Ethereum prices have been recovering aggressively after a recent decline from the $4,800 region. Investors are hoping for another push above the $5,000 level in the coming weeks.

Technical Analysis

By Shayan

Daily Charts

ETH successfully defends its $4,000 support zone that bounces out of the area. This zone overlaps with the 100-day moving average and previous demand blocks, making it a technically significant level.

The RSI is also recovering from oversold areas, currently sitting at 50, suggesting momentum is moving towards the bull. The assets are currently heading towards the midline of the $4,800 resistance level and the large ascending channel. A breakout from the area will open the doors of the historic ETH rally in the coming months.

4-hour chart

On the 4H chart, ETH printed textbook head and shoulder recovery. After bounced from the support zone close to $3,850, it regained a $4,100 level and formed a higher and lower level. We are currently approaching the $4,400-$4,500 supply zone, which began its decline last week.

Overall, the short-term structure is currently bullish. If your ETH breaks beyond the $4,500 level, your next goal could be $4,800 high. However, rejections from here may lead to a short integration stage before continuing.

Emotional analysis

Funding rate

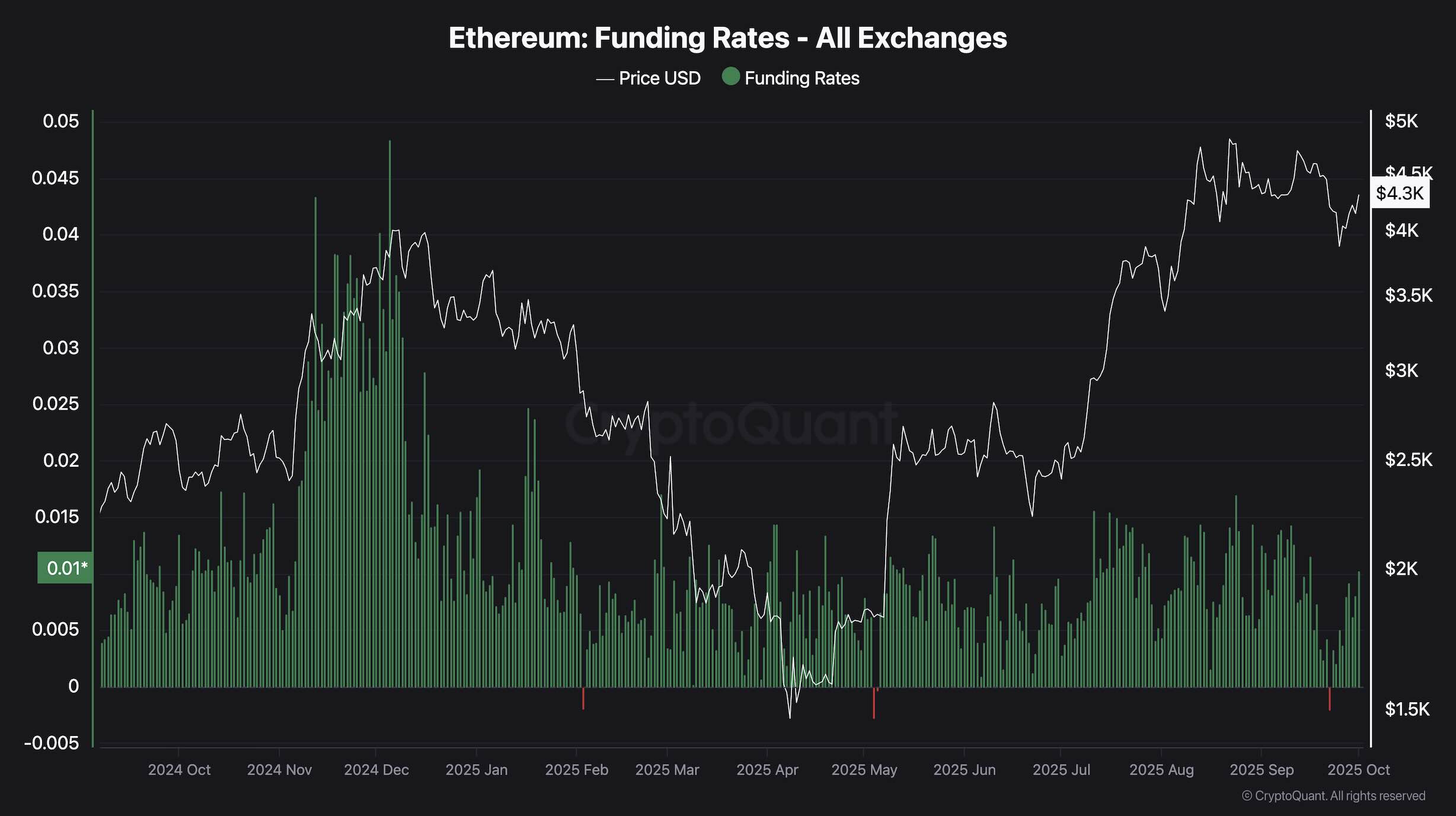

Ethereum’s funding rate has recently returned to positive territory after being temporarily negative during the latest price drop. This negative dip showed that short sellers were taking control and the market was leaning so badly that they were pushing their funding rates below zero.

However, a quick recovery suggests that these shorts have been closed or liquidated, and traders are slowly regaining confidence. A return to positive funding indicates a growing appetite for long positions, but that interest still appears cautious.

Compared to previous cycles, current funding is well below euphoric levels. There are no signs of excessive leverage or overcrowded long. This is a generally healthy sign. When funding resets such resets without spikes too quickly, it often reflects a more stable trading environment. This stable funding could support a more sustained price recovery rather than a short-lived pump.