According to local media, the central bank is considering the possibility of issuing new regulations to allow banks to enter the cryptocurrency business. Local analysts say this will allow more people to use cryptocurrencies and stablecoins.

Report: Argentina’s central bank considers opening a bank for cryptocurrencies

fact

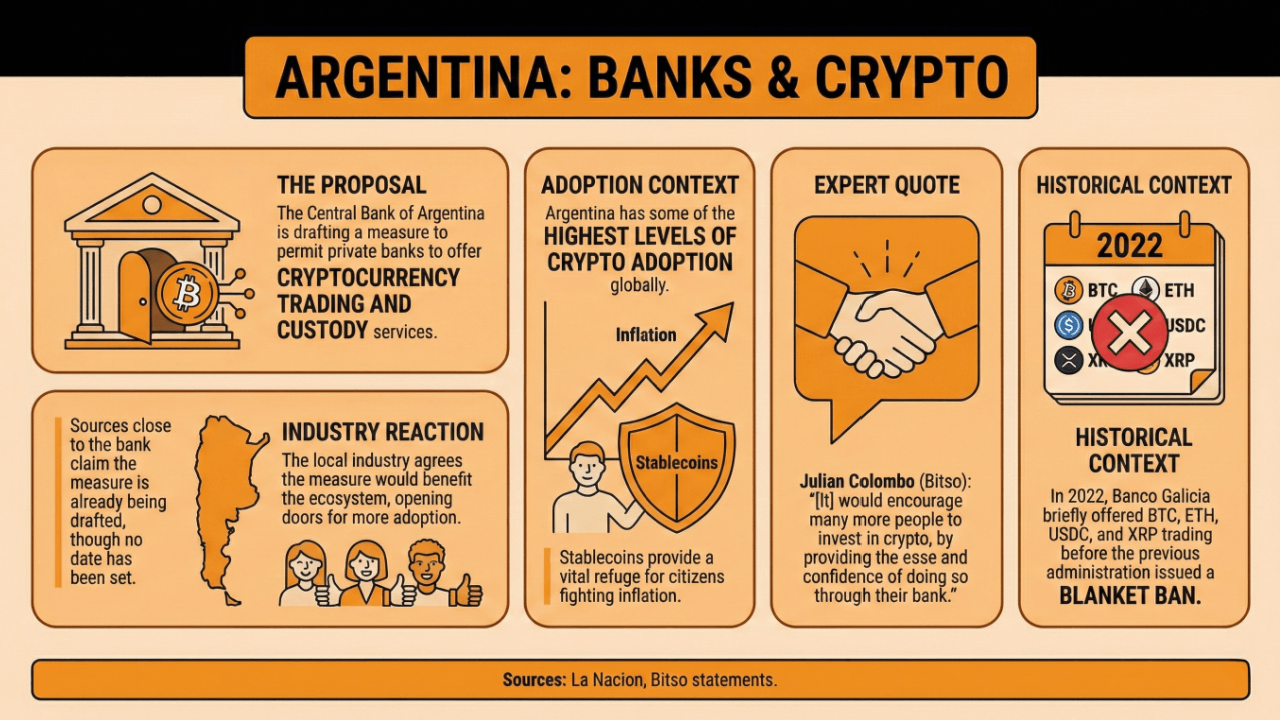

Argentina’s central bank is considering measures that would allow banks to offer crypto trading and storage as part of their service offerings.

According to local newspaper La Nacion, sources close to the bank claimed that the bank has already drawn up measures to extend this possibility to private banks. No dates or subject details were provided.

Members of Argentina’s crypto industry agreed that such measures would benefit the country’s crypto ecosystem and allow more people to experiment with and use alternative currencies such as Bitcoin as stablecoins.

Argentina is one of the countries with the highest adoption of cryptocurrencies, as stablecoins are offered to its citizens as a haven to fight inflation and currency depreciation. Julian Colombo, Bitso’s South America manager, said the move “will encourage more people to invest in cryptocurrencies by providing ease and confidence through their banks.”

In 2022, local institution Banco Galicia started offering these services, allowing customers to trade BTC, ETH, USDC, and XRP on its platform. Nevertheless, central banks under different administrations soon banned banks from providing these services altogether.

read more: Argentina’s central bank bans private banks from providing virtual currency services

Why is it relevant?

If such a decision were to be made, Argentina would become a pioneer in cryptocurrencies in Latin America, given that other countries such as Bolivia and Venezuela have hinted at taking similar steps but have not done so.

As experts say, this move will give new impetus to cryptosystems as a supported alternative to traditional rails and allow ordinary people to access crypto savings methods from their banks.

Nevertheless, the central bank needs to consider the effects of introducing these assets in the context of Argentina’s economy.

I’m looking forward to it

La Nación reports that industry insiders expect the measure to take effect by April 2026, although no date has been given.

FAQ

- What measures is Argentina’s central bank considering?

The bank is drafting a proposal to allow private banks to offer it. Cryptocurrency trading and custody services. - What impact could this have on the adoption of cryptocurrencies in Argentina?

This measure could strengthen the country’s cryptocurrency ecosystem and encourage more citizens to invest in cryptocurrencies such as: Bitcoin And stablecoins. - How have local banks approached crypto services so far?

In 2022, Banco Galicia began offering trading in the following cryptocurrencies: BTC, ETH, USDC, and XRPbut the previous administration banned these services. - What is expected from the implementation of this measure?

Industry participants predict that the new measures could have the following effects: April 2026positioning Argentina as a leading cryptocurrency pioneer in Latin America.