Roughly one-third of Bitcoin (BTC)’s circulating supply is currently in losses as Bitcoin (BTC) assets continue to face downward pressure into November.

However, market stress may not be a bad sign, as it can indicate a potential market bottom. Additionally, experts are cautiously optimistic about Bitcoin’s prospects, predicting a possible recovery.

Is Bitcoin nearing the bottom?

Bitcoin has fallen 17% over the past month, and at one point fell below the $100,000 level during the cryptocurrency crash in November. That decline has left a large portion of the market with unrealized losses.

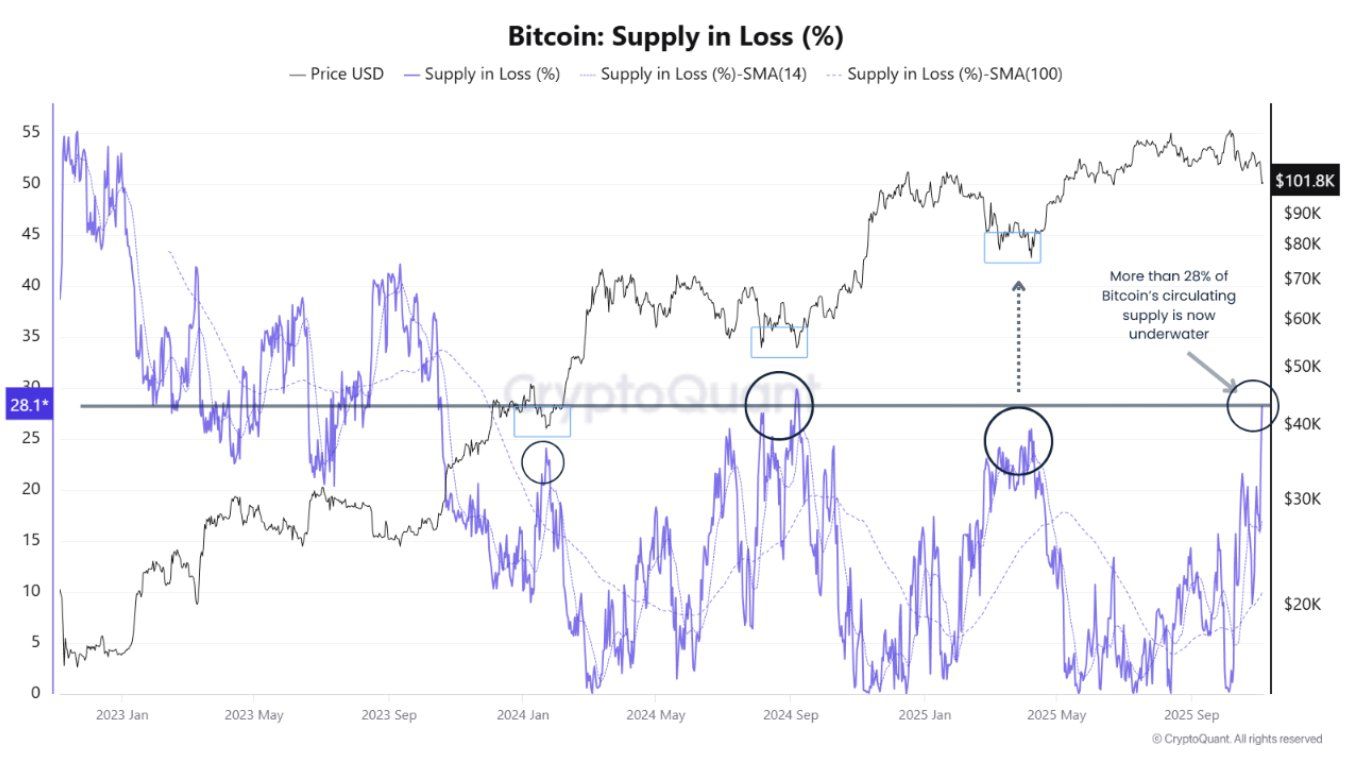

Data from CryptoQuant shows that more than 28% of Bitcoin’s circulating supply is currently in losses. This indicates increased stress among buyers who entered at high prices.

“This may sound alarming, but history has shown that such levels often indicate a local bottom rather than a breakdown in a bullish cycle,” said analyst MorenoDV.

Bitcoin supply remains in the red. Source: CryptoQuant

The analyst added that a high proportion of supply in losses often coincides with liquidity stress points, or moments when sellers become exhausted. Prolonged declines create emotional tension, prompting long-term holders to take profits and new investors to sell at break-even.

The current environment reflects a balance between fear and patience, he suggested. This psychological conflict could lead to further selling or new conviction among long-term investors.

“If sentiment does not recover and holders remain risk-averse, the demand structure could decline and signal the end of the ‘good old days.’However, if fear reaches an extreme and selling pressure naturally dissipates, these same levels could lead to a durable It could form a bottom and prepare for the next stage of accumulation. The question now is not just where the cost will be, but who will have enough faith to endure the pain,” the post concluded.

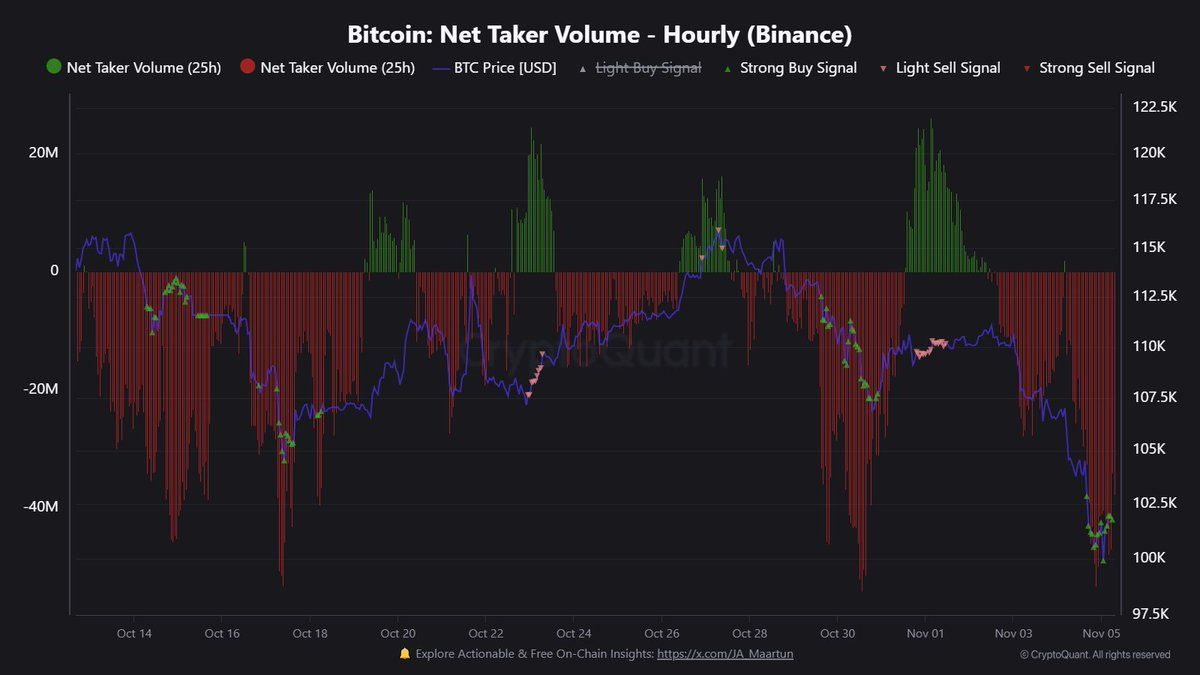

The latest on-chain data supports the argument that sellers could be exhausted. Analyst JA Martun highlighted that Bitcoin’s net taker volume has recently decreased to -53 million on an hourly basis.

While this negative number indicates strong sales activity, it may also indicate that selling pressure has reached extreme levels and seller fatigue is occurring.

“Historically, these spikes often indicate localized troughs,” the analyst said.

Bitcoin net taker volume. Source: X/JA_Maartun

Experts also point to the possibility of another bottom for Bitcoin. Ray Youssef, CEO and co-founder of NoOnes, told BeInCrypto that Bitcoin is showing signs of a classic exhaustion phase.

Positive developments no longer push prices up, but negative news immediately causes a decline. This movement suggests that purchasing momentum is weakening and that retailers are less willing to buy on the spur of the moment.

“Nevertheless, the market is already inching closer to a potential capitulation point, which historically has often been a harbinger of new growth. Mass liquidations of long positions often signal capitulation and the possibility of rock bottom,” he said.

How high can Bitcoin price rise this cycle?

Youssef further explained that after such an event, the market typically experiences a short-term rebound, especially when liquidation amounts reach extreme levels like they are currently experiencing.

He added that if Bitcoin manages to maintain the $100,000 zone and trading volumes start to recover, the next immediate target will be in the $107,000 to $109,000 range. A break above this level could pave the way for a rally above $110,000.

“However, if the selling pressure continues, the market could certainly test the $92,000 area, which could form a long-term reversal point,” the executive cautioned.

While there is still potential for more volatility in the short term, most experts remain bullish over the long term. Nick Pucklin, a crypto analyst and co-founder of The Coin Bureau, said that Bitcoin’s drop below $100,000 has added to the market’s anxiety.

“However, it is worth remembering that despite the recent decline, BTC is only about 20% below its all-time high at the moment. This is a cryptocurrency, not a bond market, so a 20% drop is often just a buying opportunity,” Packlin told BeInCrypto.

He said the key support level to monitor in the near term is the 50-week exponential moving average (EMA), which is currently around $101,000. He added that Bitcoin still has enough strength to stay above the psychological $100,000 level, but the real test will be whether the price closes out at the end of the week.

“Longer term, however, we still see $150,000 as the likely high for this cycle. It’s only going to be a bumpy ride from here, and this volatility will increasingly capture traders on both sides of the fence,” he said.

Finally, Sean Young, Principal Analyst at MEXC Research, predicts a rally for Bitcoin in November. He argued that if the coin can break through the $111,000-$113,000 resistance zone, the ground is set for a test of $117,000, and positive macroeconomic news could retest the all-time high of $126,000.

“We maintain our expectation that Bitcoin will reach the $125,000 to $130,000 range by the end of this year,” Young told BeInCrypto.

While technical and on-chain indicators suggest a bottom may be forming, macroeconomic challenges, particularly the Fed’s hawkish stance, continue to weigh on risk assets. The next few weeks will be crucial to see if Bitcoin can break out of its doldrums or if holders will cave in and face further losses.

Bitcoin holders are hurting — here’s why we’re bullish The post appeared first on BeInCrypto.