The US stock market is undergoing an identity crisis, torn between promises of blockbuster profits and panic over an artificial intelligence (AI) bubble.

Gravity of Grift

Wednesday’s mixed trading session is more than just a squiggle on a chart. It’s a tough Rorschach test of investor sentiment. The market is literally moving in two opposite directions, with the Dow Jones Industrial Average rising more than 280 points and the Nasdaq Composite Index falling.

This dual personality highlights a fundamental debate: Is the economy still resilient, or has the long-awaited outcome of an expensive AI arms race and cooling labor market finally arrived here? This disconnect shows that money is not fleeing the market, but spinning around like crazy looking for a safe story to believe.

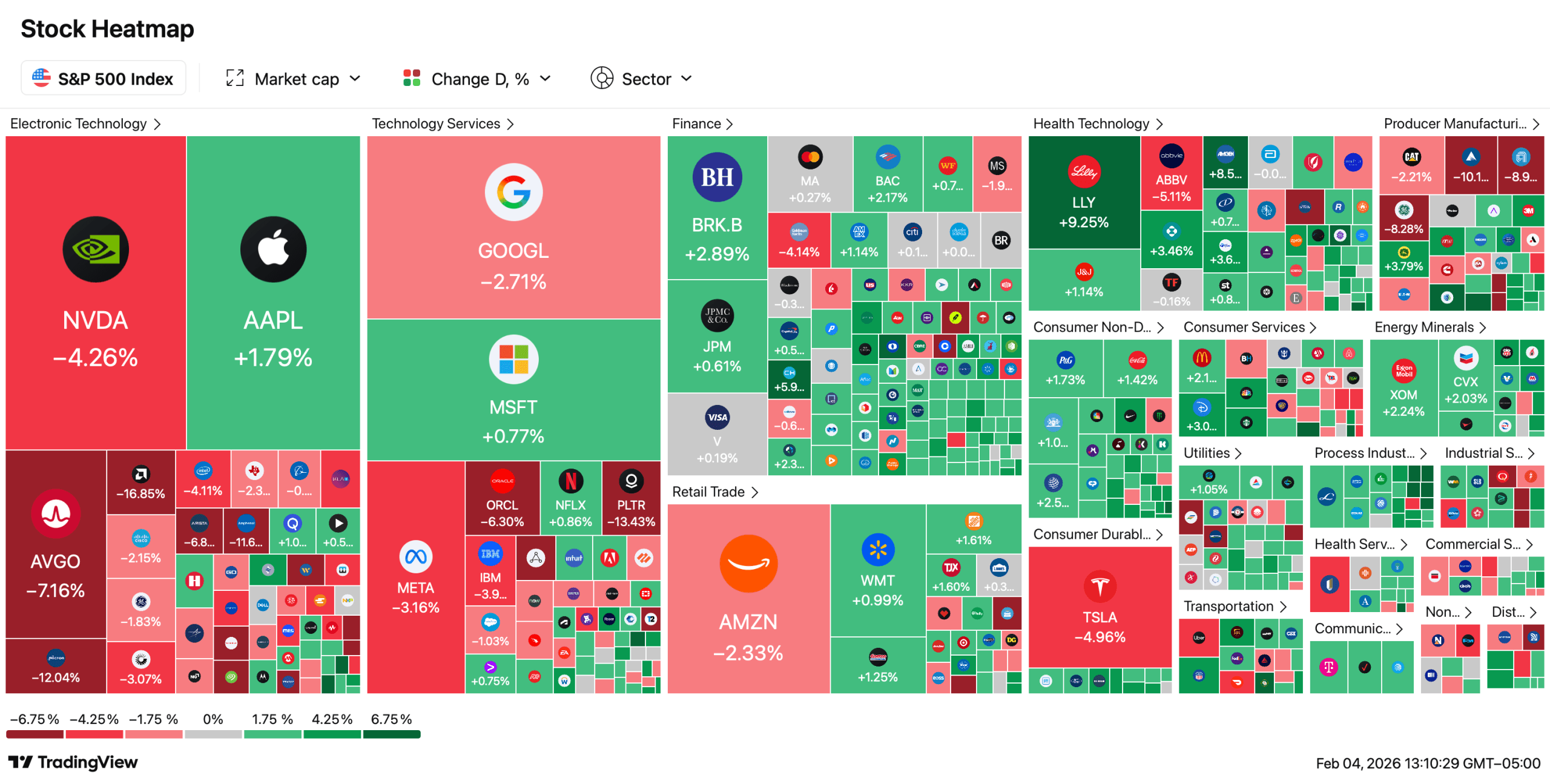

S&P 500 on February 4, 2026 at 1:15 PM ET.

Wall Street Whisper Network

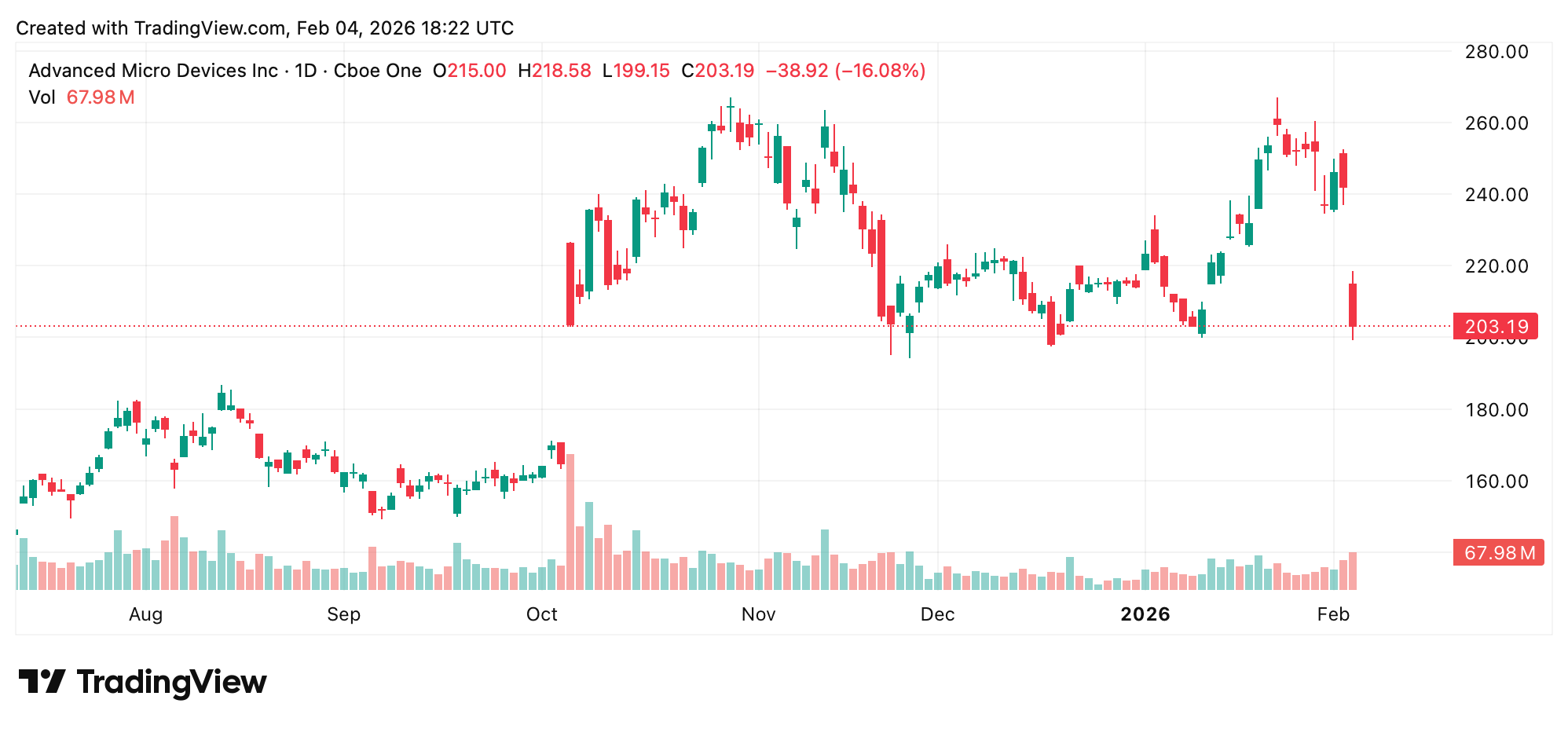

The murmur on the floor is not optimistic. “There’s a genuine concern that AI investments are going to eat software companies’ lunch,” John Praveen, managing director and co-chief information officer at Paleo Leon in Princeton, New Jersey, told Reuters, getting to the heart of the tech stock selloff. The concern is that huge capital investments are turning into a black hole. Forex.com’s Fawad Razaqzada told Bloomberg that the concern is that “the AI theme may not be as lucrative as quickly as expected.” Even impressive profits aren’t enough to calm nerves, with stocks like AMD plummeting more than 12% despite beating expectations, a classic sign that valuations have simply flown too close to the sun.

Advanced Micro Devices (AMD), February 4, 2026.

Hard numbers: A tale of two economies.

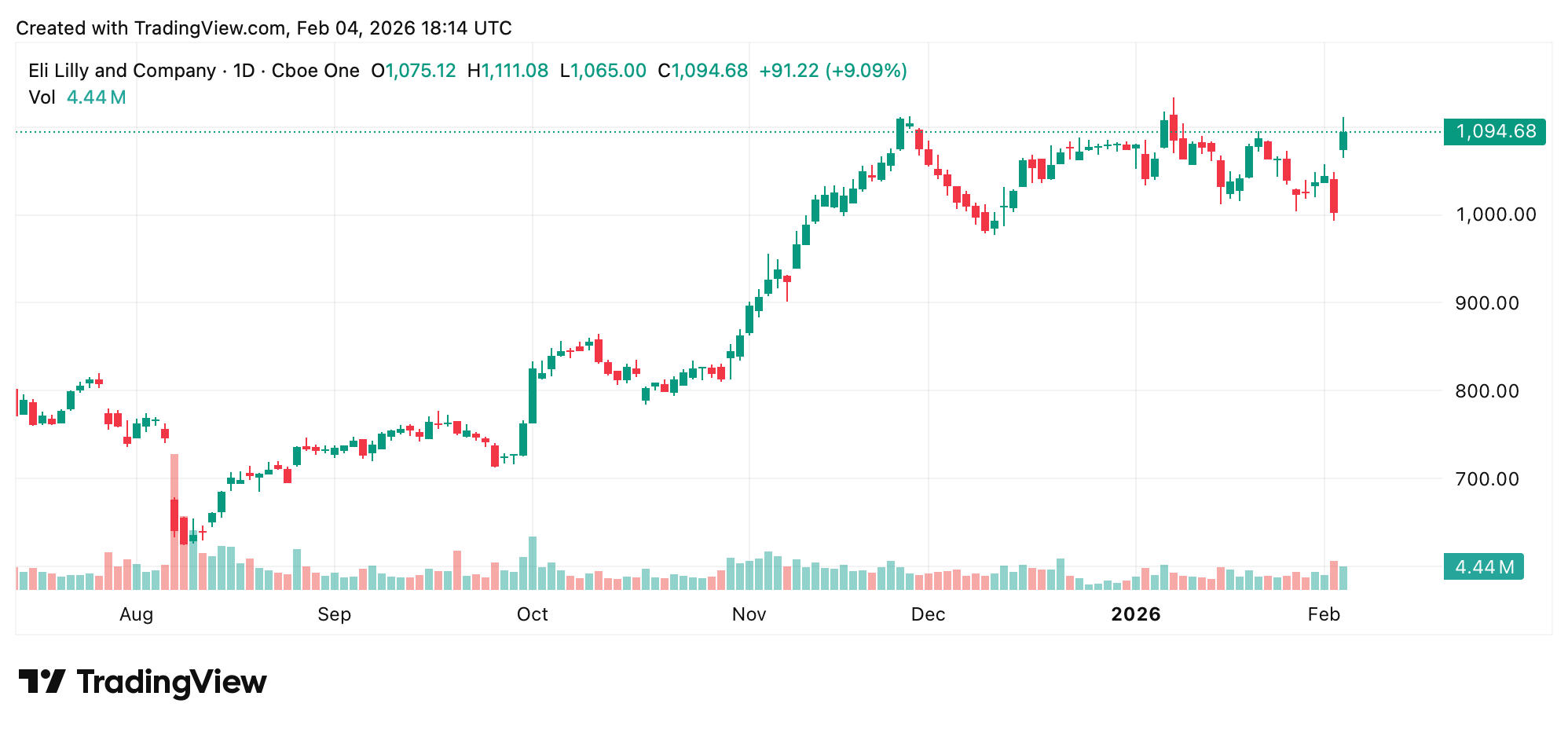

The data paint a contradictory picture. In one corner, American companies are showing strength. Eli Lilly soared more than 7% after beating profit expectations, and Super Microcomputer soared 12%, proving there’s still a winning streak left. In the other corner, the macroeconomic engine is chugging along. Private employers added just 22,000 jobs in January, a fraction of the 48,000 expected, a clear sign of economic slowdown, according to the ADP report. In particular, professional and business services lost 57,000 jobs, and manufacturing continued its long setback.

AI Anxiety: The Post-Party Hangover

The technology sector is the epicenter of the panic. It’s not just a matter of spending. It’s about existential spending. Investors are suddenly starting to question whether their multitrillion-dollar bets on artificial intelligence will pay off. Microsoft’s recent cloud slowdown caused a 10% plunge and served as a wake-up call that even the most powerful companies can be disappointed. The crash was brutal and widespread, engulfing software giants from Salesforce to Adobe. The fear is that AI itself may disrupt the very software models that these companies are built on, turning them from disruptors to disruptors.

Also read: XRP derivatives paint a cautious outlook as prices stall below $1.65

safe haven samba

As technology trembles, a classic rotation is underway. Money is dancing in a direction that seems safe. Health care stocks are rising, backed by Lilly. Daily necessities and industrial products are attracting the flow. Even gold is clawing its way back to near $5,000 an ounce after a sharp selloff as investors seek a hedge against uncertainty. Meanwhile, the 10-year Treasury yield held steady around 4.27%, suggesting the bond market is in “wait-and-see” mode between weak employment data and persistent inflation concerns in the services sector.

Eli Lilly and Company on February 4, 2026.

Friction points: reality check

The core tension is the clash between micro-optimism and macro-pessimism. The company-specific good news is overshadowed by systemic questions. Can the strong performance of a few healthcare and industrial giants offset the gravitational pull of a softening job market and a deflating tech bubble? So far, market judgment has been a hesitant “maybe”, resulting in this frustrating impasse. The delay in the release of government employment statistics, scheduled for February 11, will only add to the uncertainty.

Crossroads: What happens next?

Everyone is looking at the next catalyst. The market is caught in a waiting game, caught between the earnings of giants like Alphabet and Amazon and upcoming labor statistics. The path forward will depend on which narrative prevails. Either the economy will have a soft landing, supported by strong business health, or a technology-driven adjustment will exacerbate an even deeper economic slowdown. The wild swings in assets like gold, silver, and cryptocurrencies show that markets are desperately searching for direction, but all they can find is volatility.

Frequently asked questions ❓

- What is the cause of today’s stock market split? Strong earnings from companies like Eli Lilly and others are pushing the Dow higher, while concerns about AI spending and profitability are weighing on tech stocks and pushing the Nasdaq lower.

- Why do tech stocks fall despite strong earnings? Investors are worried that big investments in AI won’t pay off quickly, and that AI will disrupt traditional software business models, making even current strong performance seem worthless.

- What did the latest employment figures show? Private sector employment growth has been weak, with just 22,000 new hires in January, lower than expected and suggesting a cooling labor market.

- Where are investors putting their money, not technology? Money has been flowing into “safer” sectors such as healthcare and consumer staples, and some of it has flowed into gold, which has soared to near the $5,000 an ounce mark.