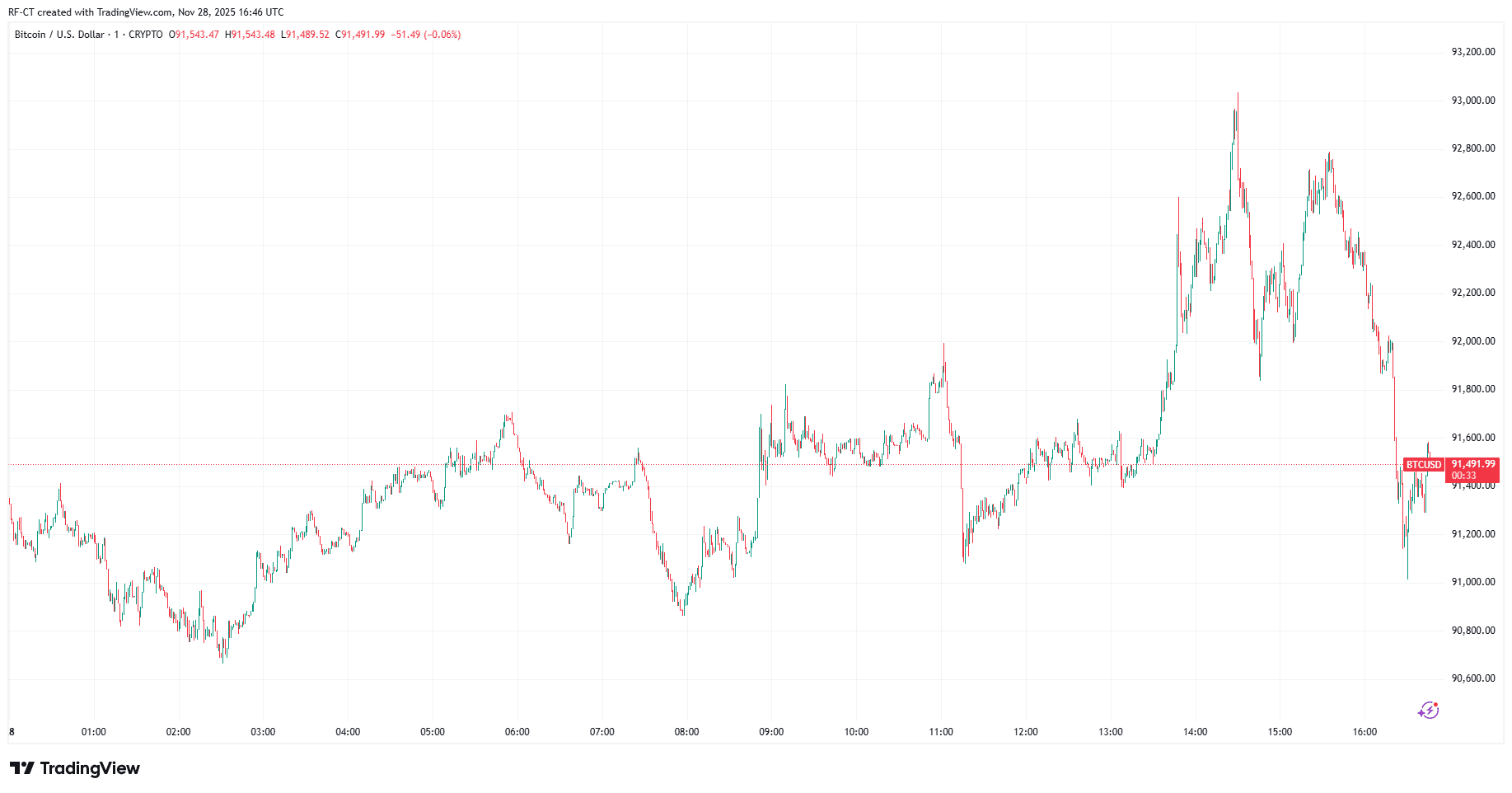

Today’s cryptocurrency market has brought severe volatility Bitcoin temporarily recovered $93,000 before returning to $91,000. While this movement looks chaotic on the surface, the underlying factors are clear and surprisingly bullish.

Here’s everything that’s unfolding across macro, crypto derivatives, and commodities, and what it means for next moves.

🚨 $15.4 billion in Bitcoin and Ethereum options expire today

This is the biggest factor behind today’s whip-like price fluctuations.

huge $15.4 billion BTC and ETH options contracts are expiring, creating significant short-term volatility as market makers push prices towards profit-maximizing levels.

What typically happens on expiration date:

- powerful pumps for sale

- Both short and long positions are targeted

- Prices gravitate toward the “maximum pain” zone

- Breakouts often fail Until the expiration date closes

Today fits this pattern perfectly.

Bitcoin rose to $93,000 but quickly returned.

Despite the decline, BTC remains above $90,000 Growing this much during expiration is a sign of fundamental strength.

🇺🇸 87% probability of Fed rate cut — significant macro boost

Polymarket’s latest data shows Federal Reserve odds 25bps rate cut Rapid increase in December 87%.

A rate cut means:

- weak US dollar

- inject liquidity into the market

- Profiting risk assets such as cryptocurrencies

- Historically boosting Bitcoin

This is one of the strongest macro signals BTC has shown in recent months, but the expiration masks its immediate impact.

🇺🇸 President Trump vows to keep US markets at ‘all-time highs’

President Trump said he would keep the stock market at “all-time highs.”

Why cryptocurrencies are important:

- trump publicly Bitcoin supporters and cryptocurrency supporters

- Stock market strength spills over into virtual currencies

- Risk-on preferences increase when political direction appears stable.

This adds an additional macro layer of bullishness beneath the surface of today’s volatility.

🥈 Silver hits new all-time high at $55

Silver reaching fresh ATH $55 is a strong indicator of growing demand for hard assets.

Historically:

- Precious metals move first

- Bitcoin will soon follow as a “digital hard asset”

This supports the idea that investors are turning toward inflation-hedging assets across the board.

🟧 Michael Saylor calls it “Black Friday”

Michael Saylor posted a simple message:

“It’s Black Friday.”

When Saylor makes posts like this, it usually reflects the following:

- Confidence in BTC’s long-term trajectory

- Suggestions that a decline is a buying opportunity

- A change in sentiment has arrived

Saylor’s timing often coincides with market reversals.

📉 So why did Bitcoin drop to $91,000?

As the market is still digesting, $15.4 billion options expired.

Expiration overrides everything else, even a bullish macro catalyst. Here’s why:

- Market makers actively hedge

- spike in volatility

- Prices are pushed towards the maximum pain zone

The good news?

Typically, this volatility is It will end when the expiration date is cleared..

📈 What to expect next

Important levels to note: $90,000.

If your BTC is above $90,000:

- Trends remain strong

- Bull regains control after pressure of time running out

- move towards $95,000-$100,000 more likely

If BTC falls below $88,000-$89,000:

- Short-term adjustment deepens

- But macro remains bullish

Potential interest rate cuts, rising commodity prices, President Trump’s market stance, and new liquidity (including the recent $500 million USDC mint) all point to a strong medium-term outlook for Bitcoin.

By TradingView – BTCUSD_2025-11-28 (1D)

Bitcoin movement $93,000 → $91,000 This is not a rejection. This is a classic option expiry shakeout with a very bullish macro setup hidden underneath.

Once the dust settles on today’s expiry date, the real trend should emerge again, and all signs suggest that BTC may be gearing up for its next big try. $100,000.