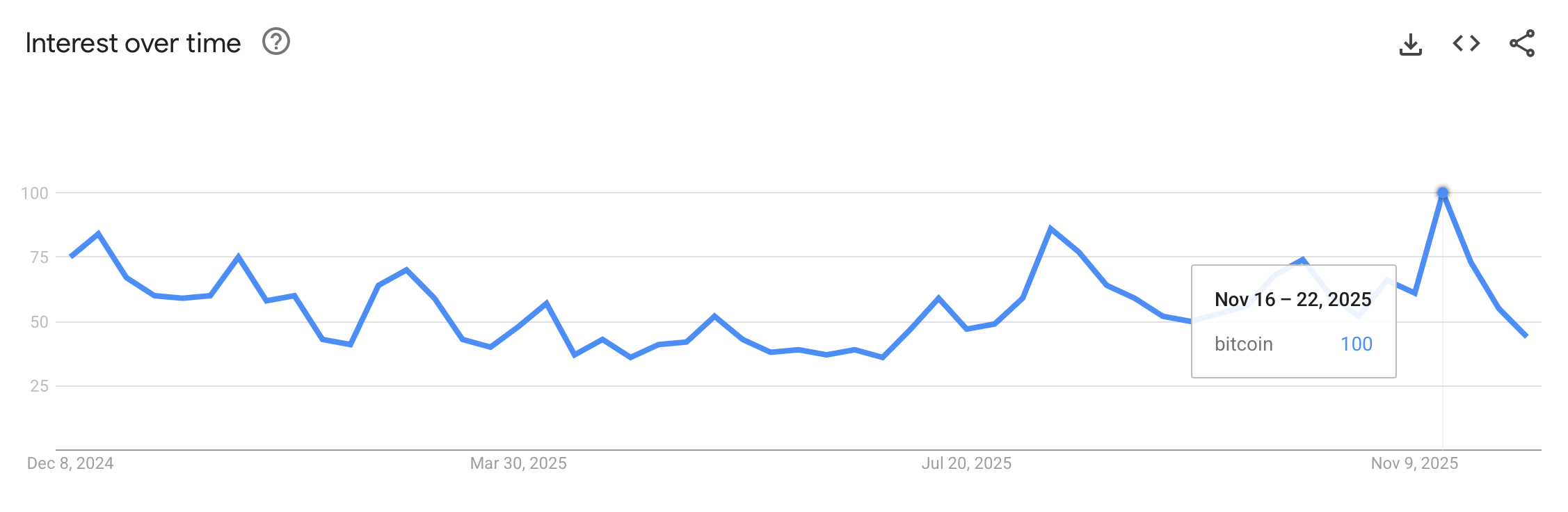

While it may seem low-profile at first glance, Google Trends data shows that over the past year, the search term “Bitcoin” has maintained a steady and fast-paced relative interest throughout the period. Zooming out to a five-year view, Google search interest in Bitcoin has remained fairly consistent, but in the moderate to low range compared to the peak of the 2020-2021 market cycle.

From viral to alarmist: how Bitcoin’s attention has changed

Bitcoin has been on a very different profile this year, with its price falling and Google search interest cooling from its peak 26 days ago, with two weeks left on the 2025 calendar. This week, we got a clearer picture of how things are changing towards the end of the year, based on data from Google Trends.

Essentially, Google Trends samples Google search queries, normalizes the results on a scale of 0 to 100 tied to peak popularity within a selected time frame and location, and shows relative search interest over time, by region and among related topics. 26 days ago, for the week of November 16th to 22nd, the search query “bitcoin” reached 100 results.

One year of Google Trends.

Over the past year, interest in Bitcoin in Google searches has moved in distinct waves, subsiding after excitement at the beginning of the year, rising sharply around mid-year, and settling into a higher, more stable range without returning to previous lows. Bitcoin started the year at 75, and its value on November 16th was its highest in 12 months.

According to Google, interest in Bitcoin was the second highest for the week of August 10th to 16th. This growth marks the first time Bitcoin has breached the $120,000 range, closing at $120,153 on August 13 and hitting $123,497 the following day. However, by November 16 of that week, Bitcoin was trading below the $100,000 level after breaking out of a key support zone three days earlier.

In both cases, Bitcoin made headlines that week, whether it went up or down. According to Google Trends, El Salvador leads the list in terms of regional interest, which is appropriate considering the legal status and cultural footprint of El Salvador’s currency. Switzerland, Austria, Slovenia and Germany followed, showing strong interest from both the retail and institutional sectors in Europe.

60 month outlook

Over a five-year period, searches for Bitcoin now account for only 24 out of 100 searches. From a trend perspective, Bitcoin seems to be an asset that people are steadily following, even at subdued levels, with increased attention centered around major catalysts. Taken together, this five-year span confirms that Bitcoin will never completely leave the global search bloodstream.

Bitcoin searches, which reached a five-year high, have not returned to that level since the 2020-2021 phase. In the first half of 2021, queries reached 100, driven by widespread retailer participation, constant media coverage, pandemic-era stimulus talk, and finally Bitcoin breaking into the mainstream conversation far beyond the financial world.

A 5-year outlook on Google Trends.

Today, Bitcoin has received much more consistent media coverage, but the spotlight has shifted from retail-driven excitement to a mix of low retail and high institutional activity, with institutional investors now dominating most of the headlines. The 60-month view shows a concentration of search interest in regions such as El Salvador, Nigeria, Switzerland, Austria, and the Netherlands.

Related queries show that this interest is not just curiosity, but practical and price-conscious. The five-year rally includes Solana Price, which shows comparisons between assets, and MSTR Stock, which reflects the growing appetite for equity-linked Bitcoin exposure. Taken together, the relevant search results demonstrate continued interest in a wide range of crypto investment vehicles.

read more: Satoshi left 15 years ago — 575th forum post marks the moment Bitcoin became independent

Historically, peaks in search interest have coincided with moments when Bitcoin bursts far beyond the financial world into the mainstream conversation, and a lot of things need to fall into place, including a decisive price move in either direction, control of the narrative, and widespread public relevance to get back to a reading of 100 on a five-year basis rather than a short period of time.

To reach that level in the long term, Bitcoin will need to become impossible to ignore in the news cycle and appear not just in cryptocurrency coverage, but on business desks, broadcast television, social platforms, and more alike. For many observers, and this point has been reiterated often this year, retailer participation remains important, and when people feel that something significant is about to happen and ignoring it is no longer an option, retailer participation tends to become important again, even if they haven’t actively invested in it.

So far, the data shows a familiar pattern. Bitcoin rarely disappears, you just have to wait. Search interest declines as the noise fades, and returns when price movements, headlines, and narrative gravity bring search interest to wider attention. As 2025 winds down, attention seems to be muted, not absent. This is a reminder that Bitcoin’s quiet phase is more hopeful than indifferent, and that the next catalyst is always one headline away.

Frequently asked questions 🧠

- What do Google Trends say about Bitcoin interest in 2025? Google Trends data shows that Bitcoin maintained steady search interest throughout 2025, although there were temporary spikes due to major price and news events.

- When did Bitcoin reach its peak of interest in Google searches this year? Bitcoin hit its highest Google Trends price in 2025 during the week of November 16th to 22nd.

- In which countries is there the most interest in searching for Bitcoin? El Salvador ranks highest on Google Trends, followed by European countries such as Switzerland, Austria, and Germany.

- Why does interest in Bitcoin searches go up and down? Search activity tends to increase when Bitcoin makes headlines due to sudden price movements, policy developments, or broader market narratives.