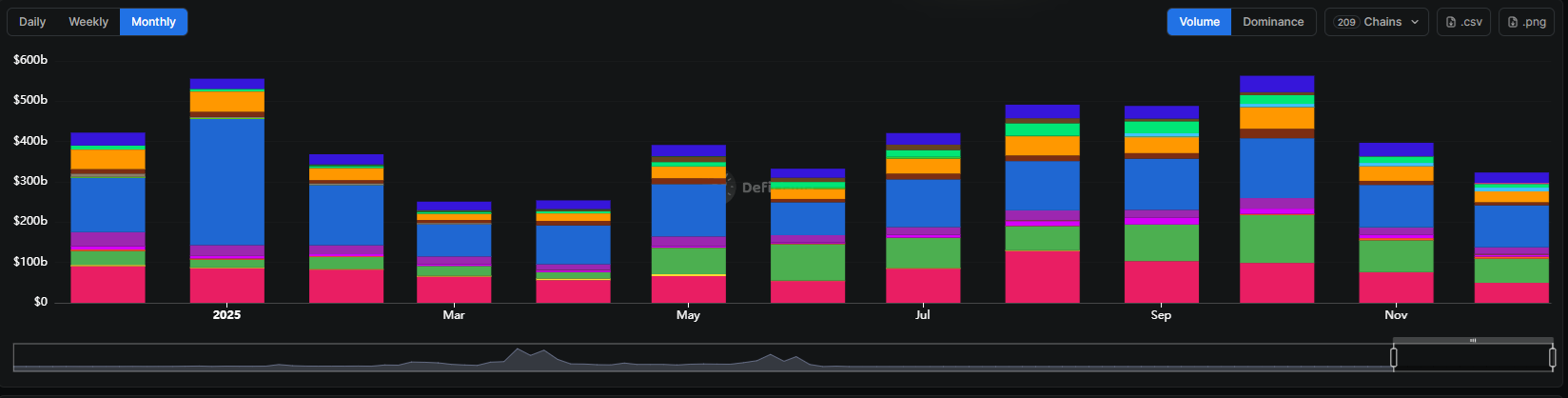

Solana ended her role as DEX activity leader for another month. In the second half of 2025, this chain became the main venue for DEX transactions, overtaking Ethereum and BNB chains.

Solana ended the year as a leader in DEX activities. L1 Chain’s DEX trading volume exceeded all other networks for five consecutive months. As a result, Solana ended the year with record revenue of $1.3 billion to $1.5 billion.

In December, Solana DEX activity totaled over $100 billion, more than double Ethereum activity of $48 billion. BNB Chain was in second place in December with $58 billion in DEX activity.

Despite the overall slowdown in meme token creation, Solana activity continued to rise. The chain exceeded Hyperliquid’s monthly trading volume of approximately $8 billion, with daily trading levels exceeding $3 billion.

Why is Solana still the DEX leader?

The main driver of Solana’s activity is PumpSwap, which expanded its footprint in late 2025.

Solana’s monthly DEX volume exceeded $100 billion for six consecutive months, breaking short-term records and becoming a model of consistency. Despite the decline in activity and the loss of “trench” traders, the chain remains the main venue for new token launches.

Solana has remained the DEX leader for the past five months, boosted by activity from PumpSwap and HumidiFi. |Source: DeFi Llama

The move into DEX activity also follows Solana’s leadership position. mind share. Even though Base is trying to become the main network for fun on-chain activities, Solana still maintains a niche position.

Solana still only holds 6.13% of DeFi liquidity while Ethereum has over 67% liquidity. The chain continues to be a leader in terms of app-based economic activity and token sales.

PumpSwap and HumidiFi power Solana

In 2025, Solana saw meme tokens go through a phase of massive hype and then slow down. Nevertheless, the meme market has had a lasting impact. PumpSwap became one of Solana’s leading DEXs, with annual fees of $584 million.

The platform accelerated its fee generation activity in the last quarter of 2025. $14.8 billion December volume.

HumidiFi powers Solana’s overall activities by providing a dark liquidity pool. DEX reported 30 billion dollars It has seen a significant amount of service delivery over the past month, making it one of the key decentralized hubs for Solana’s overall performance.

HumidiFi also reported increased activity in SOL stablecoin trading volume. The Solana ecosystem has benefited from very active USDC stablecoin minting over the past year. In December, Circle minted $7.75 billion in USDC on the Solana network, increasing available liquidity for DEXs using stablecoin pairs.

Trading on Solana relies heavily on bots. At the end of 2025, Axiom was the most active bot. 373,990 sol Funds will be deposited from the user’s wallet.

Despite the growth in activity, SOL remained depressed at $126.21 towards the end of 2025. SOL is still used for fee clearing and is sold through both DEXs and centralized exchanges. SOL fell 5.28% in December and fell more than 39% in the previous quarter. This token may react negatively to rising DEX activity, indicating selling pressure through its native market.