At the time of writing, 2026 is still two weeks away, but some Tesla (NASDAQ: TSLA) insiders have already carried out large-scale insider sales of TSLA stock.

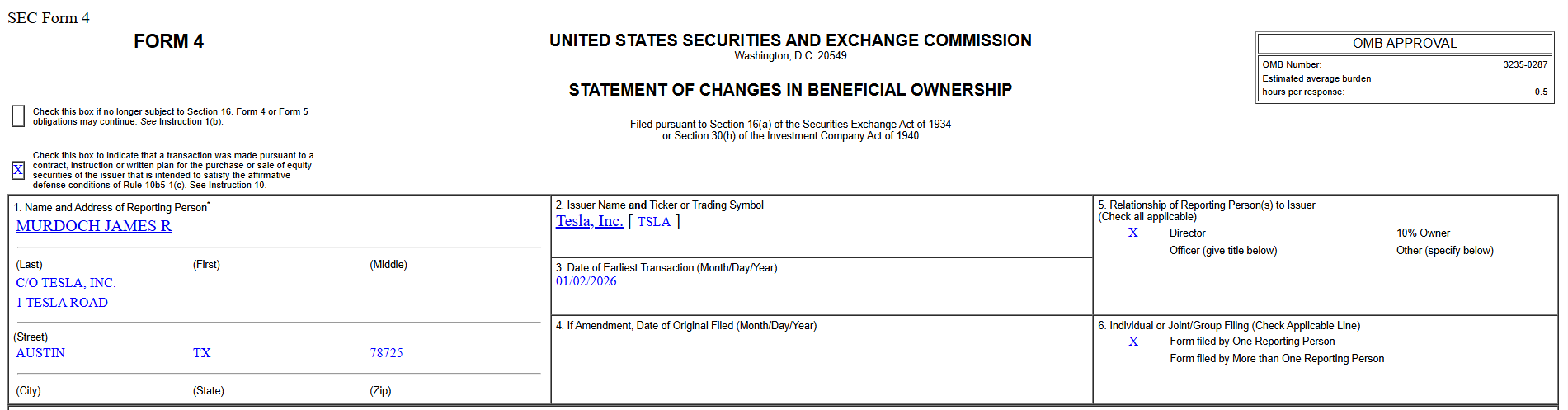

In fact, Australian-American director James Murdoch, son of former media mogul Rupert Murdoch, sold 60,000 Tesla shares on January 2nd for an average price of $445.4, for a total of $26.7 million.

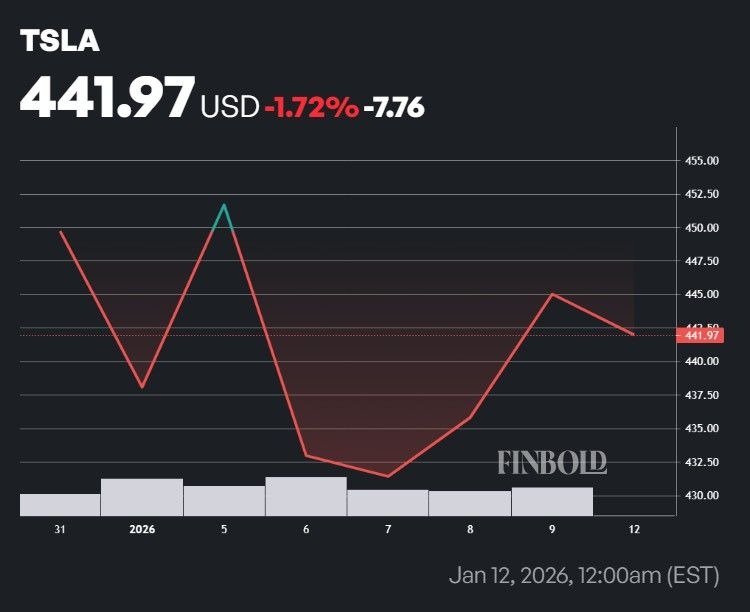

If the trade, which was reported to the Securities and Exchange Commission (SEC) on January 6, had taken place as of press time on January 12, it would have been worth a total of $26.5 million, with Tesla stock trading at $441.97 in Monday’s premarket.

While the $26 million figure is relatively modest compared to some of the other TSLA insider transactions, it’s worth pointing out that total sales in January 2025 reached $44 million, meaning senior officials at the electric vehicle (EV) maker likely sold significantly more merchandise by the end of the month than they did a year ago.

Should Tesla stock investors worry about a massive insider sale in early 2026?

Elsewhere, it’s worth pointing out that insider trading is not a reliable measure of a company’s health, regardless of its size. In fact, many executives and directors regularly carry out planned sales of stock, meaning that most such maneuvers are not conscious moment-to-moment decisions.

Nevertheless, keeping a close eye on Tesla insiders could be a wise move in 2026. Despite the big spring selloff, the EV giant posted a relatively strong full year of 2025, but recent developments are cause for concern.

After years of dominance, Tesla’s fourth-quarter delivery performance fell short of already modest expectations and showed the company’s relative weakness over the 12-month period.

Still, declining sales don’t necessarily indicate something is wrong with Elon Musk’s car company, as much of it can be related to external factors such as broader pressure from consumers and the end of EV credits last September.

Of potentially greater concern to TSLA stock investors are allegations that Musk has dismantled the EV maker’s high-tech division to benefit his new artificial intelligence (AI) company, xAI.

This move can be seen as alarming since a key factor in Tesla’s stock recovery in the second half of 2025 has been Elon Musk’s numerous promises of self-driving and robotics, which will certainly require a team of AI-focused engineers.

Featured image via Shutterstock