A record $23 billion in Bitcoin options expire on December 26th, with the biggest pain being around the current range, where liquidity is scarce and BTC volatility is poised to spike.

summary

- A record $23 billion worth of Bitcoin options will expire on December 26th, making it the largest BTC option expiration on record.

- Calls are stacked at high strikes and clusters are placed at lower levels, with maximum pain occurring around the current price.

- Low liquidity and unwinding of positions during the holiday season could amplify BTC volatility as institutional flows reset.

A record $23 billion Bitcoin options contract is set to expire on Friday, December 26th, making it the largest BTC option expiration in history, according to market data.

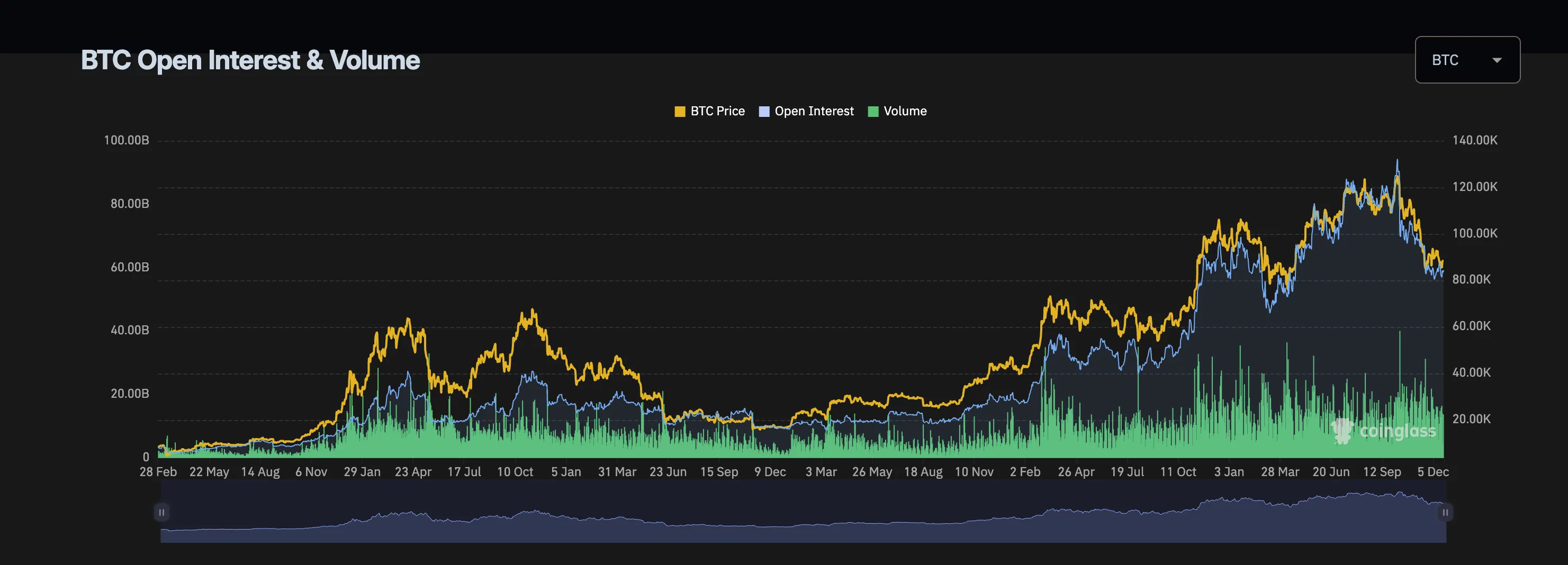

CoinGlass open interest data shows that call options are concentrated at high strike levels, indicating that traders are bracing for higher prices. Put options are concentrated at lower strike prices, suggesting that key support levels are being closely monitored.

Bitcoin options expire on December 26th

Data shows that the max-pay level, defined as the price at which an option holder incurs maximum loss, is near the top of the current trading range.

The total expiration dates exceeded previous year’s numbers, making this one of the most significant Bitcoin-related events on record.

Market analysts say the put-call ratio shows traders are seeking upside exposure rather than downside protection.

You may also like: Ethereum price target is $2,600, small bounce is a bearish sign

At the time of publication of this article, Bitcoin was trading below its recent highs. Cryptocurrencies typically experience increased volatility prior to the expiration of a major option, and prices can fluctuate rapidly as contracts expire and open interest resets.

Market watchers say price movements near expiration could cause volatile fluctuations as traders close positions or loosen hedges.

We will explain the expiration dates of high-level Bitcoin options. (December 22, 2025) pic.twitter.com/gBvx1oB6D9

— CoinGuide (William Watson) (@CoinGuideWW) December 22, 2025

Expirations are typically set during holiday weeks when market liquidity is reduced, so large orders can cause prices to fluctuate more than during normal trading periods.

Market analysts say the numbers confirm that derivatives flows are increasingly influencing price movements and that institutional investors have a growing presence in the crypto market.

read more: Justin Sun’s blacklisted WLFI wallet loses $60 million as governance concerns grow