Stablecoin usage on Revolut is increasing and reaching an exponential growth rate. This expansion comes after a record year for stablecoin minting and usage.

Revolut’s stablecoin has grown at an almost exponential rate based on the amount of interactions.

Dollar fixed asset trading volumes through Revolut have increased by 156% and total payments have increased by 38.5% over the past two years. After a slow start, the pace picked up in 2025.

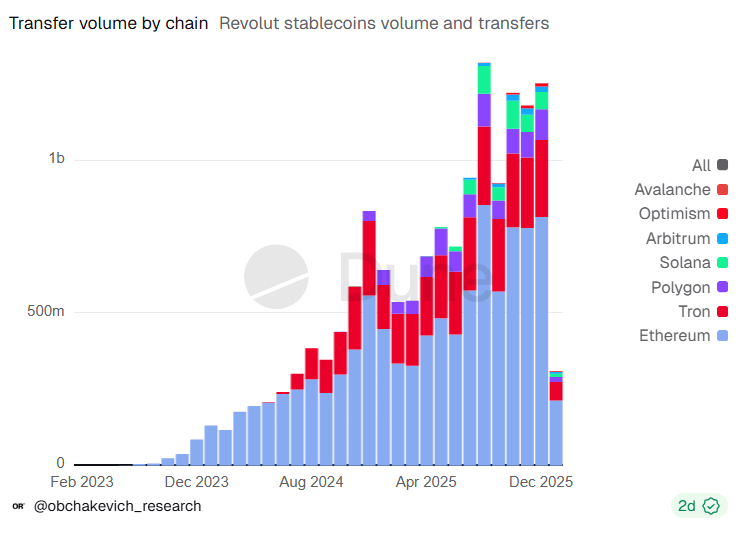

Revolut stablecoin trading has grown in raw volume, value transfer, and diversity with further new networks being added over the past year. |Source: Dune Analytics

For Revolut, the stablecoin share could grow from 0.315% to around 0.58%, according to analysts. estimate. Revolut is actively working on adopting new stablecoin rails and has partnered with Polygon to Solana At the end of 2025.

Revolut has partnered with MetaMask to add stablecoins in 2024 through RevolutX and Revolut Ramp. The exact growth rate of stablecoins in 2025 will be estimated in the coming months after data is collected.

Revolut’s monthly stablecoin volume will expand in 2025

Over the past year, Revolut has seen an upward trend in monthly stablecoin trading volumes. The app, which started with around $600 million per month, reached a record $1.2 billion in total transfers by December.

Although this score is still low compared to DeFi and exchange apps, Revolut has shown a steady growth rate.

Over time, the combination of stablecoins has also become more diverse. Overall, Revolut reflects the common usage of Ethereum and TRON in stablecoin transfers, but also expands the influence of Avalanche and Solana.

Revolut also promoted the use of stablecoins by introducing: 1:1 This means that users can move between the US dollar and the stablecoin without losing or incurring small fluctuations relative to the $1 peg.

Revolut is primarily used for retail payments between $1 and $500, but larger transfers are also made.

Revolut continues the stablecoin trend in 2026

Stablecoin remittances will total more than $10 billion in 2025 and more than $15 billion as of January 2026. The strong upward trend continues, suggesting that stablecoins may be suitable for fintech apps.

One of the drivers of stablecoin expansion in the new year will be Polygon’s Open Money Stack. The chain’s team is directly targeting fintech services such as Stripe and Revolut. Polygon leverages the latest technology to position itself as a utility network, including cheaper transactions and even on-chain revenue.

Polygon aims to offer institutional-level payments, combining well with Revolut’s already officially regulated status. The fintech app is already growing in the European market and has an advantage over other neobanks as a first mover with significant exposure to cryptocurrencies.

Revolut operates in a competitive environment that could see a new wave of crypto-based fintech apps and neobanks launch. Some new apps claim to offer KYC-free access, but this can disqualify you from some of the most developed markets.