Japan-based financial group SBI Holdings has launched an on-chain bond that grants holders an equivalent amount of money. $XRP.

SBI announced this initiative yesterday, billed as the first-ever on-chain Security Token (ST) bond issuance. The offering will allow retail investors in Japan to purchase blockchain-based bonds with automatic delivery of bonds of the same amount. $XRP At the time of subscription.

This structure effectively bridges traditional fixed income and fixed income products. $XRP This allows investors to access assets through a regulated bond framework.

Important points

- SBI Holdings has launched the first-ever on-chain security token bond, marking a major step in blockchain-based finance.

- The 10 billion yen ($64.5 million) bond issue will be targeted at retail investors and will be run entirely on blockchain infrastructure.

- What investors receive $XRP Immediately after purchase, you will have access to your digital assets equivalent to your subscription amount almost instantly.

- beyond the beginning $XRP distribution, addition $XRP Compensation will be paid on interest dates in March 2027, 2028 and 2029.

SBI launches first-ever on-chain bond

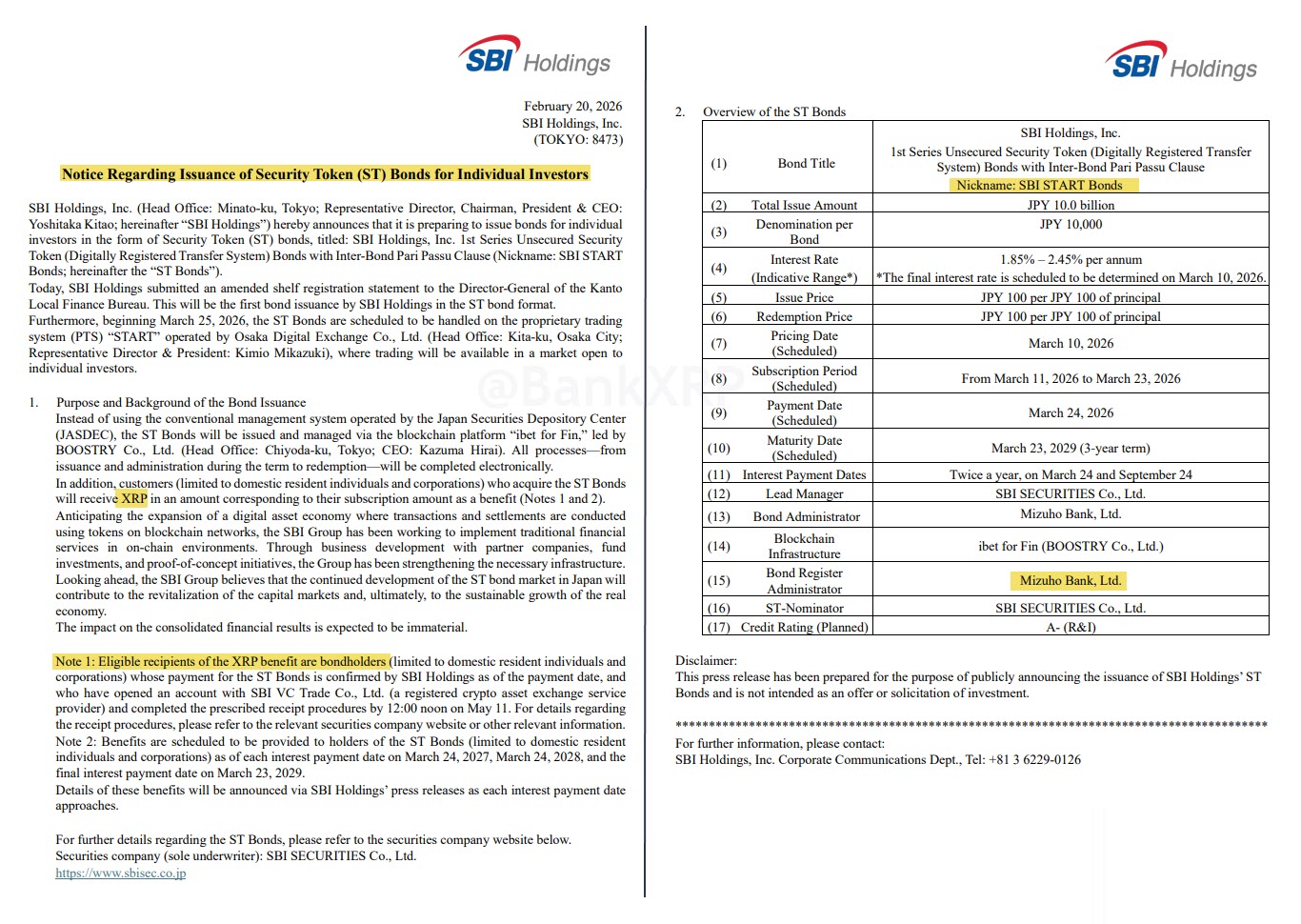

SBI Holdings, Ripple’s main strategic partner, has announced plans to issue its first series ST bonds totaling 10 billion yen ($64.52 million). The company has designed the bond specifically for retail investors and will issue, manage, and settle it entirely on blockchain rather than Japan’s traditional securities settlement system.

Instead of relying on traditional registration methods, SBI will digitally register and tokenize bonds on-chain through the ‘ibet for Fin’ platform developed by BOOSTRY.

Meanwhile, investors will trade the bonds on START’s proprietary trading system operated by Osaka Digital Exchange, with secondary market trading scheduled to begin on March 25, 2026.

$XRP incentive structure

In particular, this publication has a built-in $XRP Remuneration system. Bondholders will receive: $XRP You will receive tokens equal to your subscription amount immediately after payment confirmation. However, eligible investors must have an account with SBI VC Trade and complete the necessary procedures by May 11th.

SBI also plans to make further distributions. $XRP Benefits will be paid on each interest payment date in March 2027, March 2028, and March 2029. This approach increases financial strength while encouraging long-term participation. $XRPintegration into tokenized financial products.

Potential impact $XRP

The potential impact of this service is significant. in-house analyst $XRP Community argues rising demand for bonds could lead to sustained growth $XRP Purchases to support publishing and future payments.

Furthermore, community luminary Jay Nisbet linked this development to Japan’s yen carry trade, where investors borrow yen at low interest rates and allocate capital to high-yielding assets.

In this context, this structure provides additional liquidity. $XRP-Linked instruments. Nisbet further indicated that SBI may expand its $65 million offering to attract institutional participants.

If SBI expands this initiative, it may accelerate its efforts for institutional investors. $XRP Rather than relying solely on spot market demand, it is implemented by incorporating assets into structured financial products. Meanwhile, market participants are watching closely to see how this package accelerates. $XRP Adoption in Japan.