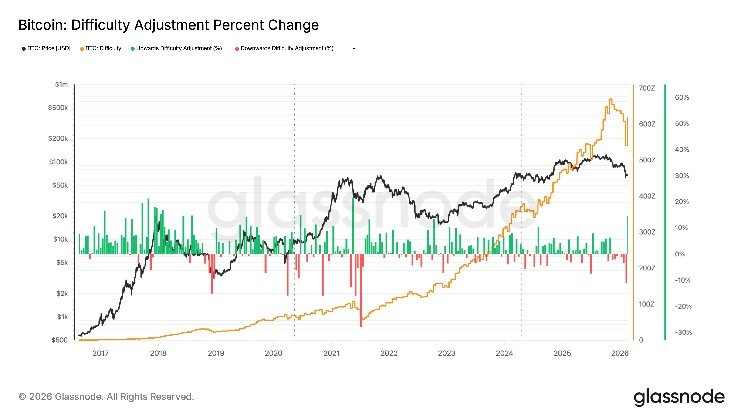

Bitcoin mining difficulty rose 15% to 144.4 trillion (T), the biggest increase since 2021 when China’s mining ban caused massive disruption, but was later revised upward by 22% as the network stabilized.

Difficulty adjustment measures how difficult it is to mine new blocks on the network. It rebalances every 2,016 blocks approximately every two weeks so that blocks continue to be generated approximately every 10 minutes, regardless of hashrate changes.

This adjustment was made in response to a 12% decrease in difficulty due to a decline in Bitcoin’s hashrate, the total computational power that secures the network. Mining activity suffered its sharpest setback since late 2021 after severe winter storms in the United States forced several major operators to scale back operations.

When Bitcoin reached an all-time high of around $126,500 in October, the hashrate also reached 1.1 Zettahash/second (ZH/s). As the price fell to $60,000 in February, the hashrate dropped to 826 exahash/second (EH/s). Since then, the hashrate has recovered to 1 ZH/s and the price has recovered to around $67,000.

At the same time, the hash price, or the estimated daily income miners earn per unit of hashrate, remains at a multi-year low (23.9 PH/s), putting pressure on profitability.

Despite these profitability pressures, large-scale operators with access to low-cost energy continue to mine aggressively. The United Arab Emirates, for example, has about $344 million in unrealized profits from mining operations.

Capital-rich companies that can mine efficiently are helping maintain hashrate growth and resilience even as Bitcoin prices slump.