The virtual currency prediction market is based on Ethereum ($ETH) The economic downturn in February is likely to continue for the rest of the month. $ETH The stock will plunge an additional 18% from its current price of $1,950.

Such expectations are in line with the token’s recent price movements, as it is arguably the biggest loser among the largest digital assets by market capitalization. Since the start of 2026, Ethereum is down 34.88%, Bitcoin (BTC) is down 23.47%, and XRP is down 24.59%.

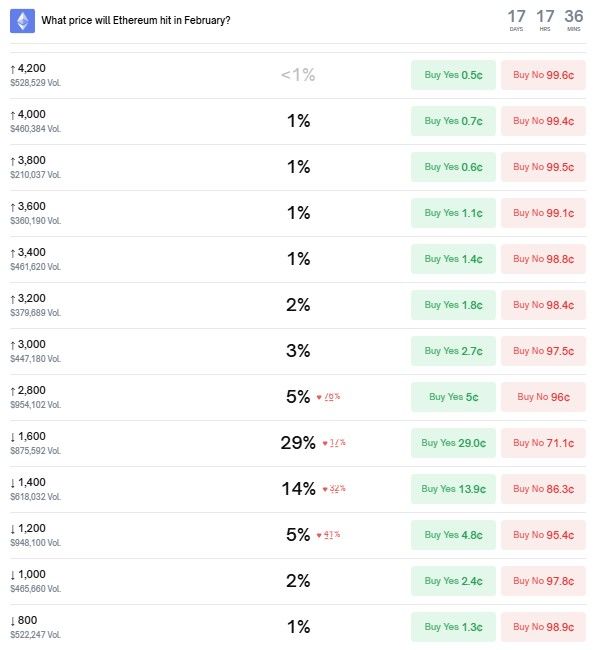

Odds in the virtual currency market are 1/20 $ETH Rise to $2,800 in February

Still, it’s worth noting that Polymarket’s predictive traders aren’t particularly confident in their estimates of where things will happen. $ETH Scheduled to land at the end of February. While it’s true that an 18% drop to $1,600 is the most widely expected price drop, the probability of actually reaching that price is only 29% as of press time on February 11th.

Other relatively popular predictions are $1,400 – 14% odds – $1,200 – 5% – $2,800 – 5% – and $3,000 – 3% odds.

Additionally, all targets from $800 to $4,000 are considered at least somewhat plausible by the Polymarket cryptocurrency prediction market, as they all have at least a 1% chance of being achieved.

In contrast, prices between $4,200 and $5,000 are considered completely unlikely at the time of writing, with clearly less than a 1% chance.

It is also possible that they have some backing due to the various trading bot strategies that exist in the market. This is because a “yes” to these strategies may have been purchased simply because of the large payouts available. $ETH Somehow over $4,200.

Similarly, the overall spread could easily be distorted by such strategies, but it is difficult to quantify how much.

Ethereum Price Prediction Spread Shows Massive Uncertainty in Crypto Market

What is not too difficult to determine is that the very wide dispersion of prices that is at least somewhat reasonable for Ethereum is indicative of the degree of uncertainty that prevails in the crypto market on February 11th.

Meanwhile, the debacle that began in late January has convinced many traders and analysts that the downside of the standard digital asset cycle has begun in earnest, with many coins and tokens heading towards new lows.

On the other hand, there is a strong sense that conditions in the sector are dramatically different from previous years, due to increased institutional adoption and acceptance, investment vehicles such as the largest cryptocurrency spot exchange-traded funds (ETFs), and a more favorable regulatory environment.

These bullish factors have led some experts and traders to believe that this price crash is temporary and that digital assets could reach new all-time highs as early as the second half of 2026.

Featured image via Shutterstock