- Ethereum price has produced a bullish breakout from the formation of a descending wedge pattern.

- Today’s price surge resulted in $140.44 million in short-term liquidations in the derivatives market, according to Coinglass data.

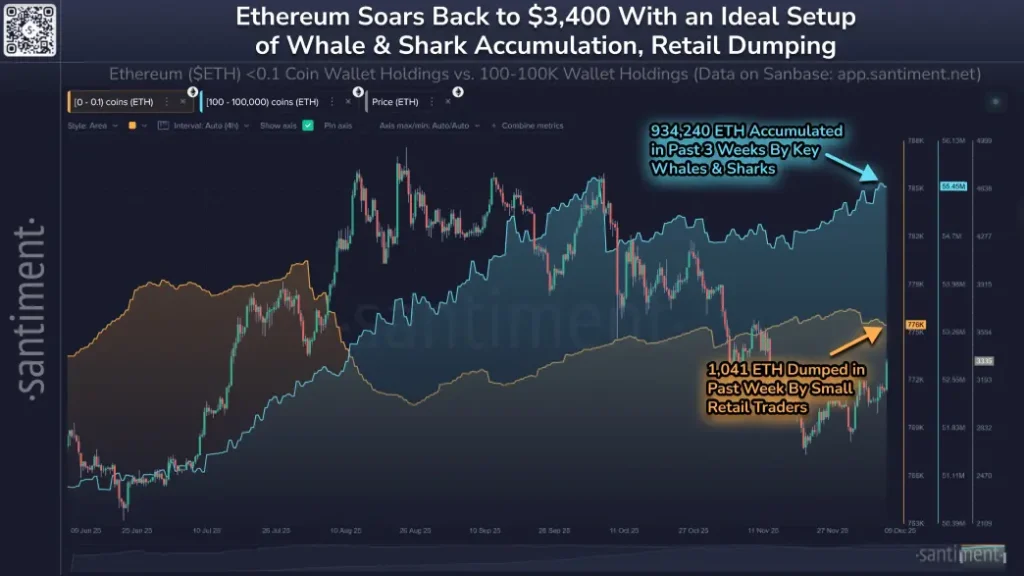

- According to Santiment data, Whales and Sharks collected 934,240 ETH in three weeks.

ETH, the native cryptocurrency of the Ethereum blockchain, surged more than 8% on Tuesday, trading at $3,383. The gains came in line with a broader market recovery as investors expected further rate cuts from the U.S. Federal Reserve. Additionally, the Ethereum price recovery gained further momentum as large investors showed interest in accumulating ETH during the recent decline.

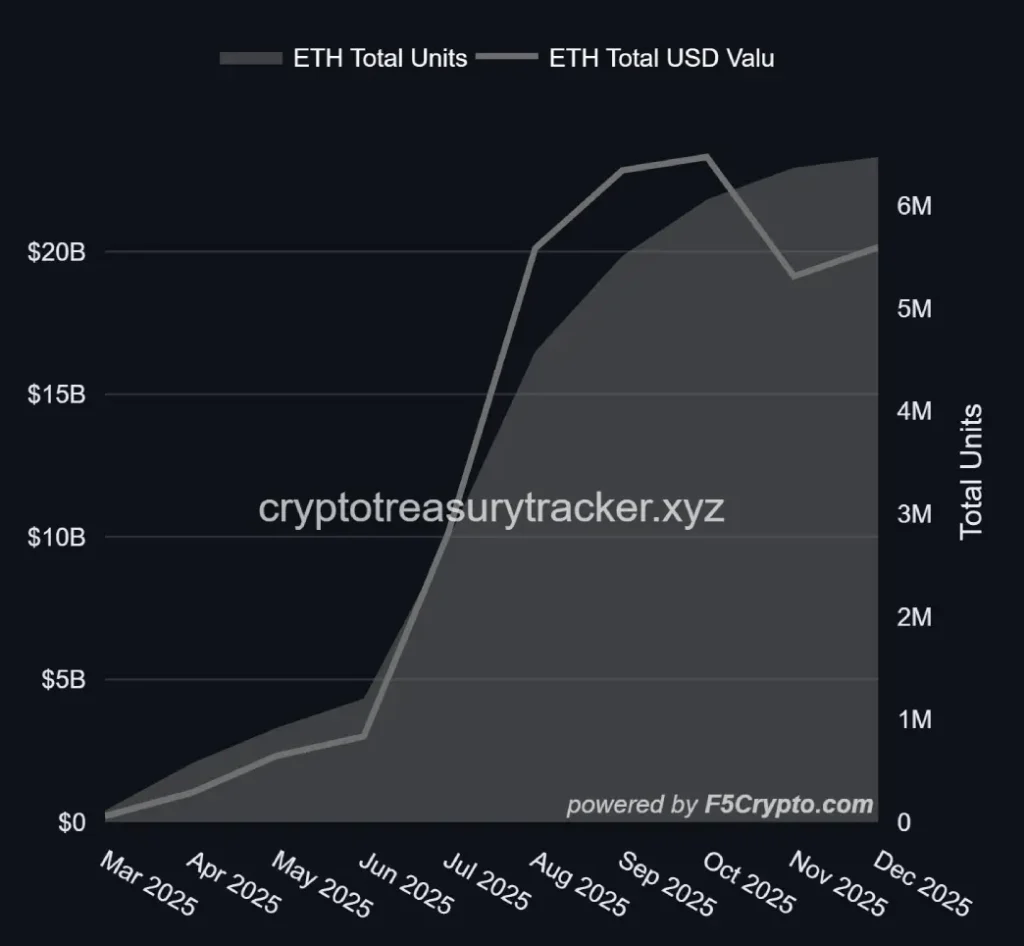

Institutional investor wallet expands ETH holdings to over 400,000

Over the past three weeks, Ethereum price has shown a strong rebound from $2,621 to the current trading price of $3,383, marking a 29% growth. This rally marks two lower lows on the daily timeframe chart, indicating a positive change in market sentiment.

The rebound gained momentum amid investor optimism about the Fed’s 25bps rate cut, but the odds are now hovering near 90%. Additionally, the recently launched Fusaka upgrade and the accumulation of large investors have also contributed to this growth.

Ethereum recorded an 8.5% gain in today’s trading, which is known as a significant rally in a volatile market. Large investors, known as whales and sharks in the crypto world, are slowly accumulating their holdings. Over the past three weeks, the following entities collected approximately 934,240 units of ETH, or a total of approximately $3.15 billion.

This buying trend is in sharp contrast to the behavior of smaller participants in the market. Last week, these companies offloaded approximately 1,041 ETH, predicting retail capitulation. In the last week alone, individual retail traders have offloaded approximately 1,041 ETH, demonstrating a divergence in strategy between large firms and regular users.

Saintly

Meanwhile, institutional ETH reserves have been steadily increasing despite downward price pressure. During November, these bonds increased by over 309,000 ETH as asset valuations softened. This trend continued until early December, with over 100,000 ETH added already recorded.

Such moves highlight the changing dynamics in the Ethereum world, where prominent accumulators appear to be taking advantage of the temporary drop.

Ethereum price exit 60 days correction trend

Today’s price increase has seen Ethereum price decisively break from the major resistance level of the descending wedge pattern. Over the past two months, this chart setup has shown a steady correction trend, as evidenced by a series of low and high formations resonating within two converging trend lines.

A descending wedge pattern is often seen at the end of a downtrend or correction, as converging trend lines emphasize weakness in bearish momentum.

The recent price rally signals a break from this bearish trend while buyers have adequate support to drive a stable recovery. The coin price also managed to regain its 20-day and 50-day exponential moving averages, highlighting a bullish shift in market sentiment.

The average value of the RSI (Relative Strength Index), a momentum indicator, rose sharply, adding strong buying pressure to support further price recovery.

If the buying continues, Ethereum price could rise another 9.8% to challenge the resistance at $3,655 and then lead towards $4,245.

ETH/USDT -1 day chart

Conversely, if the coin price fails to sustain this breakout and re-enters the wedge pattern range, the bullish theory will be invalidated.