Bitcoin remains in a tightening range just above $80,000. Despite the recent recovery from sub-$85,000 levels, the overall tone of the market remains cautious. There is no meaningful breakout and sentiment has not yet turned bullish.

BTC technical analysis

Written by Shayan

daily chart

On the daily time frame, the price is still trapped within the descending channel that has been active for the past few months. BTC recently rebounded from the $81,000 support zone and has made a series of new lows since then. However, each push is capped at approximately $95,000, which is just below the upper limit of the channel and the main bearish order block.

The asset is currently trading below its 100-day and 200-day moving averages and is curving downwards around $107,000. This is a clear sign that buyers are still battling macro trends. The structure remains bearish to neutral unless a strong daily close above $96,000 occurs.

4 hour chart

Zooming in on the 4H chart, BTC has formed a clear ascending triangle between $80,000 and $95,000. This type of structure often resolves to the upside, but only if volume and momentum support a breakout. At the moment, breakout attempts around $94,000 continue to be rejected.

There is a narrowing between trendline support and horizontal resistance, and the price is nearing the top. Therefore, a breakout or breakdown may occur within the next few sessions.

Buyers will be hoping for a clean breakout above $95,000 and volume targeting the $100,000 zone. On the other hand, sellers will focus on a break below the uptrend line and aim for a retest of $85,000 or even the crucial $80,000 area.

On-chain analysis

Bitcoin exchange reserves

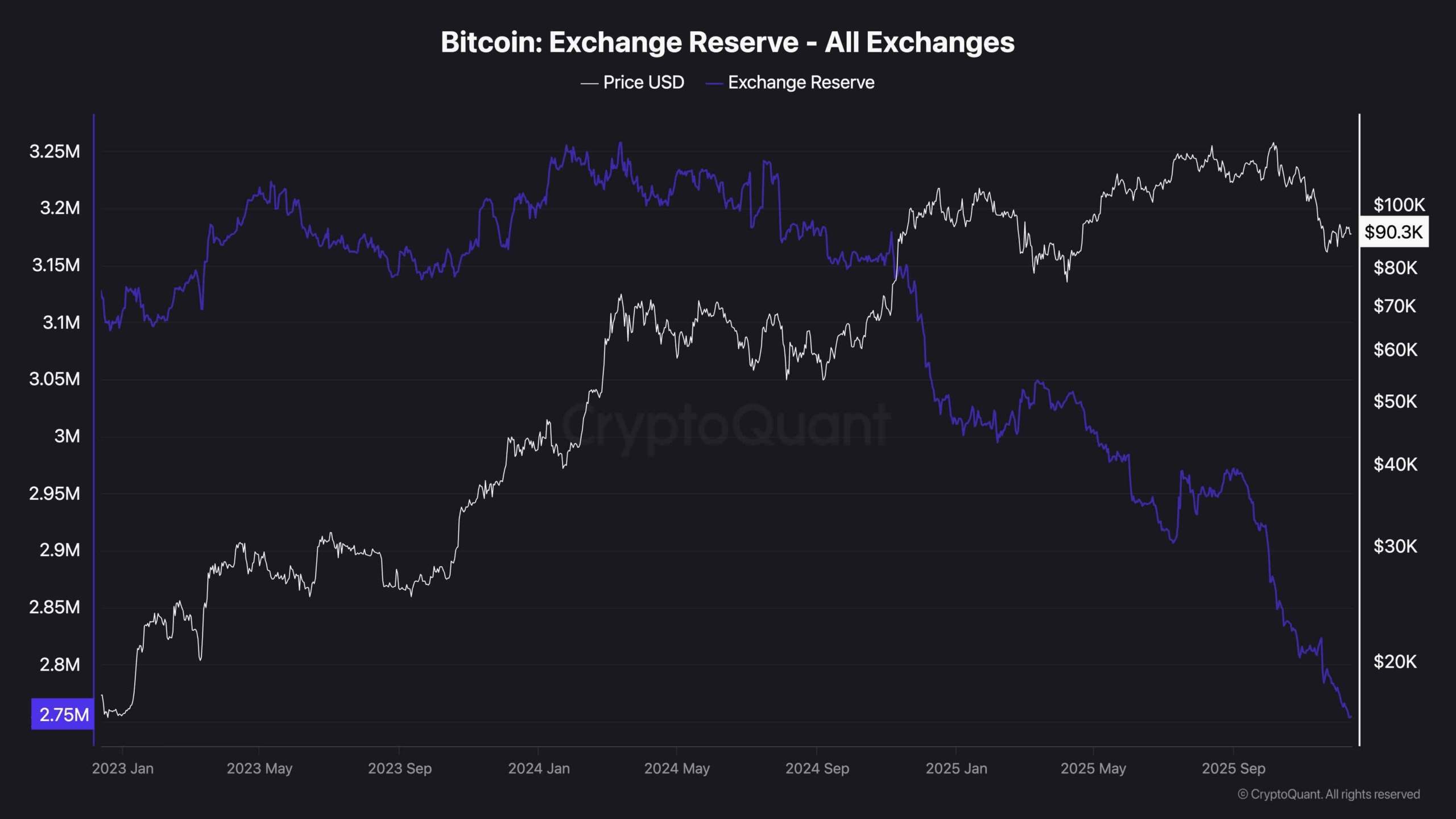

Exchange reserve data paint a more interesting picture. The exchange’s BTC reserves continue to decline significantly and are currently at a multi-year low of around 2.75 million BTC. This usually suggests that long-term holders are not interested in selling and supply is drying up.

However, this is not yet reflected in price strength. The divergence between declining reserves and flat price trends indicates that despite low exchange supply, demand is not yet strong enough to drive prices up.

This could be because institutional flows and retail interest remain weak at current levels, or because capital is sitting on the sidelines waiting for macro transparency. Until spot demand becomes serious, declining reserves alone will not be enough to trigger a sustainable bull market.