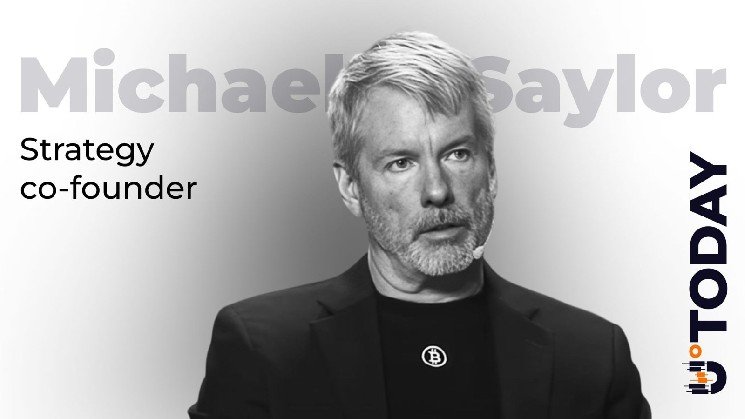

Michael Saylor, an influential Bitcoin (BTC) holder and advocate, has once again sparked debate about the nature of Bitcoin (BTC) asset acquisition. in post In X, Saylor referenced a post he made exactly five years ago when he declared his personal Bitcoin holdings.

Michael Saylor’s $175 million Bitcoin bet now worth over $2 billion

Notably, Saylor emphasized that “you don’t sell your Bitcoin.” The statement reinforces his long-standing advocacy and philosophy behind business intelligence firm Strategy’s aggressive acquisition model.

Saylor sees Bitcoin as a long-term store of value, not just a trading asset. He argues that true Bitcoin believers should stick with Bitcoin no matter how volatile the market becomes. That’s because he remains optimistic. Assets always increase in value and recover.

For context, Saylor revealed that as of 2020, he had personally accumulated 17,732 BTC over about 10 years. This shows that he had put all his purchases on hold for many years in order to build such a large portfolio. According to him, the average purchase price for personal assets was $9,882 per BTC.

You don’t sell Bitcoin. https://t.co/zMGyYU1QGX

— Michael Saylor (@saylor) October 28, 2025

Mr. Saylor’s average price of less than $10,000 indicates that most of his accumulation was done when coin prices were down. Since September 2020, Bitcoin has not traded below $10,000. This confirms that he is aligning his actions with evangelizing Bitcoin and not selling it.

It is worth mentioning that Mr. Thayer’s post on October 28, 2020, revealed that the Strategic Committee was fully aware of Mr. Thayer’s personal holdings in advance. The company has started purchasing. This was probably to avoid conflicts of interest and to be completely transparent on his part.

An eternal message to Bitcoin holders

Interestingly, Michael Saylor’s personal holdings of 17,732 BTC amount to $175,227,624 at an average cost of $9,882. As of this writing, Bitcoin is change is worth $114,820.16 and the estimated value of the same holding is $2,035,988,240. This leaves Saylor with an unrealized profit of more than $1.86 billion.

The resulting value confirms Thaler’s unwavering long-term beliefs despite the various volatile market cycles over the past 15 years he has owned the property.

for example, Awesome Cryptocurrency Liquidation The latest incident comes as a result of geopolitical tensions, but Saylor’s message to investors was: “Don’t stop believing.”

His recent message urging investors holding Bitcoin not to sell their assets therefore stems from his belief that Bitcoin will rise and outperform fiat currencies. Saylor believes that selling Bitcoin means giving up a trusted asset.