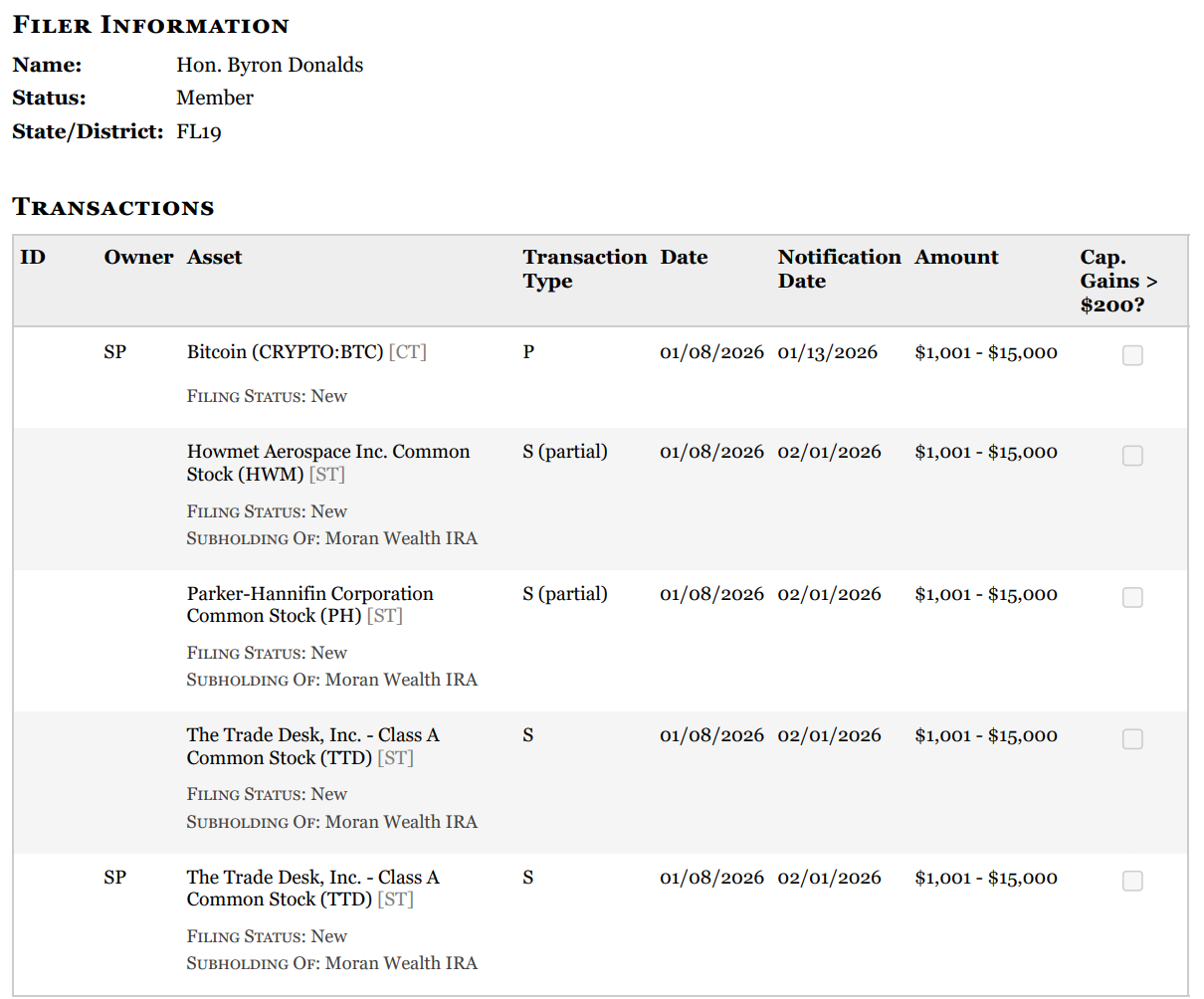

US Congressman Byron Donald has released new financial disclosures showing his purchases of cryptocurrencies amid stress in the digital asset market.

The filing describes purchases of Bitcoin (BTC) worth between $1,001 and $15,000 that were recorded on January 8, 2026 and published on February 12, 2026. This trade coincides with Bitcoin struggling to maintain key support levels and currently trading below the $70,000 spot.

In addition to the Bitcoin purchases, the disclosure shows some sales of traditional stocks, including Howmet Aerospace (NYSE: HWM), Parker Hannifin Corporation (NYSE: PH), and The Trade Desk (NASDAQ: TTD), all of which were reported in late January.

Indeed, given that he serves on the House Financial Services Committee, his trades are likely to continue to raise questions about Congressional trades.

Donald’s stock trading controversy

The filing follows previous controversies over cryptocurrencies and stock trading during Donald’s tenure. In late 2025, on the same day that he and other lawmakers sent a letter to the Internal Revenue Service asking for changes to virtual currency tax rules, he and his wife reportedly bought Bitcoin, raising questions about the timing given their involvement in digital asset policy.

His stock trading history has also come under scrutiny. In a related move, a bipartisan watchdog group has filed a complaint with the Office of Congressional Ethics, alleging that the Donalds failed to timely disclose more than 100 stock trades worth up to about $1.6 million in 2022 and 2023, potentially violating the Congressional Knowledge Trading Suspension Act, which requires members of Congress to report trades within 45 days.

The complaint also notes that some of the private transactions involved companies overseen by the House Financial Services Committee, raising concerns about potential conflicts of interest when investing in sectors that lawmakers help regulate.

Although there have been no enforcement actions or legal findings related to his Bitcoin or stock trading, his investment activities have been under constant scrutiny due to his high-profile trading patterns, proximity to policy activities, and past ethics complaints.