Cryptocurrency exchange Binance has added new features to its application programming interface (API), indicating that the platform is preparing to introduce stock trading functionality.

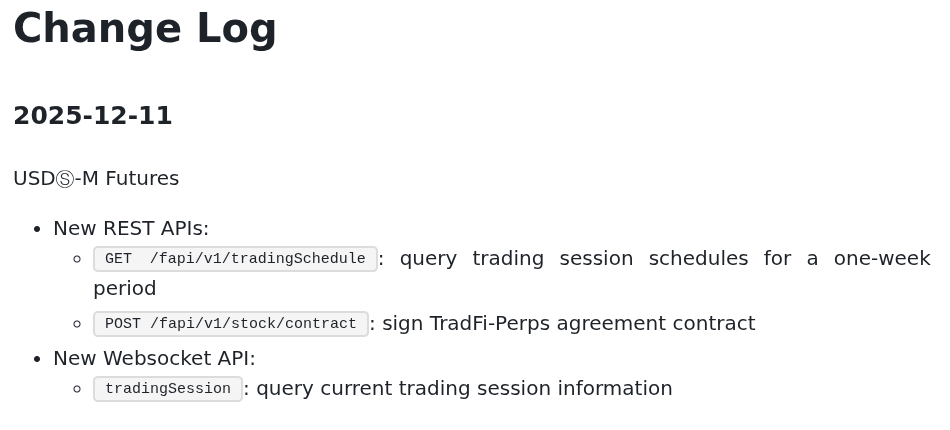

Binance’s changelog states that on Thursday, the exchange introduced three new API endpoints, one of which (URL containing stocks/contracts) allows users to “sign (a) TradeFi-Perps contracts.” Two other endpoints, introduced on the same day, allow users to query “Schedule of trading sessions for the week” or “Information about current trading sessions”.

Taken together, this suggests that Binance plans to introduce perpetual futures trading on its platform. Existing trading schedule endpoints also suggest that trading will likely take place in sessions, similar to traditional finance, rather than following the 24/7 nature of cryptocurrencies.

This follows the launch of tokenized stocks in 2021 by Binance, a relatively short-lived effort. Following the announcement in late April, Binance halted sales of tokenized shares in mid-July 2021, just a few months after it came to the attention of regulators.

Binance acknowledged Cointelegraph’s request for comment, but did not respond in advance of publication.

Binance API changelog. sauce: Binance

Related: Ondo wins Liechtenstein approval to offer tokenized shares in Europe

Tokenized stocks are all the rage

Binance’s effort follows a series of similar efforts by players in both traditional and crypto finance to take equity tokenization out of the fringes of finance. Top US-based cryptocurrency exchange Coinbase is days away from revealing its expansion into tokenized stocks and prediction markets, according to a report on Friday.

However, not everyone is enthusiastic about how equity tokenization is unfolding. Market maker Citadel Securities caused a stir earlier this month by recommending that the U.S. Securities and Exchange Commission tighten regulations on tokenized stock trading on decentralized finance (DeFi) platforms.

Market makers say DeFi developers, smart contract developers, and self-custody wallet providers should not be given “broad exemptions” to offer trading in tokenized U.S. stocks. Citadel argued that DeFi platforms likely fall under the definition of “exchange” or “broker-dealer” and should be regulated under securities laws.

He also argued that allowing these platforms to operate without regulation would “create two separate regulatory regimes for trading in the same securities.” The World Federation of Exchanges (WFE) also argued in late November that the SEC should not grant broad regulatory relief to companies that begin offering tokenized stocks.

WFE said that tokenization is “likely to be a natural evolution in capital markets” and is “a catalyst for innovation.” Still, the group insisted that “it must be done in a responsible manner that does not jeopardize investors or the health of the market.”

This comment followed tokenized stocks being introduced not only to centralized cryptocurrency exchanges, but also to the DeFi ecosystem. As of the end of June, more than 60 tokenized stocks had been launched on Solana-based DeFi platforms and crypto exchanges Kraken and Bybit.

Related: Robinhood tokenizes nearly 500 US stocks and ETFs with Arbitrum for EU users

Not all traditional finance views this as a problem.

Other traditional financial players appeared to be following a “if you can’t beat them, join them” approach to this issue.

Matt Savarese, Nasdaq’s head of digital asset strategy, said last month that his top priority is getting the SEC to approve a proposal for the exchange to offer tokenized versions of its listed stocks.

Competition intensified after it was reported that the SEC was developing plans to allow blockchain-registered versions of stocks to be traded on crypto exchanges by the end of September.

SEC Chairman Paul Atkins recently described tokenization as an “innovation” that the agency should seek to advance rather than restrict. The SEC on Thursday issued a “no-action” letter to a subsidiary of a deposit clearing company that specializes in securities tokenization, indicating the regulator intends to allow the company to offer new securities market tokenization services.