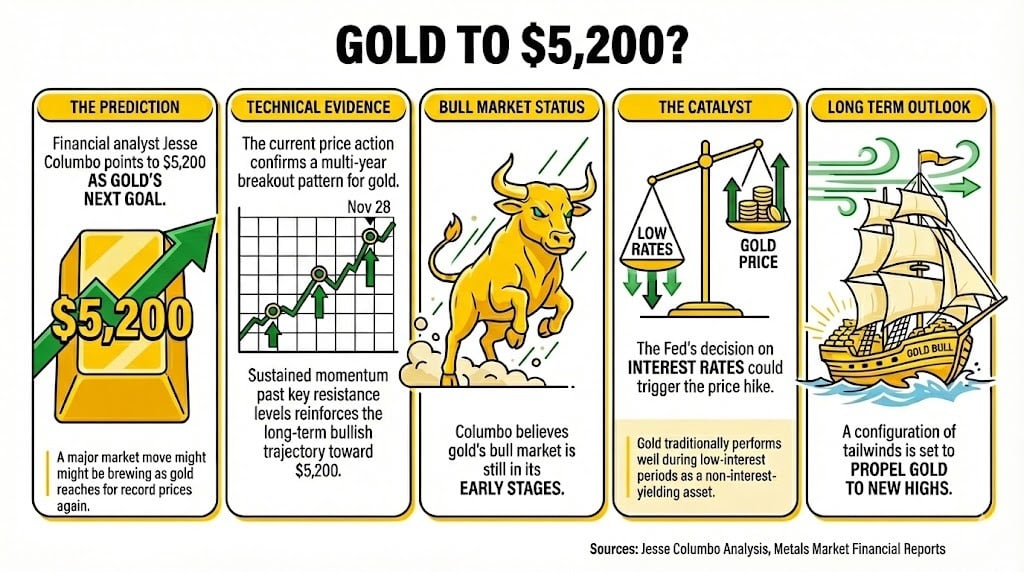

Metals financial analyst Jess Colombo argues that recent moves could signal a major breakout in gold in the near term. He notes that the preliminary breakout that occurred on November 28 points to a new price target of $5,200.

Gold signals a big move towards $5,200. The Fed may be able to help.

Jesse Colombo, a gold and metals market financial analyst, believes there may be a big move in the market and that gold could reach record prices again.

In a recent analysis of the current state of the gold market, Colombo pointed to $5,200 as the next target for gold, which has already seen several all-time highs this year.

Colombo said the recent price spike experienced by gold on November 28 is part of the evidence leading to this new price target. He explained that this is the third such move this year and that this figure could be reached if prices follow previous movements.

Nevertheless, Colombo is even more bullish on gold’s long-term view, as he recently explained that the gold bull market is still in its early stages and believes there are tailwinds to push gold to new highs.

As a non-interest-bearing asset, gold traditionally performs well during periods of low interest rates, so the Fed’s long-awaited interest rate decision could also be a new catalyst for virtual price increases.

Expectations of a quarter-point rate cut are widespread, meaning prices could temporarily fall if the Federal Reserve fails to cut rates.

read more: Fed could give gold a launching pad with upcoming rate cuts

Philip Streible, chief metals strategist at Blue Line Futures in Chicago, pondered the results. In an interview with Sputnik, he said:

The overwhelming expectation is that the Fed will cut rates further in December. If that doesn’t happen, be prepared for a downside that could even rule out December as a winning month.

Still, most companies expect the price of gold to continue rising beyond 2026, as central banks and investors are expected to maintain increased demand for gold as a hedge against inflation and uncertainty for which there are no clear alternatives.

FAQ

What does financial analyst Jesse Colombo predict about the price of gold?

Colombo believes gold can reach $5,200 This year has already seen some all-time highs and is on track for record highs.What recent evidence supports Colombo’s price prediction?

He cites a significant breakout in prices November 28th We noted that this is the third break this year as part of the trend.What factors are likely to affect gold prices in the near future?

Gold traditionally performs well during periods of low interest rates, so a potential interest rate cut by the Federal Reserve is expected to boost gold prices.What are the long-term expectations for gold beyond 2026?

Analysts generally expect gold prices to rise due to sustained demand from central banks and investors as a hedge against inflation and uncertainty.