$Ethereum is being traded $3,030regained the important $3,000 psychological level after a decisive rebound from the support. New ETF inflows, increased whale accumulation, and improved technical momentum all contributed to the rebound. ETH is currently consolidating just below a major resistance level, and traders are keeping an eye on whether ETH can trigger a breakout towards higher levels.

Below is a complete breakdown of why ETH is rising and where the price could go next based on the chart.

Why is the price of Ethereum rising?

1. ETF demand return (bullish influence)

overview

After facing each other Net outflows were $1.4 billion Through November, the Ethereum ETF turned positive. $368 million inflow during the final week. This change coincided with a decline in geopolitical tensions and a decline in ETH’s long-term performance compared to Bitcoin.

What this means

The institution looks like this Return to ETHIt will be treated as catch up game. ETF inflows reduce selling pressure; $3,000 support area is basically supported By institutional demands.

Please be careful

Will the influx continue until early December?

If ETH ETF demand exceeds BTC for the first time in recent weeks

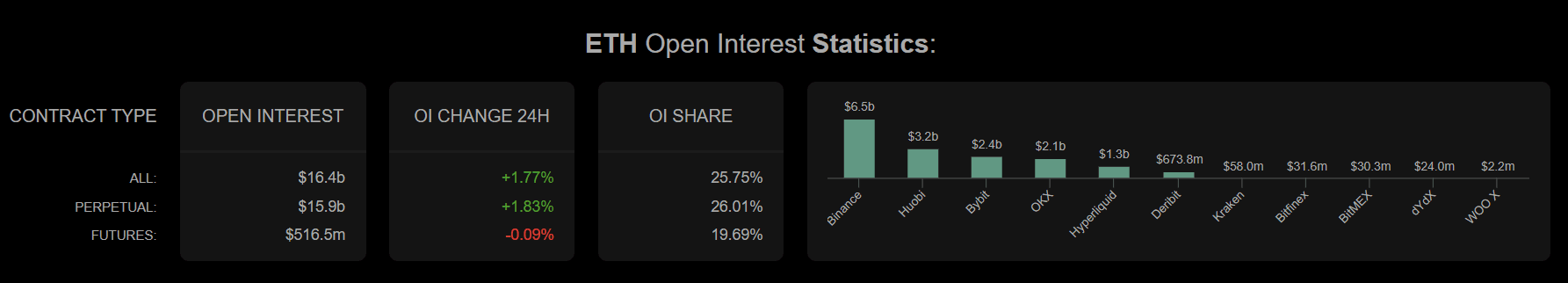

2. Whale and derivative activities (mixed effects)

overview

On-chain data shows whale added 14,618 ETH (approximately $185 million) Late November. At the same time, the open interest of ETH derivatives also increased. 700 million dollarsand Long dominates short 2:1 Nearly $2,960.

What this means

The big players are actively defending the $2,960-$3,000 zone. However, increased leverage — 3.97 million open contracts — If ETH fails to break out, liquidation risk will occur $3,100 resistance.

Please be careful

Long-term liquidation if ETH declines between $3,100 and $3,200

Take advantage of resets that can cause volatility spikes

3. Technical momentum (bullish in the short term)

overview

ETH is 20-day EMA ($2,968) and printed bullish MACD crossover has a strong histogram +37.73. zone between $2,960 and $3,000 Currently functioning as Verified Support.

What this means

If ETH maintains its daily close above $3,000, traders will see major Fibonacci levels, especially 38.2% retracement at $3,270. however, 200 day moving average and $3,520 It remains a major barrier to resistance.

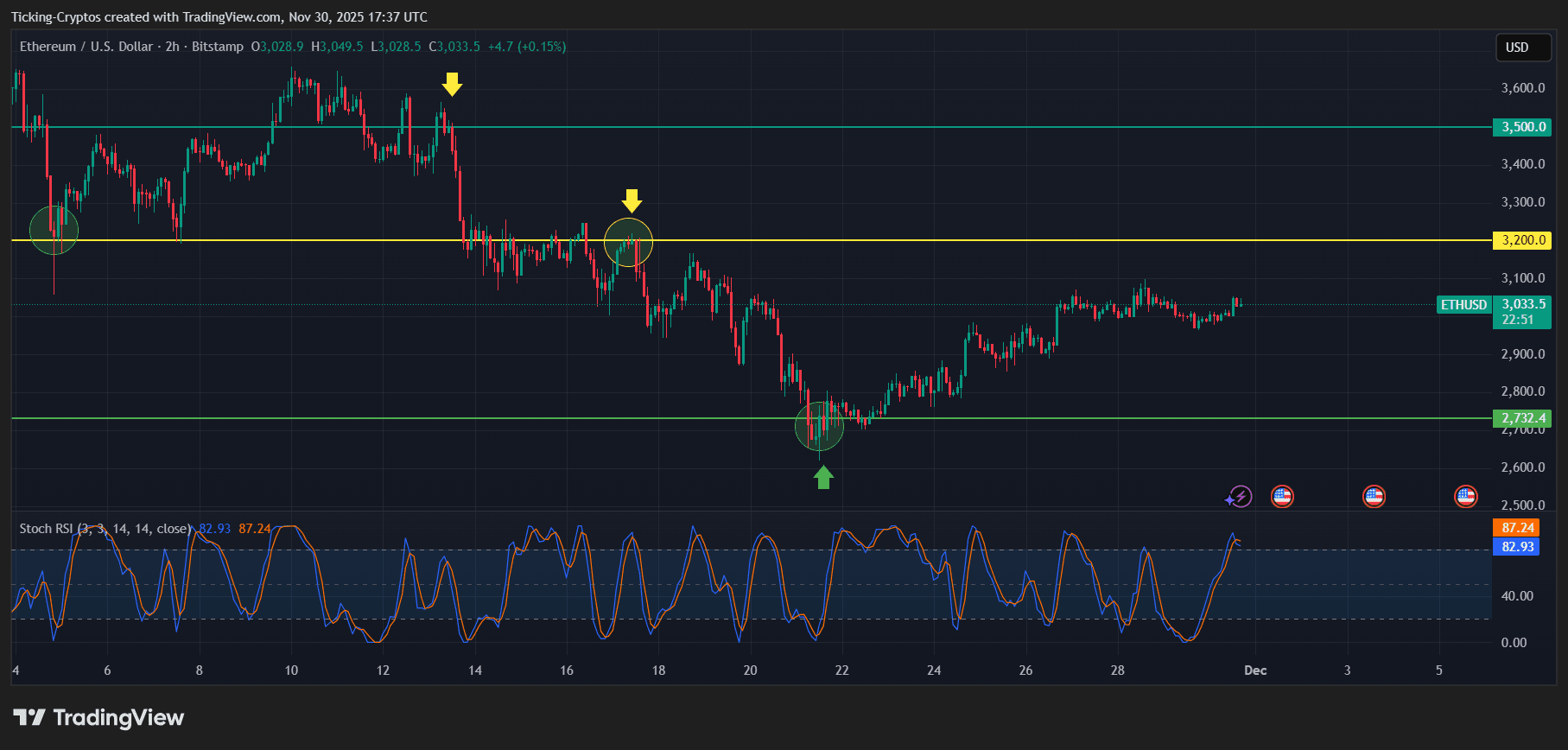

Ethereum chart analysis: what happened

If you look at the attached graph, you’ll see a clear pattern.

ETH/USD 2 hour chart – TradingView

1. ETH repeatedly rejected at $3,200 (yellow line)

The graph shows multiple rejections at: $3,200marked with a yellow arrow and a circle. This zone acted as intermediate-range resistance for several weeks.

2. Strong rebound from $2,732 support (green line)

ETH has completely bottomed out $2,732 Structural SupportHere, the green arrow confirms a large amount of reuse. Each historical touch at this level caused a powerful reversal.

3. Current flat consolidation is around $3,030

ETH is currently stabilizing in a narrow band just below resistance, which often precedes a breakout attempt.

4. Stoch RSI indicates overbought momentum

The current Stoch RSI is:

- 82.93(Blue)

- 87.24 (orange)

Since ETH is overbought in the short term, there may be a short cooldown before proceeding.

Ethereum Price Prediction: Where Will Ethereum Land Next?

Based on current chart structure, momentum signals, and market fundamentals:

Bullish scenario (most likely if ETH is above $3,000)

ETH will rise due to the current consolidation.

Upside price target

- $3,200 (first major breakout zone)

- $3,270 (38.2% Fibonacci level)

- $3,500 (strong resistance)

- $3,520 (200 day moving average – major trend reversal level)

If ETH ends above $3,500–$3,520the next macro target opens. Over $3,800.

Bearish scenario (if ETH cannot hold $3,000)

If rejected at $3,200, ETH could make a corrective move.

Downside price target

- $2,960

- $2,850

- $2,732 (Critical support zone)

A break below $2,732 will shift the trend to a medium-term bearish phase.