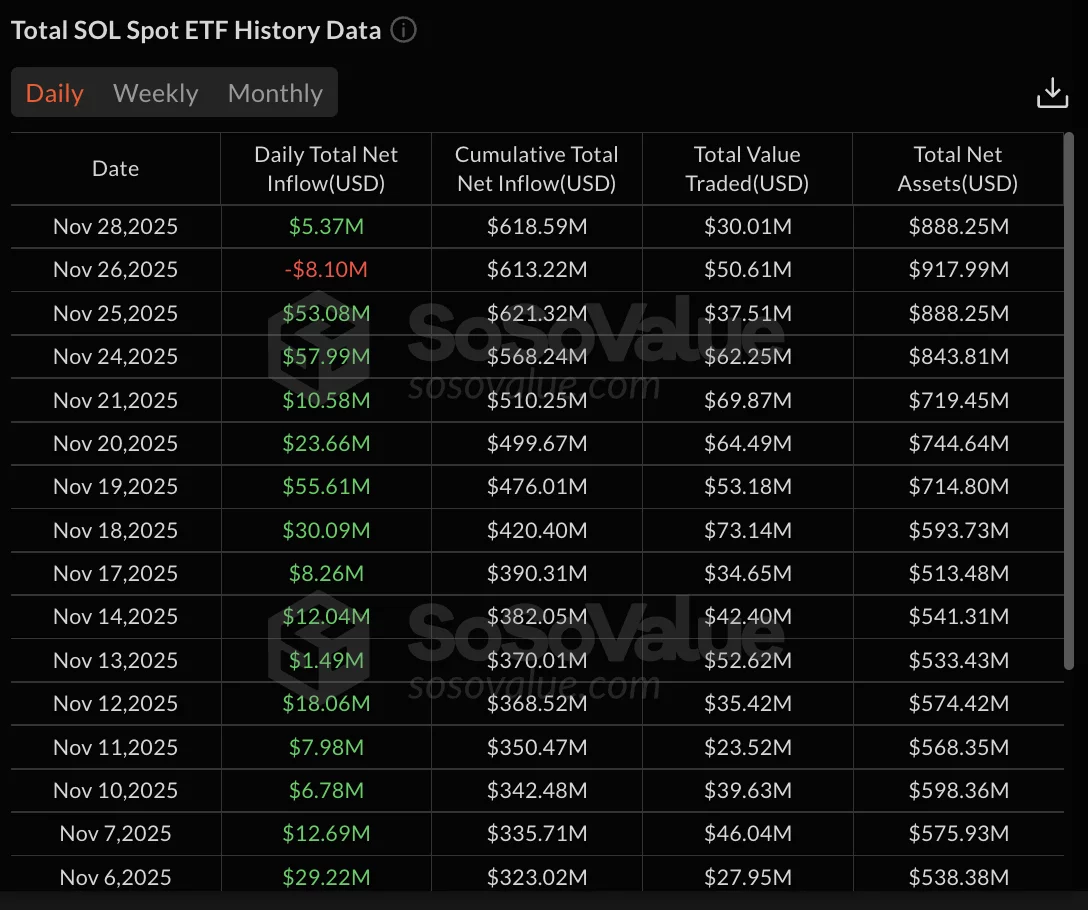

The Solana Spot ETF recorded net inflows of $5.37 million on November 28, ending a 21-day losing streak.

summary

- The Solana ETF had inflows of $5.37 million after 21 days of outflows, led by Grayscale and Fidelity.

- Despite the ETF’s recovery, SOL price remained below $140, continuing a 30-day decline.

- Cumulative inflows into the SOL ETF reached $618.59 million.

This recovery comes as the price of Solana (SOL) fell below $140 to $137 amid a general market downturn.

Grayscale’s GSOL led the inflows with $4.33 million, while Fidelity’s FSOL attracted $2.42 million.

There was an outflow of $1.38 million from 21Shares’ TSOL, partially offsetting the gains. Bitwise’s BSOL, VanEck’s VSOL, and Canary’s SOLC recorded zero flow activity.

You may also like: Ripple RLUSD stablecoin’s supply on Ethereum exceeds $1 billion

Even with ETF recovery, Solana will not exceed $140

Solana’s price has fallen 2% in the past 24 hours and 30% in the past 30 days. The token traded as high as $143 in the past 24 hours before dropping to current levels. SOL has risen 8% in the past 7 days.

The November 28 inflow ended a three-week period of ETF outflows. The most recent withdrawal amount was $8.1 million on November 26th.

Prior to that, the SOL ETF had raised $53.08 million on November 25th and $57.99 million on November 24th.

SOL ETF Data: SoSo Value

As of November 28, cumulative net inflows across all Solana ETFs reached $618.59 million.

Total net assets under management were $888.25 million. On November 28th, the total transaction amount reached $30.01 million.

November flows dominated by grayscale and fidelity

Grayscale’s GSOL had cumulative net inflows of $77.83 million. Bitwise BSOL leads all Solana ETFs with total inflows of $527.79 million. Fidelity’s FSOL has cumulative assets of $32.3 million.

21Shares TSOL has recorded net outflows of $27.6 million since inception. VanEck’s VSOL and Canary’s SOLC maintain small asset bases.

You may also like: Visa leverages Aquanow to expand stablecoin payments in CEMEA

The discrepancy between ETF inflows and price changes suggests lower levels of institutional accumulation.

The SOL ETF raised money on November 28, but the token continued to decline for 30 days. SOL was unable to recover the $140 even after the inflow of funds recovered.