South Africa’s central bank echoed Standard Chartered’s warning, confirming that the rapid rise in stablecoins could destabilize emerging market (EM) banks.

Standard Chartered predicts that the digital dollar could drain up to $1 trillion from emerging market bank deposits over the next three years as consumers and businesses move their savings to alternatives pegged to the stable US dollar.

Standard Chartered’s wake-up call: Emerging market banks are in crisis

In a recent research note, Standard Chartered highlighted 48 countries along the opportunity-vulnerability continuum.

As reported by BeInCrypto, the bank’s global head of digital asset research, Jeff Kendrick, identified Egypt, Pakistan, Bangladesh, and Sri Lanka as most at risk of deposit outflows.

“As stablecoins grow, we believe there will be several unintended consequences, the first of which is a potential outflow of deposits from banks in emerging countries,” they told BeInCrypto.

Even in high-risk economies, these outflows can amount to about 2% of total deposits. While this alone represents a small percentage, it could destabilize countries already facing currency depreciation and budget deficits.

Similarly, Madhur Jha, Head of Thematic Research, pointed out that stablecoins are accelerating structural change, with banking functions increasingly moving to non-bank digital platforms.

South Africa confirms increased risk

The South African Reserve Bank (SARB) has highlighted the financial stability risks posed by stablecoins and other crypto assets.

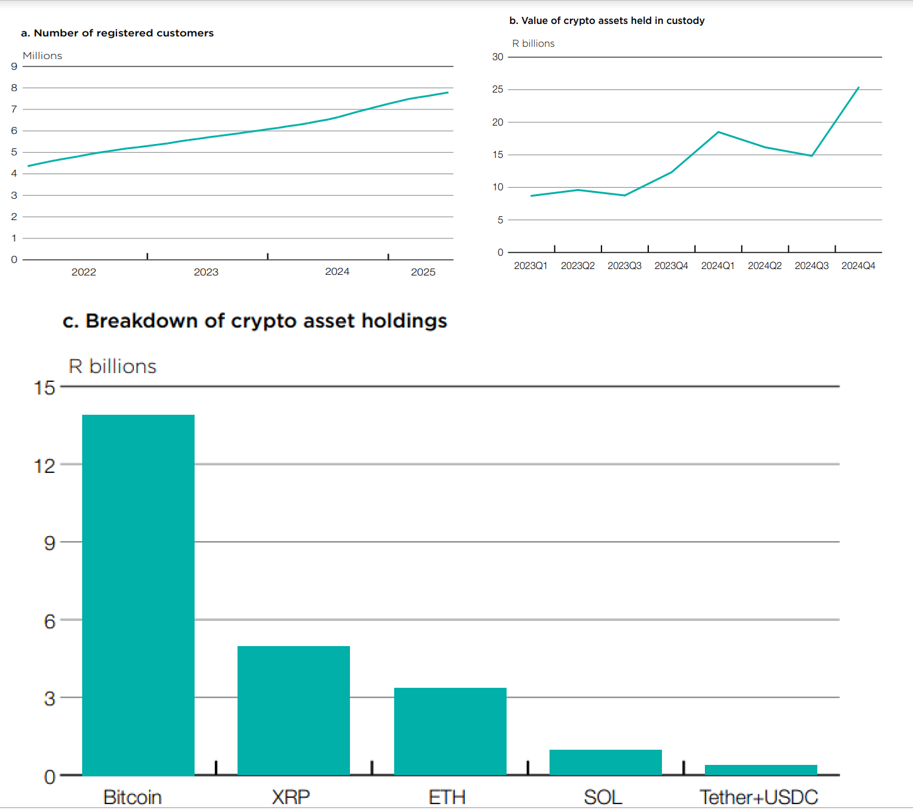

According to the 2025 Financial Stability Review, stablecoin adoption has skyrocketed, with transaction volumes increasing from R4 billion in 2022 to nearly R80 billion ($4.6 billion) by October 2025.

Cryptoassets and stablecoins as new risks. Source: South Africa’s 2025 Financial Stability Review

The central bank warned that cryptocurrencies are fully digital and borderless, making it possible to circumvent exchange control laws.

SARB’s chief macroprudential expert Herco Steyn emphasized the urgency. He pointed out that without comprehensive regulation, authorities will not be able to adequately monitor these fast-paced markets.

Regulatory gaps and market impact

South Africa is actively working on developing new rules to bring cross-border crypto transactions under regulatory oversight. Nevertheless, major platforms such as Luno, VALR, and Ovex currently serve 7.8 million users and store approximately $1.5 billion.

The trend towards stablecoins pegged to the US dollar reflects the market’s preference for lower volatility compared to traditional crypto assets such as Bitcoin and Ether.

Standard Chartered’s warning, coupled with South Africa’s confirmation, highlights broader risks to emerging market banking systems.

Turkiye, economies with twin deficits such as India, Brazil, South Africa and Kenya are particularly vulnerable to capital flight from stablecoins.

Policy makers in emerging countries may therefore be at a crossroads. As the adoption of stablecoins accelerates, countries will need to balance innovation and stability and put in place frameworks to protect against systemic risks while supporting the growth of digital finance.

The post South Africa confirms Standard Chartered’s troubling stablecoin warning appeared first on BeInCrypto.