Cryptocurrency Black Friday’s record liquidation wiped out $19 billion in positions and exposed the transparency gap between centralized and decentralized venues. While Binance stumbled, Hyperliquid held steady, with the 10.10 crash being the biggest stress test for cryptocurrencies since FTX.

This crash and Binance’s recent listing controversy have highlighted one growing theme: the cost of centralization and the appeal of open systems.

A crash that shook trust

Latest updates

Bloomberg reported that while Binance suffered an outage and refunded users, HyperLiquid processed more than $10 billion of the $19 billion in liquidations. The DEX maintained 100% uptime and proved its resilience even under extreme volatility.

background context

Bitwise CIO Matt Hogan said the blockchain “passed the stress test” and highlighted that DeFi venues such as HyperLiquid, Uniswap, and Arv continued to operate while Binance had to compensate traders. His conclusion was that diversification would keep the market healthy as leveraged traders collapsed.

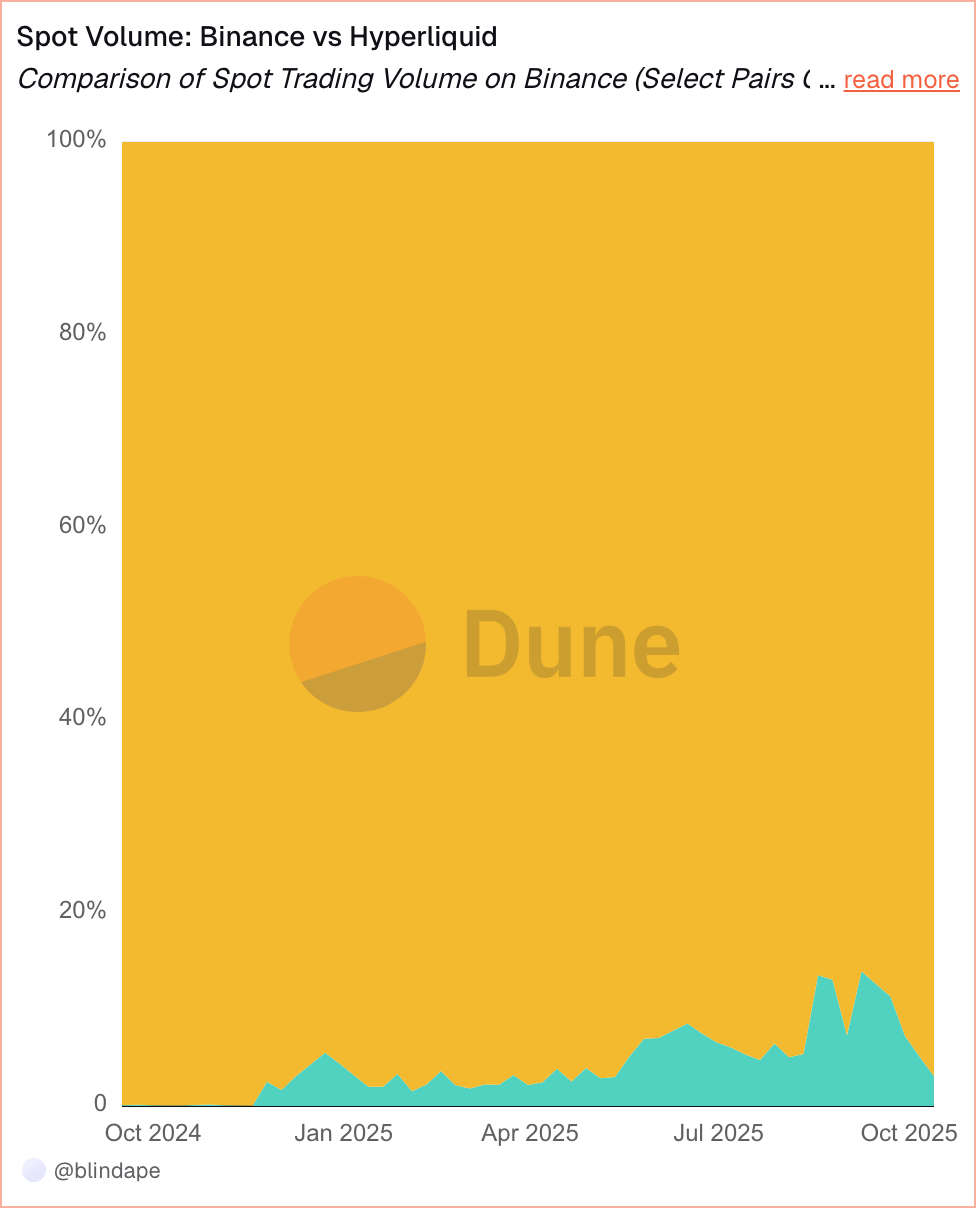

Spot Volume: Binance vs Hyperliquid | Dune

While Binance dominates spot trading volume, HyperLiquid’s share remains below 10%, despite steady growth through mid-2025, according to Dune data. The same trust gap that surfaced during the crash soon resurfaced in a different form: the listing fee debate.

Binance faces backlash from listing

deeper analysis

The CEO of Limitless Labs claimed that Binance required 9% of the token supply and a multi-million dollar deposit for listing. Binance denied this, citing refundable deposits, and defended its alpha program. Confidence in CEX has hit an all-time low, sparking a debate over fairness.

behind the scenes

CZ argued that exchanges follow a different model, saying, “If you don’t like fees, just build your own zero-fee platform.” HyperLiquid responded that its network has “no listing fees, no divisions, no gatekeepers.” Spot deployments do not require permission. You can launch your tokens in any project by paying gas with HYPE and earn up to half of the trading fees for the pair.

DEXs and AMMs already provide free listing, exchange, and liquidity for any asset.

If a project is willing to pay high publication fees, it’s because of marketing, not market structure.

We’re proud of the role we played in making this happen

— Hayden Adams 🦄 (@haydenzadams) October 15, 2025

Uniswap founder Hayden Adams argued that DEXs and AMMs already offer free listing and liquidity, and if projects still pay CEX fees, it is purely for marketing purposes.

Hyperliquid emerges as an on-chain competitor

important facts

DefiLlama Data: Perp DEX share rose from less than 10% in 2023 to 26% in 2025.

I’m looking forward to it

VanEck confirmed that Hyperliquid captured 35% of blockchain fee revenue in July. Circle added native USDC to the chain, and Eyenovia launched a validator and HYPE Treasury. HIP-3 enabled permitless Perps, allowing builders to create a futures market for any asset.

Grayscale cited Hyperliquid as a breakout in 2025 and reported that DEX is in price competition with CEX. We predict that DEXs may dominate the long tail of assets where transparency and community governance are most important.

Hyperliquid’s advantage lies in efficiency. A team of 10 engineers runs a venue that rivals Binance’s 7,000 staff and $500 million in marketing spend. DEXs reduce the complexity and advertising of listing, turning savings into token value and liquidity rewards. VanEck calls this “profit without marketing spend.” This is a moat that centralized companies cannot imitate.

According to the data, Hyperliquid’s share of Binance’s trading volume reached around 15% in August and has declined slightly since then, indicating traders’ growing interest in on-chain derivatives.

The path forward for exchange

Risks and challenges

Bitwise analyst Max Shannon told BeInCrypto that once regulations are in place, annual transaction volume for decentralized criminals could reach $20 trillion to $30 trillion within five years. He warned that DEXs, which process $67 billion daily, could face scrutiny and require standardized oracles, audited insurance funds and risk management.

expert opinion

“Perp DEX can fail, but that risk is transparent and on-chain,” said Max Shannon of Bitwise.

“Hyperliquid has everything you need to become a financial institution,” says OAK Research.

“Centralized exchanges will be able to stay relevant by adopting a hybrid model that combines non-custodial trading, deep liquidity, and regulatory trust,” Bitget CEO Gracy Chen told BeInCrypto.

conclusion

Paradigm called on the CFTC to recognize the transparency of DeFi, arguing that decentralized trading already meets important regulatory goals such as fair access and auditability. As regulators warm to DeFi and institutions embrace on-chain models, Hyperliquid’s permissionless ecosystem serves as the most reliable alternative to centralization in crypto, replacing trust with transparency as the foundation of finance.