Cryptocurrency analyst Dr. Cuadrado criticized the way the broader crypto market assigns value to blockchain projects, citing Cardano as a prime example.

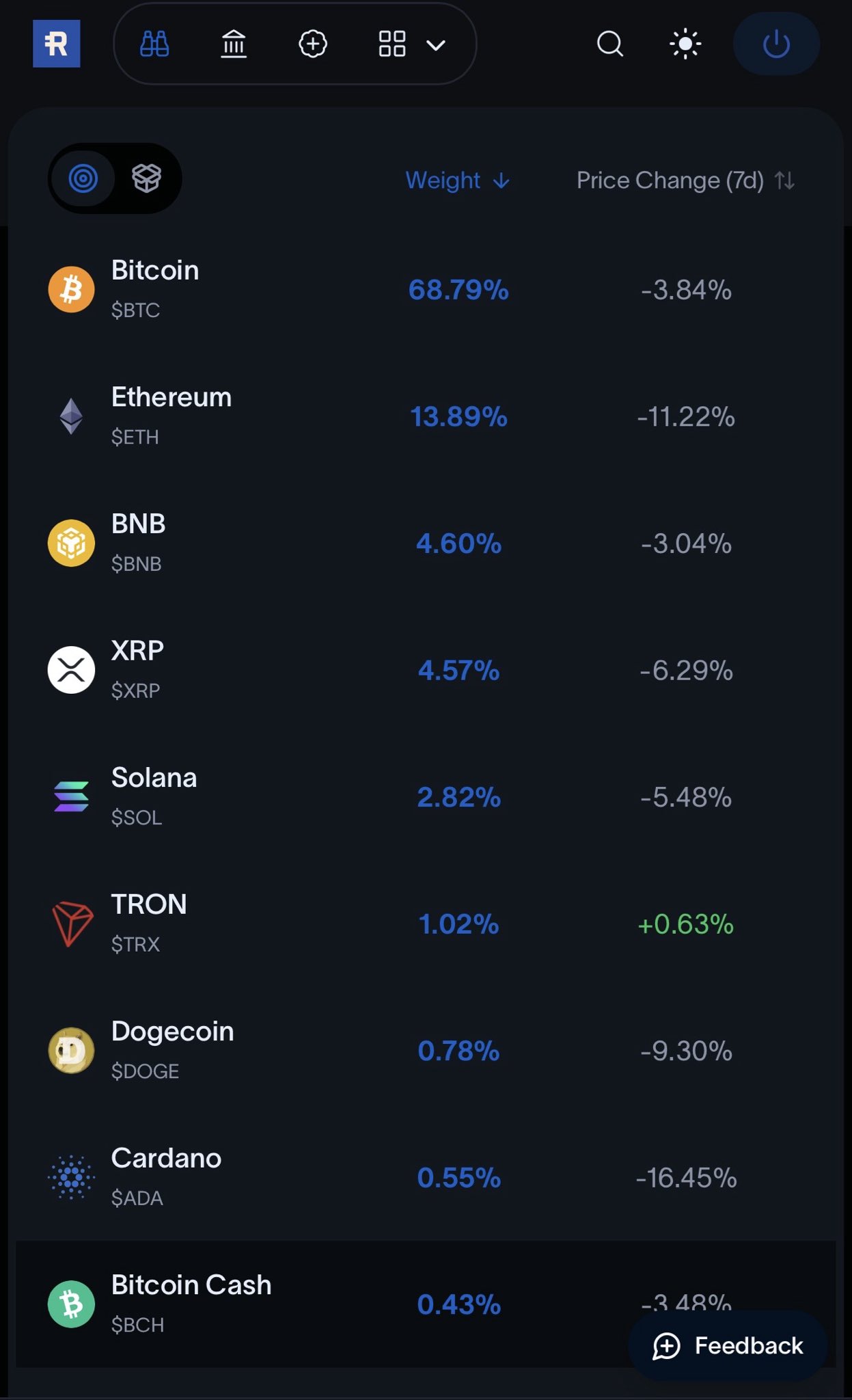

In recent comments, Cuadrado pointed out that Cardano (ADA) accounts for just 0.55% of the “Cryptocurrency Top 20 Index (DFT).” By comparison, Bitcoin dominates the index with around 69%, followed by Ethereum with around 14%. Meanwhile, the weights of other major assets such as BNB, XRP, and Solana are 4.60%, 4.57%, and 2.82%, respectively.

Cardano is not dead money, it’s a once in a lifetime opportunity

Reacting to these numbers, Cuadrado expressed concerns about Cardano’s marginal allocation, stating that the 0.55% weighting is unusual, especially for a project that has survived all major crypto bear markets since its launch.

Cuadrado said that based on this imbalance, critics often refer to Cardano as “dead money,” but the main reason for this is Cardano’s recent failure to generate explosive short-term price movements. But he disagrees with that characterization. Instead, analysts argued that the market has largely ignored Cardano, with many traders focusing on short-term price movements rather than long-term fundamentals and network resilience.

Notably, Cuadrado described Cardano as a once-in-a-lifetime opportunity, stressing that this view is based on fundamentals rather than hype. According to him, his beliefs stem from a deep understanding of Cardano’s architecture, underlying technology, and competitive advantages.

In his view, evaluating networks through these lenses reframes the conversation and provides clearer insight into its true value.

Regulation resets the market

Meanwhile, Cuadrado argued that the market’s obsession with short-term profits is coming to an end as the regulatory framework begins to take shape. By the way, the U.S. Senate is currently considering the CLARITY Act. This law aims to clarify the regulatory status of cryptocurrencies like Cardano, designate appropriate regulators, and reduce market manipulation.

As a result, Cuadrado characterized regulation as a market reset mechanism, arguing that it could curb persistent manipulation on centralized trading platforms and bring attention back to fundamentals. He predicts that many will eventually realize that while other projects have been busy building their beliefs, they have been keeping a close eye on the noise.

Amazon parallel

In particular, the overall market downturn is weighing heavily on Cardano’s price performance. Since the beginning of 2025, ADA has decreased by 55.4%, by 59.3% in the past three months, and by 9.42% in the past week alone. ADA’s current price is $0.374, trading 87.94% below its all-time high of $3.10.

In the midst of this sell-off, Cuadrado compared Cardano’s current price movement to Amazon’s stock (AMZN) at the time of the dotcom crash.

At that time, AMZN plummeted nearly 90%, from $113 to $6, with many observers labeling the stock dead. But Cuadrado pointed out that Amazon’s internal metrics continue to improve and the company is steadily strengthening its business behind the scenes.

To make this point, he quoted Amazon’s executive chairman Jeff Bezos, summarizing the lesson succinctly. “Stocks are not companies.”

AMZN is currently trading around $221, and Cuadrado argued that history rewards those who recognize strong fundamentals early, rather than those who react impulsively to short-term price movements.