Deutsche Börse Group executives said that tokenization is a natural evolution of market infrastructure and is not a threat to traditional markets, adding that exchange operators are in a position to integrate tokenized and traditional assets.

Carlo Kerzer, Head of Digital Assets at Deutsche Börse and CEO of the group’s trading platform 360T, expressed bullish outlook on the tokenization of real-world (RWA) assets and predicted a future where digital and traditional markets operate in a closely linked ecosystem.

“Our role as Deutsche Börse Group is not only to build bridges between two different worlds, but also to create a true hybrid market,” Kelzer told Cointelegraph, explaining the company’s vision for a unified trading environment.

The comments come shortly after 360T integrated Kraken-backed xStocks, a leading tokenized stock platform, on February 9th, allowing customers to trade tokenized stocks from companies such as Nvidia, Google, and Circle.

The role of traditional market infrastructure is crucial

“Tokenization enhances the flexibility and efficiency of capital markets, not by making traditional market infrastructure obsolete, but by transforming how its core functions are delivered,” Kelzer said, adding:

“In a tokenized environment, trusted institutions remain essential for risk management, oversight, and ensuring orderly markets, and technology requires greater resilience and transparency.”

Deutsche Börse sees this change as a strategic evolution and does not see it as a threat.

“For us, tokenization is an opportunity to pioneer new models and lead the transformation of the market, while bringing the same trust and confidence that we bring to the market today,” he said.

Risks and regulatory concerns associated with tokenization

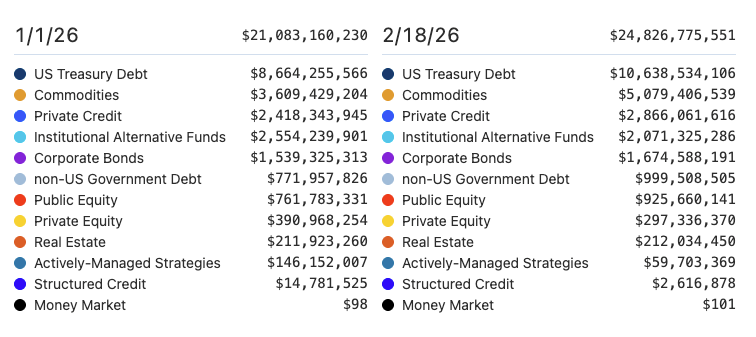

As tokenized assets continue to expand, with the market up about 18% since the beginning of the year, some analysts have reiterated concerns about commodity-based RWAs and stablecoin backing.

Critics also point to the lack of a clear regulatory framework across jurisdictions and warn that investor rights and protections can vary by structure and location.

In early February, it warned that securing tokenization platforms risks putting the European Union behind the United States and called on lawmakers to amend the European Union’s DLT pilot to address asset scope limits and delays in regulatory updates.

RWA Market Ratings by Category (January 1 vs. February 18, 2026). sauce: App.RWA.xyz

Despite these concerns, Deutsche Börse and 360T remain bullish on tokenization in Europe, citing progress within established regulatory frameworks such as the Markets in Financial Instruments Directive (MiFID).

Related: Amid shakeout of crypto VCs, Dragonfly closes $650 million fund focused on real-world assets

“We welcome continued efforts to evolve our initial approach, enable growth in line with market demand, and accelerate tokenization activity,” Kelzer said, adding that this will ensure Europe continues to attract innovation.

The executive also addressed criticism of “paper Bitcoin,” a term used to describe synthetic or derivative-based exposure to Bitcoin through futures, perpetual swaps, exchange-traded funds, and some centralized exchanges.

“This issue highlights the core importance of market integrity and regulated infrastructure,” he said, adding that Deutsche Börse and 360T aim to provide regulated access for customers to gain exposure to assets without uncertainty regarding trading venues or service providers.

“Our approach is the same for crypto assets and tokenized products. We aim to provide a robust, reliable and fully regulated service,” he added.

magazine: Is China hoarding gold so much that the renminbi, rather than the US dollar, is the world reserve?