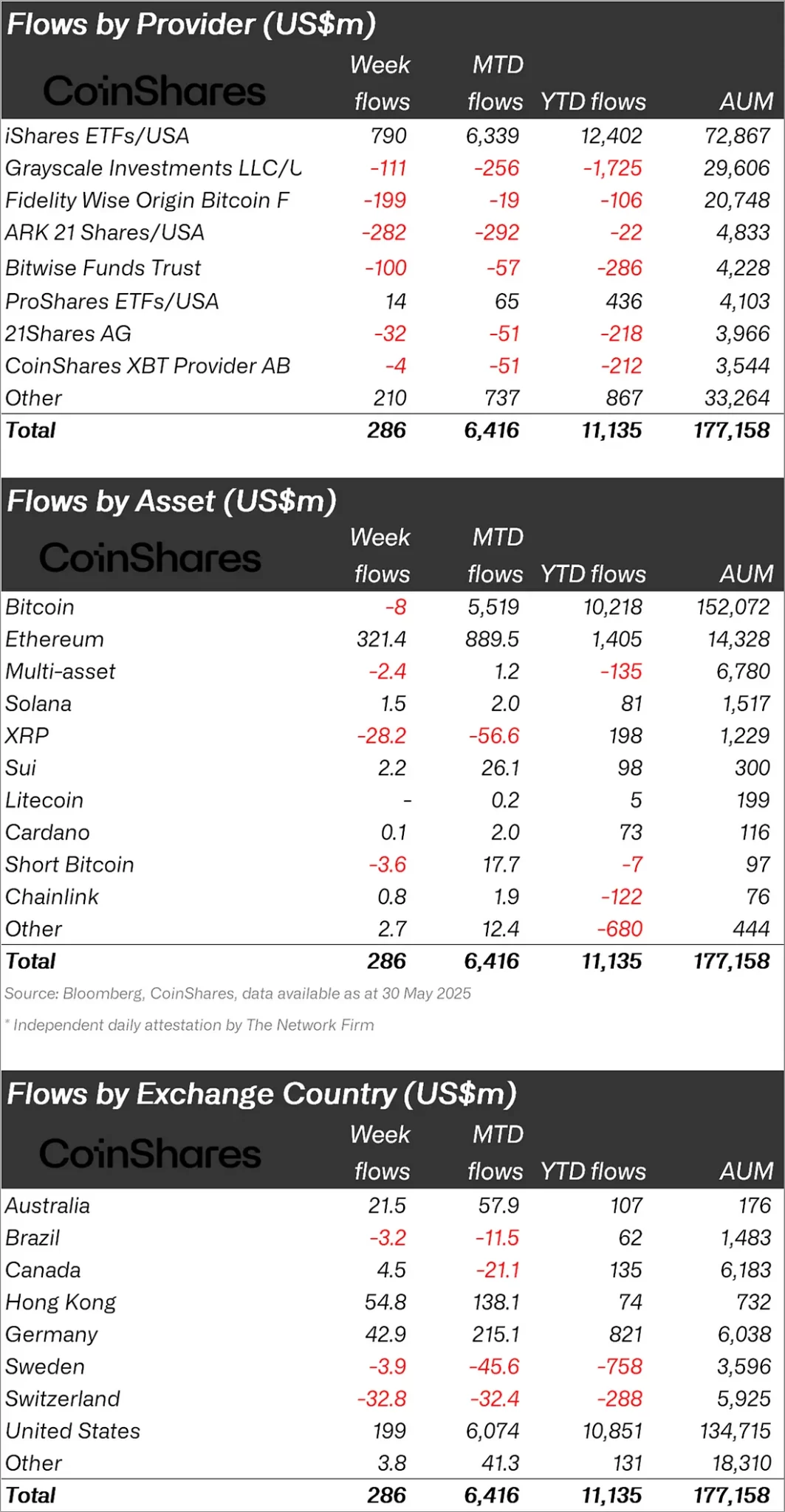

Bitcoin (BTC) and Altcoins have recently experienced pullbacks, but despite the pullbacks, expectations for an increase continue. While Bitcoin continues to consolidate at a critical level, Coinshares published its weekly cryptocurrency report, saying it had an influx of $286 million last week.

“Last week there was a $286 million inflow into cryptocurrency investment products, but the total inflow over the seven-week period reached $10.9 billion.

Ethereum Rises, Bitcoin Stalls: Ethereum took the lead with a $321 million influx, delivering its best performance in six weeks since December 2024.

Meanwhile, Bitcoin revived mid-week, finishing the week with a $8 million exit. ”

Bitcoin uptrend, big comeback from Ethereum!

Looking at the individual cryptocurrency funds, we can see that there was a leak in Bitcoin and a large influx in Ethereum.

BTC experienced a $8 million outflow, while Ethereum (ETH) experienced a $321.4 million inflow.

Looking at other altcoins, SUI has experienced an influx of $2.2 million. Solana (SOL) experienced a $1.5 million inflow, while XRP experienced a $28.2 million outflow.

“Ethereum increased its six-week inflow to $1.19 billion this week with an additional weekly inflow of $321 million.

It was the strongest entry since December 2024 and showed a decisive improvement in emotions.

XRP totaled $28.2 million after seeing the second week of outflow.

The week began with a strong influx of Bitcoin. Bitcoin reversed mid-week following a New York court decision to declare US tariffs illegal. At that point, the week ended with a small $8 million spill.

This was the first exit after a six-week inflow series totaling $9.6 billion. ”

Looking at the inflows and outflows of local funds, we found that the US was ranked first with an inflow of $199 million.

After the US, Hong Kong and Germany saw an inflow of $54.8 million and $42.9 million, respectively.

In response to these influxes, Switzerland had a $32.8 million runoff, Sweden had a $3.9 million runoff, and Canada had a $9.4 million runoff.

*This is not investment advice.