Skycorp Solar Group Limited (PN), a Chinese manufacturer of solar cables and connectors, has risen 8.39% in its shares following the company’s announcement that it plans to buy Ethereum (ETH) as part of its long-term digital asset financial management strategy.

The announcement comes amid growing institutional interest in Ethereum. Public companies around the world are stepping up their efforts to integrate “digital oil” into their financial framework.

Public companies accelerate push to buy Ethereum

In its latest press release, the company emphasized that it will use partial cash reserves and returns from renewable energy projects to fund ETH purchases. Skycorp Solar also announced that it will accept Bitcoin (BTC), Ethereum and stubcoin, such as USDC (USDC), Tether (USDT), and other such as Ethereum and stubcoin as payment methods for international transactions starting August 1st.

The company says a licensed RWS provider specializing in blockchain forensics will process payments for all digital currency. Additionally, the transaction complies with regulatory guidelines set by the Singapore Monetary Authority (MAS) and the Financial Conduct Task Force (FATF).

“The recent Genius Act provides the trust and stability needed to establish a regulatory foundation for term coins and seamlessly adopt digital payments. We believe in investing in clean energy infrastructure and ETH investments in line with long-term growth opportunities,” said CEO Weiqi Huang.

Following the announcement, the company’s stock price rose to $3.10, with an 8.39% valuation. However, Google Finance data showed that PN had sweeped out almost all of these profits in pre-market trading as it dropped by 6.13%.

Skycorp Solar Group Stock Performance. Source: Google Finance

As new players continue to enter the market, pioneers are also doubling their ETH strategies. Sharplink Gaming highlighted that as of July 20th, its holdings reached 360,807 ETH, more than $2 billion.

Despite this, others are not late. Beincrypto yesterday reported that Cathie Wood’s Ark Invest had purchased more than 4 million shares of Bitmine Immersion Technologies (BMNR). The company said it plans to use funds from its latest stock sales to buy more Ethereum.

“We are pleased to see Cathie Wood’s Ark Invest has a significant stake in Bitmine after seeing an exponential opportunity aimed at reaching 5% of ETH,” Tom Lee said.

While these two public companies are still the largest corporate ETH owners, new companies could threaten their position. Ether Machine, a newly formed company, has announced plans to open up to over 400,000 ETH on its balance sheet.

The move will be the largest public vehicle offering facility-grade exposure to Ethereum. Backed by $1.5 billion in dedicated capital, the company aims to generate returns by leveraging Ethereum’s staking, retour and decentralized finance strategies.

“We have put together a team for the ‘Ethereum Avengers’ to actively manage and unlock yields to market-leading levels for investors,” said Andrewkies, co-founder of Ether Machine.

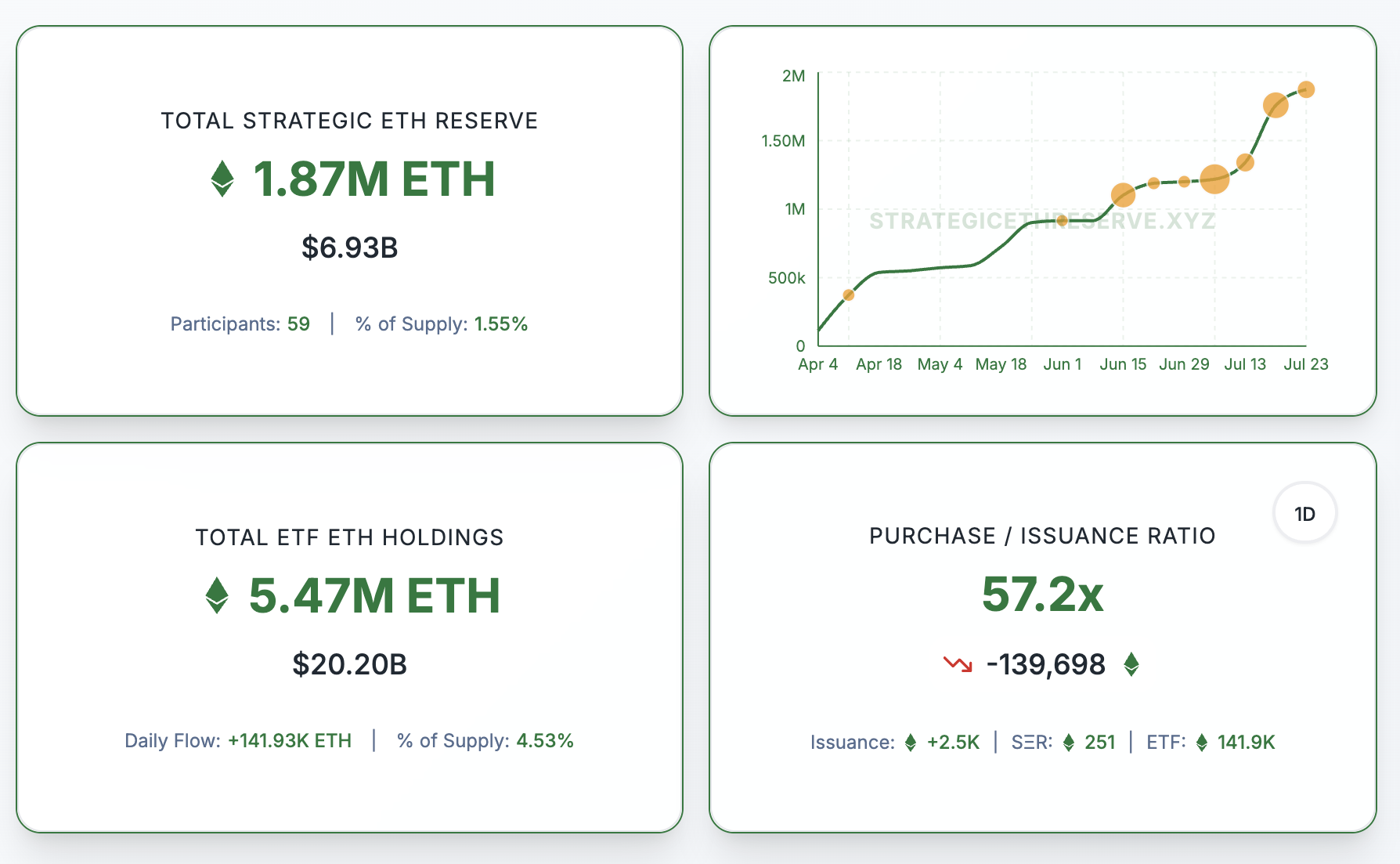

Meanwhile, the company collectively owns 1.87 million ETH, worth nearly $7 billion in the Treasury Department, according to latest data from Strategic ETH Reserve.

Holds total Ethereum of the entity. Source: Strategic ETH Reserve

Beincrypto stressed in May that experts expect to exceed 10 million ETH by 2026.