Kevin Hassett, a former Coinbase advisor who owns more than $1 million in COIN stock, leads the race for Federal Reserve Chairman with a 56% probability of nomination on prediction markets.

Amid growing criticism of Jerome Powell from President Trump, final interviews are underway through Treasury Secretary Scott Bessent.

Hassett emerges as top contender in volatile prediction market

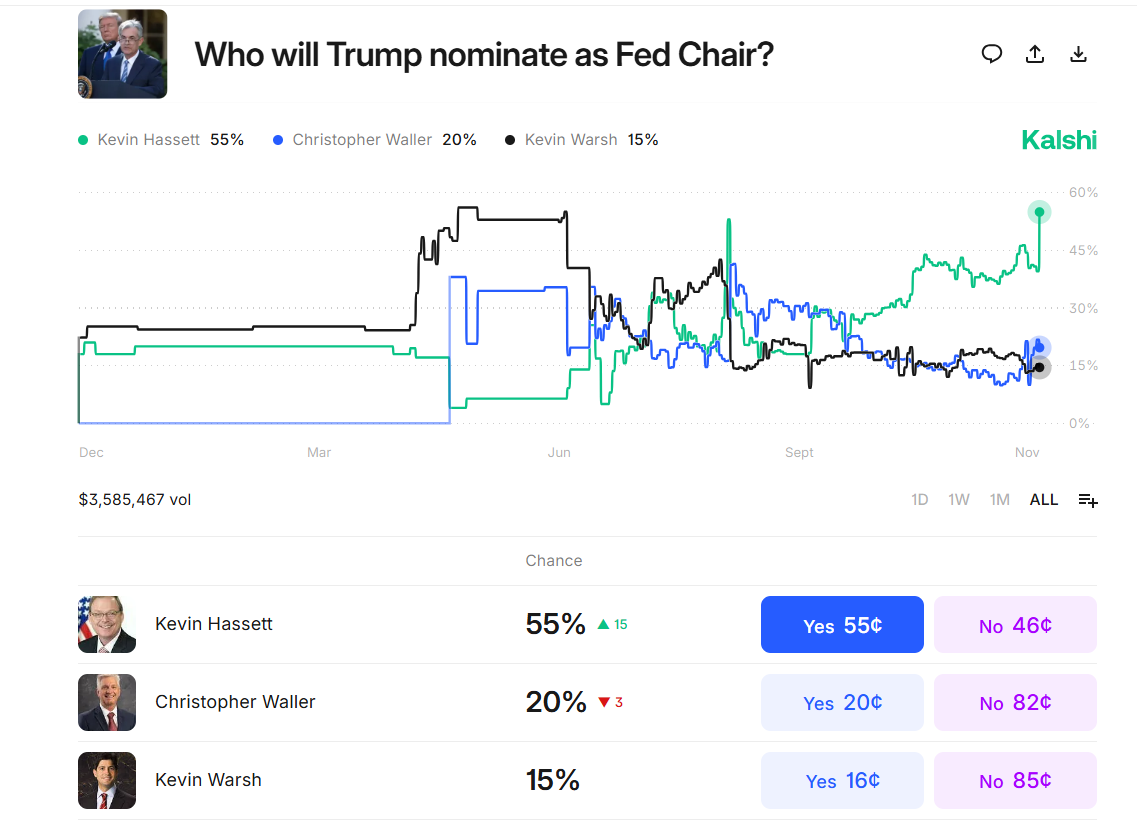

The Calci prediction market currently has a 55% chance that Kevin Hassett will be named Federal Reserve Chairman. This represents a 15% increase over the past 24 hours, well ahead of Christopher Waller (20%) and Kevin Warsh (15%).

Fed Chairman’s Forecast. Source: Karshi

As a former chairman of the Council of Economic Advisers, Hassett is known for advocating lower interest rates and maintaining direct ties to the crypto industry.

Kevin Hassett is currently the front-runner for Fed chair and recently supported a 50 basis point interest rate cut in December. Reflecting growing market confidence, the 10-year Treasury yield is already below 4%. Looking ahead, we believe there is potential for further declines, with a target of 3% over 10 years.

— Steve Grasso (@grassosteve) November 25, 2025

Coinbase officially announced its global advisory board in late November 2025, confirming Hassett’s position.

The council will help guide the company’s engagement with global regulators, marking a growing relationship between crypto companies and policymakers.

As a visiting fellow at the Hoover Institution, Hassett has pushed for more accommodative monetary policy in 2024-2025. His strong proportional rate-cutting approach therefore stands out from the hawkish stance taken under current Fed Chairman Jerome Powell.

However, Hassett’s experience as a Coinbase advisor and large holdings in COIN stock gives him a direct connection to the crypto sector.

This has raised both concerns about potential conflicts of interest and hopes for a change in the Fed’s approach to digital assets.

Meanwhile, as the search for a new Federal Reserve chairman continues, President Trump is increasing public criticism of Jerome Powell. During a recent Oval Office session, President Trump shared his frustration with Chairman Powell’s leadership.

Reporter: “Have you started interviewing the Fed chairman yet?”

President Trump: “Yes…I think I already know my choice. Well, I liked him. *points to Secretary Scott Bessent* But he’s not going to take the job.”

“I’m talking to various people… (I want to get Jerome…) pic.twitter.com/yiFgP0l5aM

— RedWave Press (@RedWave_Press) November 18, 2025

Final interviews for the new chair are underway, led by Treasury Secretary Scott Bessent. President Trump has hinted that he will field a preferred candidate, but is reportedly keeping details private to see how the market reacts to speculation.

Jerome Powell’s current term ends in May 2026, giving Trump limited time to make changes. The researchers note that President Trump’s choice may be unpredictable, but speculation continues to rise ahead of an expected announcement before Christmas in 2025.

Note: Scott Bessent said: “It’s very likely that President Trump will announce a new Fed chair before Christmas.” pic.twitter.com/b5gNmWsMbx

— BeInCrypto (@beincrypto) November 25, 2025

Crypto policy and its impact on market trends

Hassett’s appointment could bring an unprecedented level of cryptocurrency support to the Federal Reserve. His role as an advisor and investor at Coinbase puts him in a unique position among the candidates.

These connections could influence policies regarding digital asset regulation, central bank digital currencies (CBDC), and the integration of cryptocurrencies into traditional finance (TradFi).

Juan Leon, senior investment strategist at Bitwise, said: “If Kevin Hassett becomes Fed chair, the implications for cryptocurrencies will be very bullish. 2. He led the White House’s Digital Assets Task Force and formed regulations to support cryptocurrencies. 3. He serves on the advisory board of Coinbase and holds a large stake in COIN.”

The market is broadly hopeful that a dovish and crypto-savvy chair could increase acceptance by financial institutions and regulatory transparency.

Some critics are concerned that Hassett’s cryptocurrency holdings could create a conflict of interest in policies affecting digital assets.

The Federal Reserve has significant influence over banking and regulation of cryptocurrency exchanges and stablecoin issuers. Therefore, if a chair is appointed with a personal investment in the industry, there will be increased scrutiny.

The contrast between Hassett and his candidate, Christopher Waller, suggests two different paths for monetary policy and crypto regulation. While Waller signals policy stability and caution towards technology, Hassett’s candidacy signals further support for innovation and crypto growth.

Who will be the next Fed chairman?

Christopher Waller’s odds were better than Kevin Hassett and Kevin Warsh.

For months, I have believed that Christopher Waller is the frontrunner to become the next Fed chairman.

Here are some articles I wrote about why I think so. pic.twitter.com/RMcxpKu22r

— Willy Lee (@willyLee) November 25, 2025

The decision will shape not only interest rates but also the Fed’s stance on new technology. Both financial and crypto markets are wary of changes in US monetary policy and digital asset regulations as the December announcement approaches.

Post Cryptocurrency Fed? The post Trump’s chair search takes a strange new twist appeared first on BeInCrypto.