Financial institutions are moving away from Ethereum (ETH) and choosing proprietary blockchains customized to meet their needs.

Recent developments such as Klarna’s launch of stablecoins on alternative networks and the rise of privacy-focused chains like Canton have raised questions about the network’s dominance.

Enterprise blockchain adoption signals new threat to Ethereum: Here’s why

On November 25th, Klarna announced KlarnaUSD, becoming the first bank to issue a stablecoin on Stripe and Paradigm’s payments blockchain, Tempo. This decision sparked debate in the cryptocurrency community. Some see this as a bearish signal for Ethereum.

“Can someone please tell me why this is not bearish for Ethereum? The big fintechs that are making big moves into stablecoins haven’t launched it on Ethereum. If Tempo didn’t exist, this probably would have launched on Ethereum or ETH L2…Tempo is gaining market share in stablecoins, which is the main theme of Ethereum,” the analyst said.

Ethereum hosts major stablecoins such as Tether (USDT) and USDC (USDC), which have a combined market capitalization of over $100 billion. These cause significant network activity and charges. By choosing Tempo, Klarna bypasses the Ethereum ecosystem and potentially bypasses liquidity and innovation.

Another analyst, Zach Lines, emphasized that Klarna’s decision shows that while public chains continue to be overshadowed by large fintech companies, enterprise blockchain adoption is on the rise.

“It is yet another confirmation that the Corpo L1 chain is here to stay and that our favorite commoditized ‘neutral’ public chain #375936 is once again being rampaged by fintechs,” he said.

The rise of cantonal networks further exemplifies this. This is a Layer 1 network built with privacy controls at its core. Institutions can choose how visible or limited their activities are, allowing them to set up systems ranging from completely permissionless to completely private.

Despite these differences, applications on Canton can connect and interact over the network. Goldman Sachs’ Digital Asset Platform (GS DAP) uses Canton’s network natively.

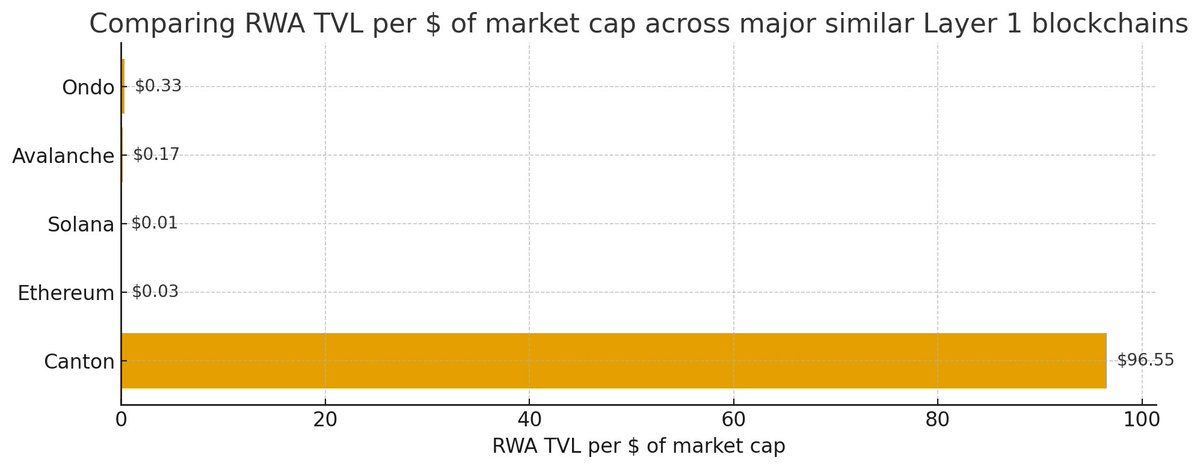

Notably, Canton has demonstrated remarkable levels of capital efficiency, generating approximately $96 of RWA Total Value Locked (TVL) for every $1 of market capitalization. In contrast, Ethereum generates approximately $0.03 of RWA TVL for every $1 of market capitalization.

Comparison of RWA TVL per $1 market capitalization. Source: X/MattMena__

But why are institutions moving away from Ethereum? Privacy may be a major factor in this exodus. Public blockchains like Ethereum provide permanent visibility of all transactions. This is a central challenge for institutions.

This transparency is a significant risk when banks and businesses transfer large amounts of money. Competitors can analyze patterns, make front-of-the-line deals, and uncover strategic business relationships.

COTI Network analysis shows that companies adopting Web3 often overlook blockchain transparency as a drawback. The article points out that public blockchains expose all transactions and metadata, which can expose sensitive data and undermine negotiation leverage. This raises regulatory concerns regarding laws such as GDPR and exposes trade secrets.

This disconnect explains why institutions are building private blockchains or seeking public networks with enhanced privacy. Transparency, a known virtue of cryptocurrencies, creates vulnerabilities when dealing with multi-billion dollar transactions and sensitive relationships.

This trend suggests a split. Public networks like Ethereum are used for decentralized or retail use, while institutions move to private or specialized chains with confidentiality. As finance undergoes a digital transformation, it remains unclear whether Ethereum will be able to regain the trust of institutions or whether specialized networks will be able to take over.

This article Institutions move to dedicated blockchains as privacy concerns drive shift away from Ethereum originally appeared on BeInCrypto.