Bitcoin prices are trading around $64,670 today after rebounding from session lows of $60,001, which fell below $65,000 for the first time in over a year. Backlash occurs as whale wallet releases $81,068 $BTC In just eight days, the supply of large holders has hit a nine-month low, with retail investors aggressively adding to their holdings.

Whale dumping ground 81,000 $BTC Supply of large holders hits 9-month low

Santiment data reveals dramatic changes in Bitcoin’s ownership structure. Whale and shark wallet that can hold 10 to 10,000 pieces $BTC The supply share has fallen to the lowest since late May 2025, adding up to just 68.04% of all Bitcoin.

81,068 dumps $BTC These eight days coincided with Bitcoin’s 27% decline from $90,000 to $65,000. When large holders reduce their exposure at this pace, it signals confidence that the asset has peaked, rather than a temporary change in positioning.

On the other hand, the holding value of the retailer’s “shrimp wallet” is less than 0.1. $BTC It rose to a 20-month high and now accounts for 0.249% of supply, or about 52,290 units. $BTC. Santiment warns that this combination of major players selling and retail buying creates historically bearish cycles.

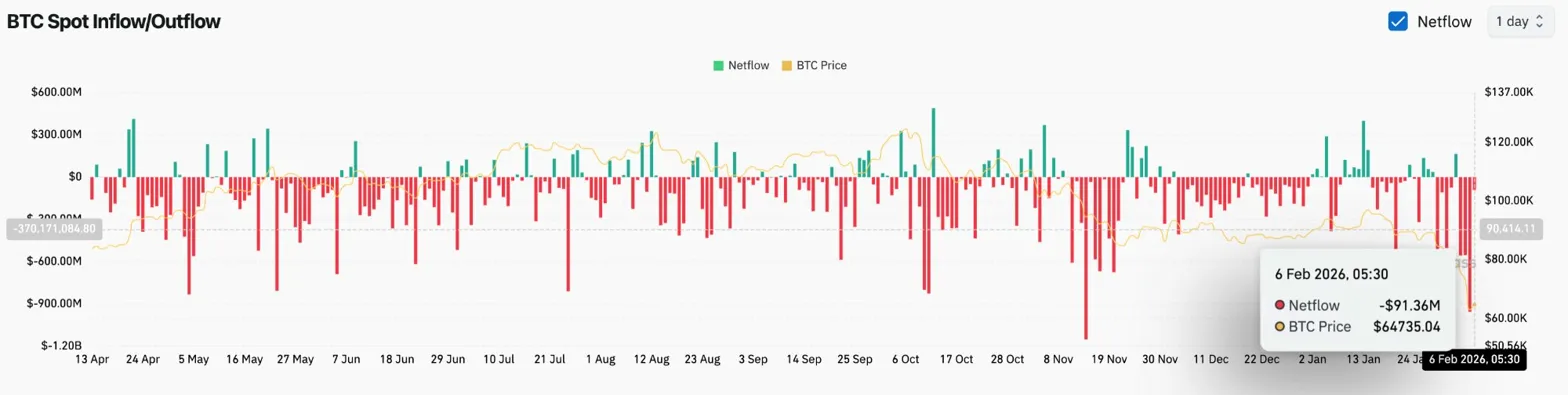

Spot outflow amount approaches $2 billion in 3 days

$BTC Netflows (Source: Coinglass)

According to Coinglass data, spot outflows on February 6 were $91.36 million, an expansion of the massive outflows that characterized last week. Withdrawals from institutional ETFs are accelerating in tandem with spot selling, with spot outflows approaching $2 billion in three days.

Analysts at Deutsche Bank attributed the decline to heavy withdrawals from institutional ETFs. This outflow pattern represents one of the toughest distribution periods for Bitcoin ETFs since their launch, and suggests an institutional capitulation rather than a temporary repositioning.

Related: Cardano Price Prediction: ADA Price Weakness Gets Deeper as Hoskinson Urges Focus Beyond Red Days

If outflows of this size continue during a crash, it confirms the confidence of sellers. The lack of buying interest at the $60,000 level suggests that the market has not yet found a price at which demand can absorb supply.

Daily chart shows critical support levels

$BTC Price dynamics (Source: TradingView)

On the daily chart, Bitcoin broke through multiple support levels with devastating speed. The $77,950 supertrend level was broken first, followed by the $76,000 horizontal support that had held for several months.

Price is currently trading well below all four major EMAs. 20 days is $80,431, 50 days is $86,262, 100 days is $91,452, and 200 days is $96,435. The difference between the current price of $64,670 and the nearest EMA of $80,431 indicates the severity of the breakdown.

The $54,469 level marked on the chart represents the next major support if $60,000 fails. This zone coincides with the summer 2024 consolidation area where Bitcoin traded before rising to all-time highs.

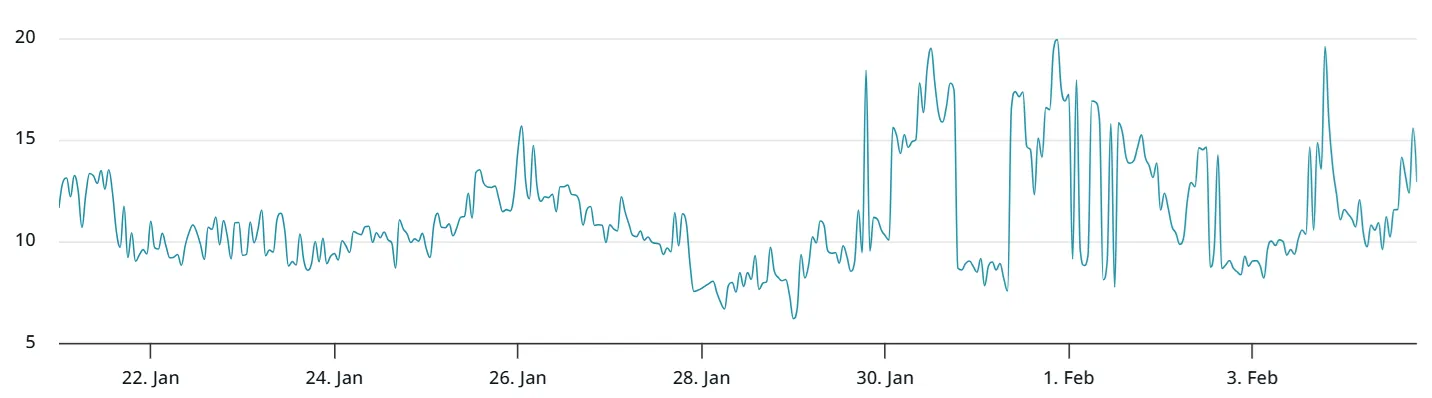

Fear index is at its lowest since the collapse of Terra

On Friday, the Crypto Fear & Greed Index fell to 9 out of 100, its lowest reading since mid-2022, when the market was reeling from the collapse of the Terra blockchain. A reading of extreme fear suggests that emotions have reached a level of surrender.

CryptoQuant CEO Ki Young Ju pointed out that all Bitcoin analysts are currently bearish and the unanimous view is that this could sometimes be a turning point. But whale dumping and ETF outflows suggest there is fundamental support for this pessimism.

Related: Solana Price Prediction: SOL Downtrend Deepens Despite Slowing Selling Pressure

The geopolitical backdrop continues to put pressure on cryptocurrencies. The combination of the U.S. detention of Venezuelan President Maduro, Trump’s threats against Greenland, and the Warsh Fed nomination sent investors scrambling for traditional safe-haven assets such as gold and silver, sending them to historic highs.

Short-term chart shows resistance on the downtrend line

$BTC Price Action (Source: TradingView)

On the 30-minute chart, Bitcoin is trading below the downtrend line that has led to its decline since February 3rd. The trend line is now above $66,000, providing immediate resistance to any recovery attempts.

The RSI has recovered from the heavily oversold level to 46.47, indicating some stability after the crash to $60,001. The MACD has turned positive and the histogram is widening, suggesting short-term momentum may be changing.

A rebound from $60,001 to $64,670 represents a 7.8% recovery and would require a break above $63,000 to indicate meaningful stabilization. A rejection at the downtrend line would result in a retest of the $60,000 low.

Outlook: Will Bitcoin Rise?

Trends remain bearish while whale distribution and institutional capital outflows continue.

- Bullish case: A close of the day above $77,950 will reinstate the supertrend, and a low of $60,000 will signal a capitulation. Extreme Fear Index readings of 9, when combined with stabilizing flows, have historically preceded bounces.

- Bearish case: A close below $60,000 would confirm the breakdown and target the $54,469 support zone. 81,000 whales dumped $BTC The historic bear cycle setup that Santiment describes remains active.

Related: Shiba Inu price prediction: SHIB recovers 15% from crash as Bitcoin dips below $65,000

Disclaimer: The information contained in this article is for informational and educational purposes only. This article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the use of the content, products, or services mentioned. We encourage our readers to do their due diligence before taking any action related to our company.