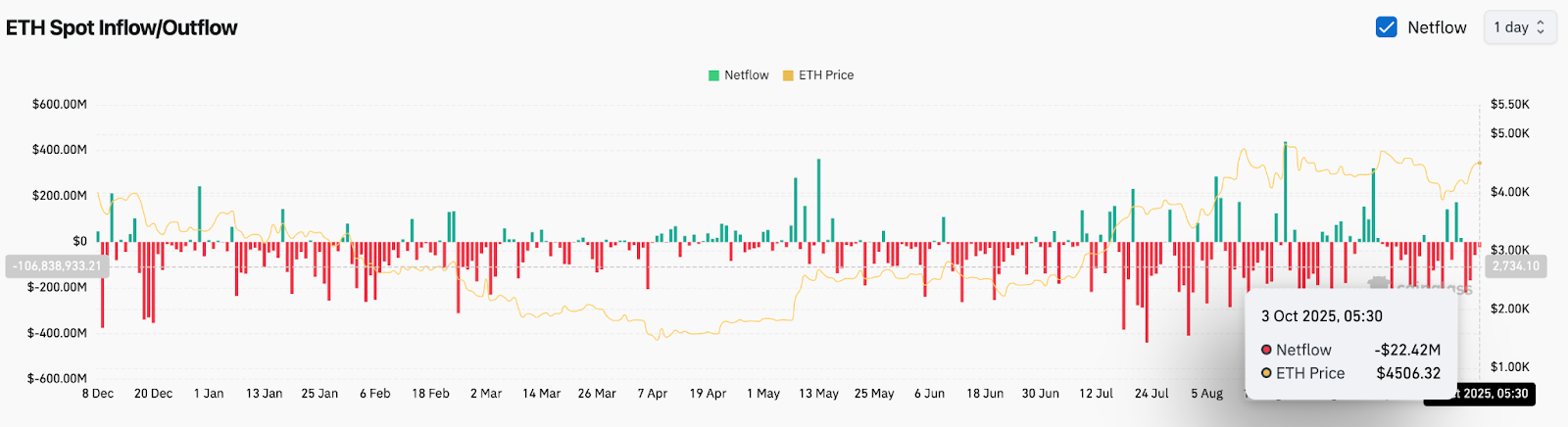

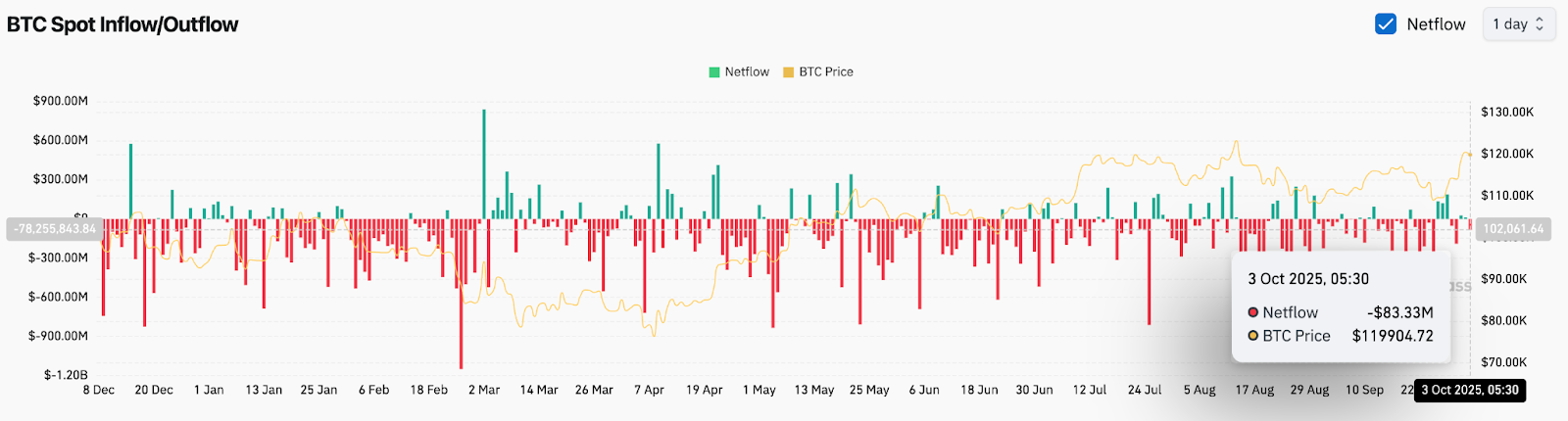

ETF flows remain slow and negative. Monday shows -$40 million from BTC, -$145 million from ETH, and +$27 million to the SOL ETF. On a weekly basis, last week saw net outflows of $1.5 billion across ETFs, reversing some of the buildup from a very strong opening through October. The SOL ETF was the only product to show net inflows, adding +$14 million.

Inside DATCO, BMNR is running away with it. The vehicle currently holds 3,236,014 ETH, which is more than all other ETH DATCO holdings combined and represents 2.67% of the total ETH supply. Remarkably, while most other ETH DATCOs have remained flat, BMNR has continued to increase its ETH stack by nearly 70% since the end of August. By doing so, BMNR’s market share in ETH held by DATCO has increased from 50% to 65% currently.

This story is reflected in the trading volume of ETH DATCO. BMNR accounts for 60-85% of ETH DATCO’s trading volume and its stock is the most liquid. This liquidity feature gives the vehicle preferential appetite from larger allocators and also reduces the marginal price impact of ATM stock offerings. For ETH financial companies, BMNR seems to be the clear winner in this space.

With SOL DATCO, the situation is less clear. FORD remains the largest vehicle in terms of holdings, with almost all of this size acquired through proceeds from the PIPE offering. Despite the launch of the $4 billion ATM offering program, this vehicle has yet to meaningfully expand its stack through ATM equity offerings. Approved.

Moving down the list, holding growth remains slow, with HSDT recently rising to second place.

The trading volume of SOL DATCO shows the same thing. While DFDV used to account for the majority of the sector’s volume, the situation tends to be more evenly split between the top names. Although FORD accounts for approximately 43% of DATCO’s SOL holdings, it accounts for only approximately 10% of the sector’s trading volume, indicating relatively low trading volume for the stock. This data could be a good basis to justify why the SOL accumulated through FORD’s ATM products is so low.

BMNR has emerged as the clear winner for ETH names, but the SOL sector leader may still have a chance. Over the next month, we expect trading volumes to become increasingly concentrated around the top names, with cream at the top.

Meteora’s TGE: What is the fair value of MET?

The much anticipated TGE of Meteora (MET) will take place on Thursday, October 23rd. Contrary to the recent trend of projects conducting ICO sales, Meteora did not raise any funds prior to TGE. Instead, it will be airdropped to eligible recipients, including Mercurial affiliates, Meteora LP, JUP affiliates, and Launchpad partners. Airdrop recipients will receive MET unlocked by default or choose to provide liquidity at launch to earn trading fees (up to 10% of the total supply of 1 billion tokens).

For historical context, Meteora was launched in February 2023 by the team behind Solana’s largest DEX aggregator and Perps trading platform, Jupiter. When Meteora was started, the previous iteration of the protocol Mercurial Finance has sunk. The reason we shut down Mercurial and its governance token (MER) was because there was a large amount of MER involved in FTX/Alameda, and the team decided the best bet was to rebuild the platform with a new token (MET).

In 2023, the team announced 20% of MET tokens will be distributed to Mercurial stakeholders in TGE. As you can see below, the team has kept its original promise and allocated 15% to Mercurial stakeholders and 5% to Mercurial Reserve (a shareholder directly affected by FTX’s bankruptcy). Additionally, DEX has been implementing a points program since January 31, 2024, with a total of 15% of MET will be assigned. At launch, 48% of MET’s supply will be in circulation, giving it a higher float rate (13.5% float at launch) compared to other notable token launches within the Solana ecosystem, such as JTO, KMNO, or JUP itself.

sauce: https://met.meteora.ag/

sauce: https://met.meteora.ag/

As previously mentioned, 10% of the total supply (100 million MET) will be used to bootstrap initial liquidity via a dynamic AMM pool, with a starting price of $0.5 ($500 million valuation) and liquidity extending to a $7.5 billion valuation. In the initial stage, the liquidity pool will be one-sided (MET only) and early buyers will exchange USDC to MET. Note that pool fees are initially high, but the fee scheduler reduces them significantly over time.

sauce: https://met.meteora.ag/

sauce: https://met.meteora.ag/

Mathematical evaluation of napkins

DEXs, especially Solana, historically don’t have a big moat because they don’t own the front end. The best example of this move is Raydium losing millions of dollars in volume and revenue after Pump decided to redirect its tiered coins to its own AMM, PumpSwap. Meteora has attempted to alleviate this problem by vertically integrating and expanding distribution capabilities through Jupiter and selected Launchpad partners.

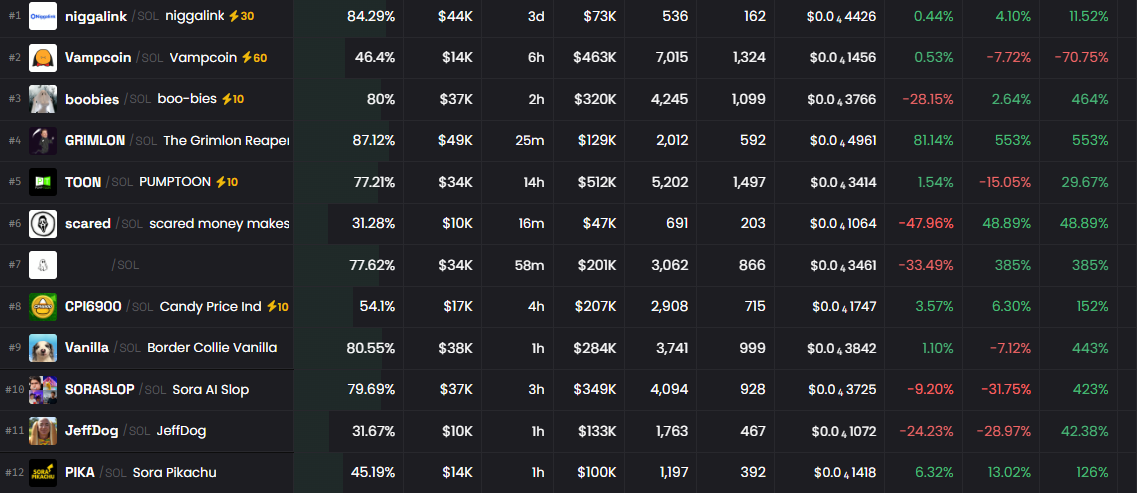

As mentioned above, the DEX is run closely with the Jupiter team and is a gateway for less sophisticated retail users to transact on-chain. More Meteora Partnered with Moonshot We introduced Launchpad in August 2024 and have introduced new partners over time, including Believe, BAGS, and Jup Studio. The graph below shows that Launchpad activity has contributed between $200,000 and $800,000 to Meteora’s weekly revenue in recent weeks, with most of the flow coming from Believe and BAGS.

Looking at the overall financials, Meteora has generated $8.8 million in revenue across all pools over the past 30 days, with weekly revenue consistently approaching $1.5 million, even during periods of relatively low on-chain activity. Note that over 90% of Meteora’s revenue comes from the memecoin pool. Memecoin pools typically have higher fee tiers than SOL stablecoins, Project Tokens, LST, and stable-to-stable pools.

In terms of ratings, you can look at Radium and Orca as comps. The chart below shows the annualized price-sales ratio for RAY and ORCA over the first 30 days of the year. You can see that both assets were priced in relatively similar proportions until September, when RAY started trading at a premium. Zooming out, both assets have a median P/S of 9x in 2025.

The table below compares RAY and ORCA’s P/S ratios over various lookback periods. We see that ORCA trades pretty similarly across all annualized time frames, with a P/S ratio of around 6x. In contrast, RAY has seen its price rise in recent months as revenues have declined. We can see that Meteora’s annual revenue is between about $75 million and about $115 million, depending on the historical period.

Finally, below are MET’s potential valuations across various revenue and P&L ranges. In our view, a P/S of between 6x and 10x is most likely based on historical pricing for RAY and ORCA. As such, MET can reasonably be expected to trade between $450 million and $1.1 billion upon launch (circulating market capitalization). Based on the numbers below, note that valuations start to get a little expensive above $1 billion relative to comps, and MET is almost certainly overvalued once it gets above $2 billion unless the revenue run rate increases.