Ethereum faced a noticeable increase in purchasing pressure, leading to bullish rebounds with key support of $1.5,000. The price is facing a critical range of resistance at $1.8k, and is expected to enter short-term integration before it breaks.

Technical Analysis

By Shayan

Daily Charts

After a period of calm price action and market inactivity around the decisive $1.5k long-term support area, Ethereum ultimately surged into pressure purchases, causing bullish rebounds. This wave of demand has led prices to a key resistance zone of $1.8,000. This area coincides with the important ordering blocks that Smart Money usually places orders and strengthens its importance.

Price action at this level is important. A successful breakout of over $1.8k will confirm a bullish inversion scenario and open the path to the 2.1K target. However, short-term integration of this resistance is possible before a critical move unfolds.

4-hour chart

In the lower time frame, the integration of the previous tight range of ETH was broken by a prominent buyer inflow, resulting in impulsive breakouts on top of the descending channel. This breakout was accompanied by strong bullish momentum, pushing prices towards the 1.8k key $1.8K resistance zone.

The area is aligned with Ethereum’s previous swinglow, making it a robust supply area. As a result, short-term consolidation is expected at this level until supply or demand pressure determines the next move. A bullish breakout of over $1.8k sets the $2.1,000 range as a potential target for buyers:

Emotional analysis

By Shayan

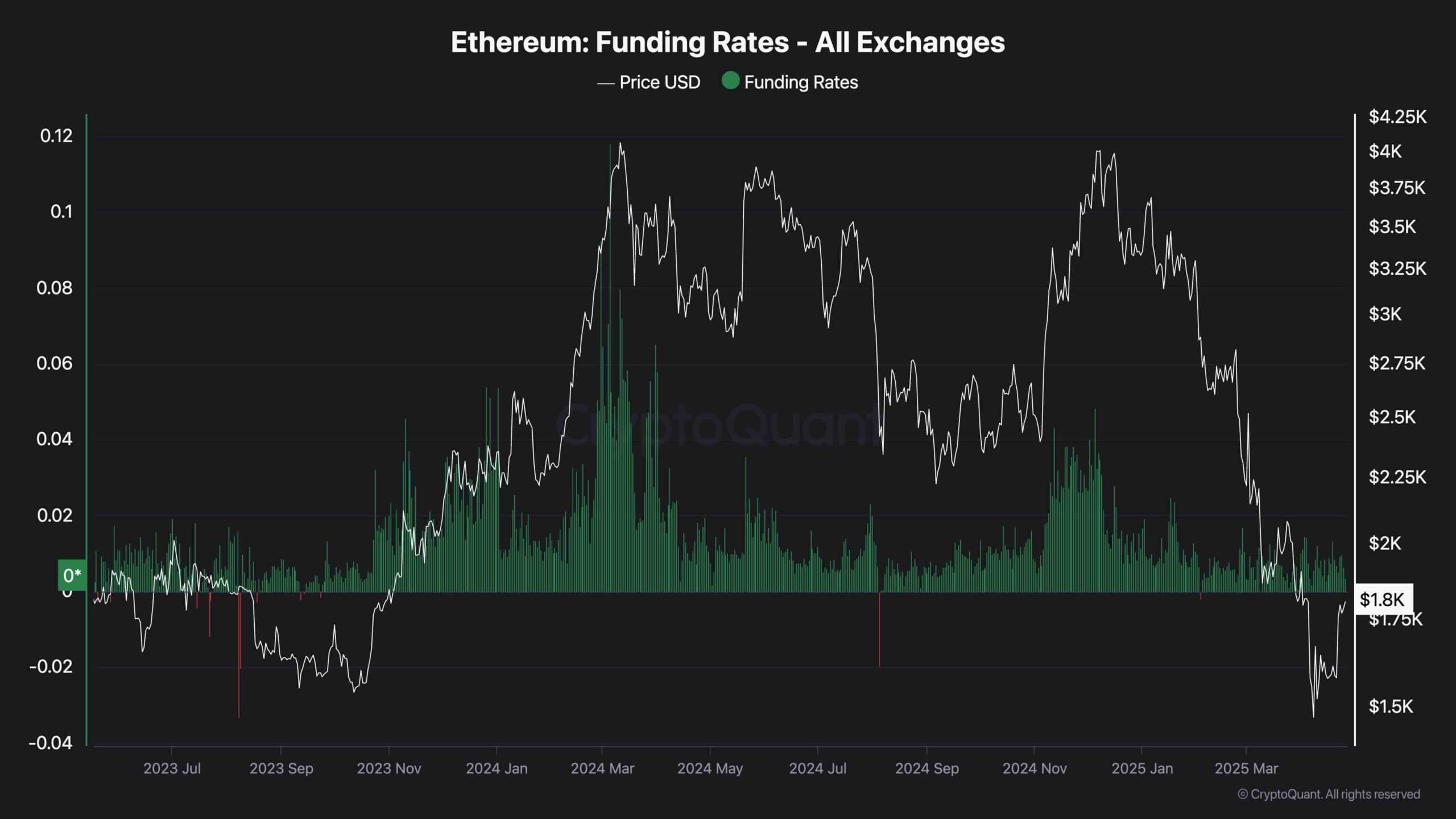

Funding rate indicators are key indicators of sentiment in the futures market. Analyzing recent behaviors gives you important insight into the latest surge in Ethereum. Typically, healthy, sustainable bullish trends are accompanied by increased funding rates, indicating an influx of buyers in both the lasting future and the spot market.

However, the funding rate is currently consolidated and there is no significant increase. This suggests that Ethereum’s recent price surge is driven primarily by purchasing spot markets rather than speculation in the futures market. This bullish trend is examined and sustainable, financing rate indicators must begin to rise, reflecting increased confidence in the futures market and aggressive purchasing.